Small business taxes and write-offs can seem intimidating, even overwhelming, but they don’t have to be. We’ve broken down the small business tax strategies that every business owner should understand and put into practice as their business grows.

In this whitepaper, you’ll learn…

How the type of business entity you choose impacts your taxes

The tax write-offs that are the backbone of tax-saving strategies for small businesses

How to choose the best cloud-based accounting software for your business

Tips on how your accountant and cloud-based accounting software can work together

Organizational tax strategies for small business owners on the go

Taking time to plan and prepare a comprehensive tax strategy for your small business will help your business be unencumbered by complications related to taxes.

Let’s do this!

Step 1. Choose the right business entity

When starting a small business, your first instinct may be to become some sort of official business entity. Many small businesses operate as LLCs or Limited Liability Corporations.

Some small business owners even incorporate themselves right off the bat, depending on their assets and liabilities. But making the leap from a sole proprietor or independent contractor is actually quite a big step and may not be the right first step for everyone—at least not right away.

If you’re interested in tax planning strategies for companies, it starts with understanding how different business entities affect your tax liability.

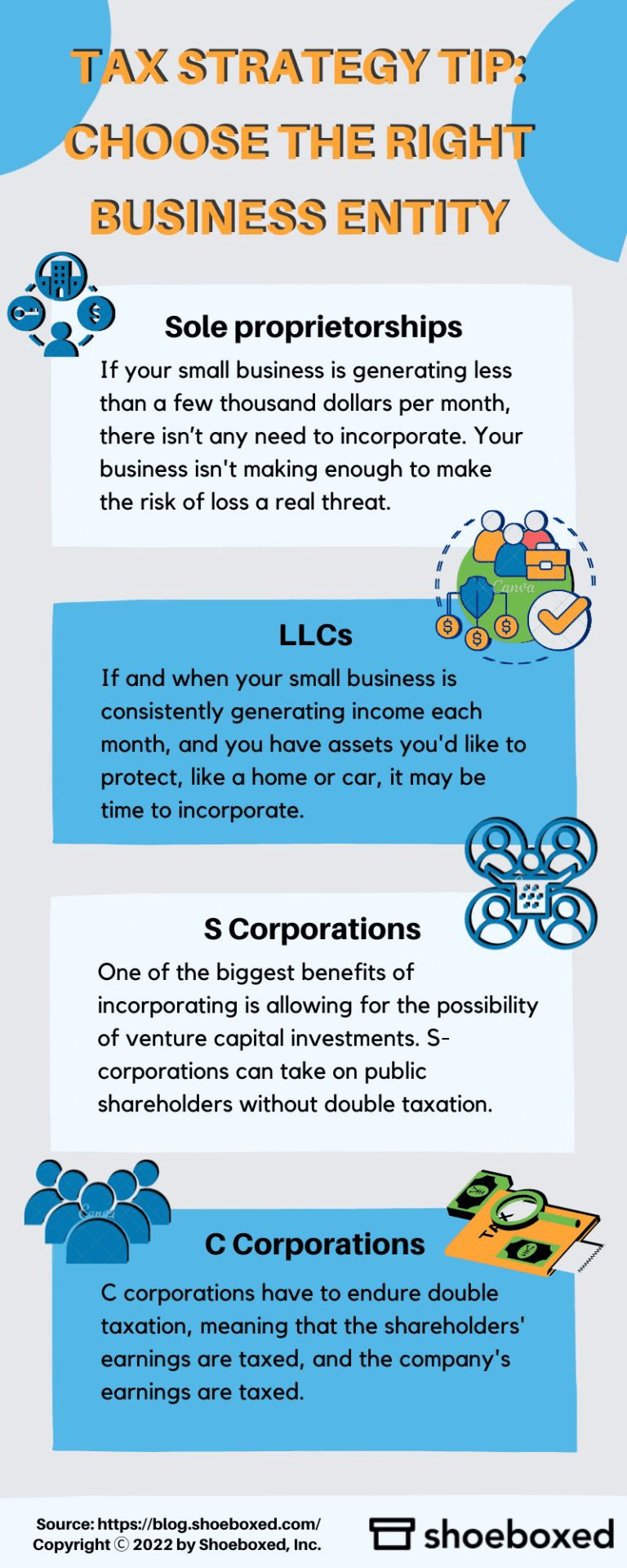

Tax Strategy Tip: Choose the Right Business Entity

Sole proprietorships

Small business owners need to protect themselves from risk and liability the second they go into business. But what if you’re in your first year of business, and you’re barely turning a profit? What if you’re spending more than you’re making?

If your small business is generating less than a few thousand dollars per month, there isn’t any need to incorporate. Your business simply isn’t generating enough revenue to make the risk of loss a real threat. This is especially true if you don’t own your own home or car and don’t have other assets that could be put at risk if you were sued.

Incorporating is more expensive than remaining a sole proprietor. That’s because the IRS treats the corporation as its own entity. That means that state and federal taxes will have to be paid on money the corporation earns. Once you begin the process of incorporating, you’ll be paying increased tax fees to your home state as well as the federal government. You’ll also incur additional fees from your accountant or tax advisor since you will need to file a separate return.

