An original version of this article was first published on the Shoeboxed Blog in November 2013 and was written by Ian Crosby, the CEO of Bench.co, an online accounting firm. This version has been altered to reflect IRS updates and new Shoeboxed features.

Holding on to detailed receipts for expenses is one of your best defenses in an audit. Receipts also act as a log, allowing you to jot down important context about your (sometimes costly) expenses.

Of course, not all receipts are created equal, so we’ve compiled a list of five, highly scrutinized receipts you’ll want to keep.

1. Meal & Entertainment Receipts

Winning clients and building relationships are two of the many reasons we like to break bread with business contacts.

Unfortunately, the line between “contacts” and friends is often blurred, making this an expense the IRS likes to scrutinize.

For that reason, it’s best practice to keep receipts handy and properly documented in case of an audit. This includes recording information about who attended the meal and the purpose.

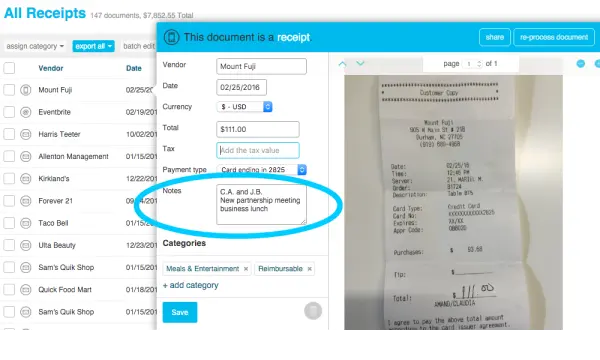

👉 Shoeboxed Pro Tip: You can record this information using Shoeboxed in the “Notes” field for each receipt. When you submit an expense, simply include the initials of everyone who attended and a quick description of meeting purpose in the Notes section.

Or if you use Magic Envelopes, you can jot down the information on the receipt and then add the information in the Notes field once the receipt has been processed. Simple as that.

In the Shoeboxed web app, you can add receipt information like client name or meeting purpose under the “notes” section. Better documentation of Meals and Entertainment receipts will protect you from audits and verify that the expense is indeed deductible.

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. Try free for 30 days! ✨

Get Started Today2. Receipts from Out of Town Business Travels

Out of town business travel generates tons of receipts from airline tickets, taxis, meals, laundry, lodging and more.

Of course, business travel can also be mistaken for “pleasure”, making this another IRS favorite prone to audit scrutiny.

Receipts verify what was purchased on the trip and also act as a travel log of where time on the business trip was spent.

Some important factors that determine eligibility include: how much of the trip was personal in nature, if the trip was away from your tax home and if the amounts are justifiable.

👉 Shoeboxed Pro Trip: When traveling, make it habit to submit receipts as you make the purchase—don’t wait until the end of your trip to document your paper trail.

Using the Shoeboxed Receipt and Mileage Tracker app can help you achieve this, and it can also eliminate the possibility of losing a receipt.

You wouldn’t want to lose reimbursement or deduction money because of a misplaced piece of paper!

Receipts verify business expenses used on business-related trips & keep a time log of your travel activities.

Keeping track of receipts as you buy when traveling eliminates the risk of losing proof of purchase.

At the end of your trip, organize deductible receipts by creating expense reports right from your phone.

See also: The Ultimate Receipt Organization & Management Resource

Costco Receipt: A Step-by-Step Guide on Accessing Receipts

3. Vehicle Related Receipts

“Mixed use” assets, like a vehicle used for both personal and business purposes, require extra care to distinguish when they are being used for business and when they are not.

Since only the portion of use that is for business should be counted in the company’s books, keeping clear and detailed records of when, where and why a vehicle is used for business purposes helps to establish what portion of use is business related.

The portion of use that is business related (e.g. 20% of use is for business) can then be applied against any vehicle related expenses (maintenance, parts etc).

Always keep a detailed receipt (as opposed to a credit card statement) that lists what items or services the vehicle needs.

Remember, if an auditor can’t easily establish that a payment to Costco was for car tires and not for Tide, chances are that vehicle-related expense won’t be considered for business purposes.

👉 Shoeboxed Pro Tip: Use the Shoeboxed Receipt and Mileage Tracker App to track mileage using your phone’s built-in GPS when traveling to and from business meetings.

Not only will the app record the precise start and end points of your trip for detailed documentation, but it will also apply the standard mileage rate.

Drop a pin whenever you want to start, pause or end a trip to make sure you are maximizing deductible mileage rates.

Adding a trip name and a note to distinguish the business-related nature of the trip will ensure it is deduction-friendly.

Shoeboxed's mileage tracking syncs with your phone’s built-in GPS for accurate documentation of vehicle trips.

4. Receipts for Gifts

Gifts are a thoughtful way to build rapport, however, there are several nuances to be aware of.

For example, deciphering whether concert or sporting event tickets are considered ‘gifts’ or ‘entertainment’ depends on whether or not the gift giver goes with their client or business prospect.

Documenting this kind of information on the gift receipt is key to allowing your accountant to treat the expense correctly for tax purposes.

For more detailed information on gift expense limits and interpretation, check out this publication.

👉 Shoeboxed Pro Tip: If you want to keep better track of gift receipts, add a “Gift” category and assign that category to receipts that would be considered gifts for deduction purposes.

You can also add information which can validate whether or not the receipt can be considered a gift in the “Notes” field under receipt details.

Add a “Gift” category and assign them to expenses that could be deducted as gifts. Organizing receipts by category can also help you and your accountant treat the expense correctly for tax purposes.

5. Home Office Receipts

Like vehicles, a home office is considered “mixed-use” and the expenses associated with claiming a home office are therefore closely scrutinized.

The key to properly accounting for home office expenses is to establish what portion of the home and the home’s expenses the office represents.

If the home office makes up 20% of the home’s space, for example, then this proportion of expenses is deemed common to both the home and home office such as rent, electricity, internet to name a few.

Keeping the bills and proof of payment for the home expenses with the business’ files is important in case these home office related expenses are challenged.

Be sure to read the IRS publication on home office expenses for more information on what shared use items do or don’t qualify.

👉 Shoeboxed Pro Tip: Documents other than receipts (like bills and invoices that prove home office expenses) can also be used to protect your business in case of an audit. Luckily, you can upload a variety of documents to Shoeboxed—we don’t just scan receipts!

Home office deductions can get tricky because shared space with the “home” complicates the use of business expenses.

Documents other than receipts (like bills and invoices that prove home office expenses) can be used to protect your business in case of an audit when receipts alone cannot distinguish home vs. office use.

Learn how to pay less to the IRS with this webinar from Bench. Sign-up to Bench using this link, and get 30% off your first 3 months!

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!