Patrick Tuttle, an Enrolled Agent and the CEO of Monument Tax Solutions, suggests taking into account the increased expenses of incorporating before making the leap and speaking with a tax professional to ensure that the timing is right for your business. “If, for example, you paid your accountant $300 to file your taxes as an independent contractor, you could end up paying an extra $800 to $2000 each year just by incorporating,” says Tuttle.

Not only is the drawback to remaining a sole proprietor the lack of liability protection, but it is also harder to get a business loan if you aren’t incorporated. To some extent, credibility can become an issue for sole proprietors, and therefore, financial institutions would rather work with corporations. The capital in a sole proprietorship is limited to what the owner can come up with.

If you’re a sole proprietor, you will want to apply for an Employer Identification Number, which establishes you as a business in the eyes of the IRS. This number can be used when paying contractors and employees and is a requisite of many nonprofit organizations that work with small businesses. For example, if you are donating your goods or services to a 501(c)3 in exchange for a receipt-in-kind at the end of the year, the nonprofit may require that you have an EIN number before they can offer a receipt. Independent contractors can apply for an EIN number through their tax professional or by filling out form SS-4.

LLCs

If and when your small business is consistently generating income each month, and you have assets you’d like to protect, like a home or car, it may be time to incorporate.

Tuttle suggests doing all the necessary planning before making the leap to an LLC. He cautions, “You may find after doing research that the leap is not one you need to make in the early stages of your business. Every business is different, and you may find that waiting to incorporate is more beneficial in the beginning. The bottom line is that you need to do thorough research and get as many expert opinions as possible before making such an important decision.”

With an LLC structure, you and your business will enjoy more protection than a sole proprietorship or a partnership while also enjoying many tax benefits associated with partnerships. If you are a sole proprietor and you’re sued, your personal assets are at risk. If you are sued after you have already incorporated, your personal assets are protected, and only those properties and finances that belong to the business are at risk and can be used to fulfill debts incurred by your business.

A limited liability company is a great “in-between” place to be when you’re ready for protection but aren’t ready to be a corporation. Limited liability companies have more freedom in terms of how they are taxed and enjoy the benefits of being classified as “partnerships,” at least as far as the IRS is concerned. There is far less paperwork involved with starting and maintaining an LLC than there is with a corporation. With an LLC, you get the flexibility to decide who can be a shareholder in your company and how they interact with the overall organization of the company.

LLCs are a great midpoint for companies looking for protection from liability but still want to enjoy a relatively informal way of doing business.

See also: Bookkeeping for LLC: Best Practices and FAQs

Corporations

One of the biggest benefits of incorporating is allowing for the possibility of venture capital investments. Investors prefer to work with corporations above LLCs because corporations are required to hold regular meetings to let investors vote and have a say in the direction of the company.

There are two different types of incorporations—an S corporation and a C corporation. S corporations have the ability to take on public shareholders, but those shareholders’ dividends are not taxed, freeing the S corporation from double taxation. S corporations, however, have a cap on how many shareholders can own stock in the company.

C corporations have to endure double taxation, meaning that the shareholders’ earnings are taxed, and the company’s earnings are taxed. However, a C corporation is allowed to have more investors and shareholders than an S corporation and can offer stock options and other benefits to investors.

If you decide to become a corporation, you’ll be required to hold regular meetings for shareholders, allow them to vote on important company issues, track and record the minutes of those meetings, and fill out paperwork on a regular basis throughout the year.

Which business entity should you choose for the best tax savings?

When trying to determine which level of incorporation is right for your small business, it’s a good idea to keep in mind your long-term goals. Many small business owners aren’t interested in growing their business to a Fortune 500 company. If your business is locally-owned and operated and you enjoy a small structure based mainly on word-of-mouth recommendations, you may never need any kind of protection beyond an LLC.

Enrolled Agent Patrick Tuttle advises that you create a strategic business plan based on thorough research to figure out when it’s time to incorporate. “Incorporating brings with it more protection, but also more expenses and complications. I suggest making this leap as a strategic, thought-out business move, as opposed to doing it just to do it.”

Step 2. Use a cloud-based accounting platform

The web’s first wave of online-based accounting software included companies like TurboTax, which allowed individuals and small business owners to file their taxes electronically.

Today, cloud accounting has exploded, allowing SMBS and individuals alike to keep track of personal and business expenses, tax deductions, income, and invoices throughout the tax year. Many cloud accounting options have smartphone apps that allow for any type of cloud-based bookkeeping. Better yet, these applications make it easy to export data and share it with your accountant or tax professional.

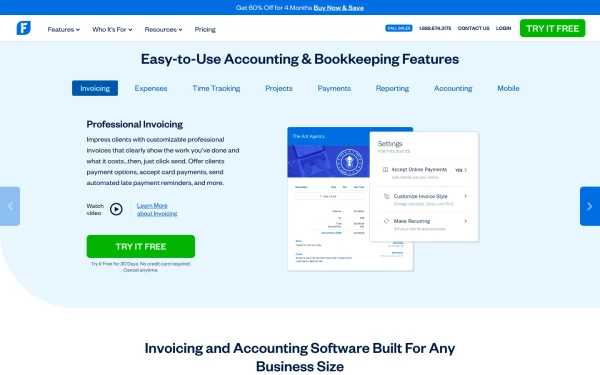

FreshBooks

FreshBooks is a cloud accounting application that does the work for you. It allows you to track and manage projects in real time, create seamless invoices, manage teams and employees, track expenses, manage your income, and generate reports with ease.

Freshbooks’s Website

All of your unbilled hours and income are displayed prominently, giving you an instant snapshot of the financial situation of your company and its trajectory over the past four months. A fresh, easily navigable interface makes it a snap to toggle between invoicing, expense reporting, time tracking, and estimates.

When creating a new project or working with a new client, you can use FreshBooks to manage the entire project. The application allows you to enter client information and tailor tasks to whatever type of project you happen to be working on. Your employees can keep track of their billable hours and add line items to invoices that then get sent to the client.

Once an invoice, estimate, or expense report is created, FreshBooks automatically integrates the data into your account, updating individual projects and overall finances for the entire year. When tax time comes around, you can generate detailed reports of just about anything you can think of—revenue generated by individual employees, payments collected, individual itemized tasks, etc.

Your tax professional can log into your account and pull whatever they need. Or you can download the necessary documents and send everything in an email. The first paid level of membership allows up to 5 clients and unlimited invoices to those five clients. More expensive plans let you add managers to your account, create team timesheets and team-based expense reports, and utilize your account as a comprehensive, company-wide financial management system.

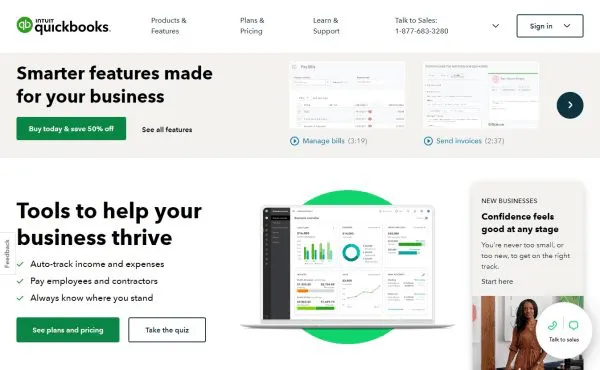

QuickBooks Online

QuickBooks Online allows you to organize various tasks and documents in a meaningful way. For example, the application creates groups based on vendors, clients, and banking transactions. Navigate to exactly what you need while having all past payments and invoices just a click away.

QuickBooks.com

In the contact management area of QuickBooks Online, you can import customers and clients from a variety of different applications, including everything from a simple Excel spreadsheet to the most advanced CRM software. The coaching tutorials help beginners get started without too much difficulty.

QuickBooks allows you to link your business bank accounts with its software, incorporating all of your transactions into the application. There are also options to pay your employees through QuickBooks, accept credit card payments, take stock of inventory and track payroll taxes.

Shoeboxed integrates with the cloud-based version of QuickBooks. This integration allows all of your Shoeboxed receipts to automatically be sent to your QuickBooks account and, in true Shoeboxed fashion, organize and label those receipts quickly and easily.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayQuickBooks Online begins with the most basic package and increases in price as more features are added. The most professional package allows you to create and send purchase orders, generate various types of reports, and offer direct deposit payments to your employees.

Sage Intacct

Sage Intacct offers cloud-based accounting software and financial tracking solutions for businesses that are growing fast. This software is flexible and intuitive. As you take on more clients and begin to bring in more revenue, Sage Intacct automatically updates your company’s financial infrastructure within your account. The software gives you the power to import data from a variety of different business applications, providing you with a comprehensive snapshot of every area of your business. If you have multiple businesses or do business in a variety of different currencies, it can consolidate all of your financial information in the form of easy-to-read charts and graphs.

Sage Intacct’s Website

One of the coolest features of Sage Intacct is that it allows you to tailor your application to your industry, profession, and even your position within the company. A CEO in the healthcare industry, for example, will have a completely different interface experience than the CFO of a nonprofit organization. Since Sage Intacct is meant for growing small businesses that require more specific functionality than most, pricing is customizable. A nice benefit is that you only pay for what you use, assuring that your investment in the software is a sound one.

Step 3. Maximize small business tax write-offs

Many small business owners skip lucrative tax credits and tax deductions simply because they’re unsure of whether or not they qualify for certain deductions.

But that could mean you’re missing out on significant tax savings for small business owners and keeping a high tax burden.

Tax credits differ from tax deductions in one key aspect. Whether you’re filing personal or business taxes, a tax deduction is used to reduce your taxable income before the calculation of the adjusted gross income. A tax credit reduces the tax liability or raises the return.

Here are a few of the most misunderstood small business tax deductions you may be missing out on throughout the tax year and how to start including them as a part of your annual small business tax strategy.

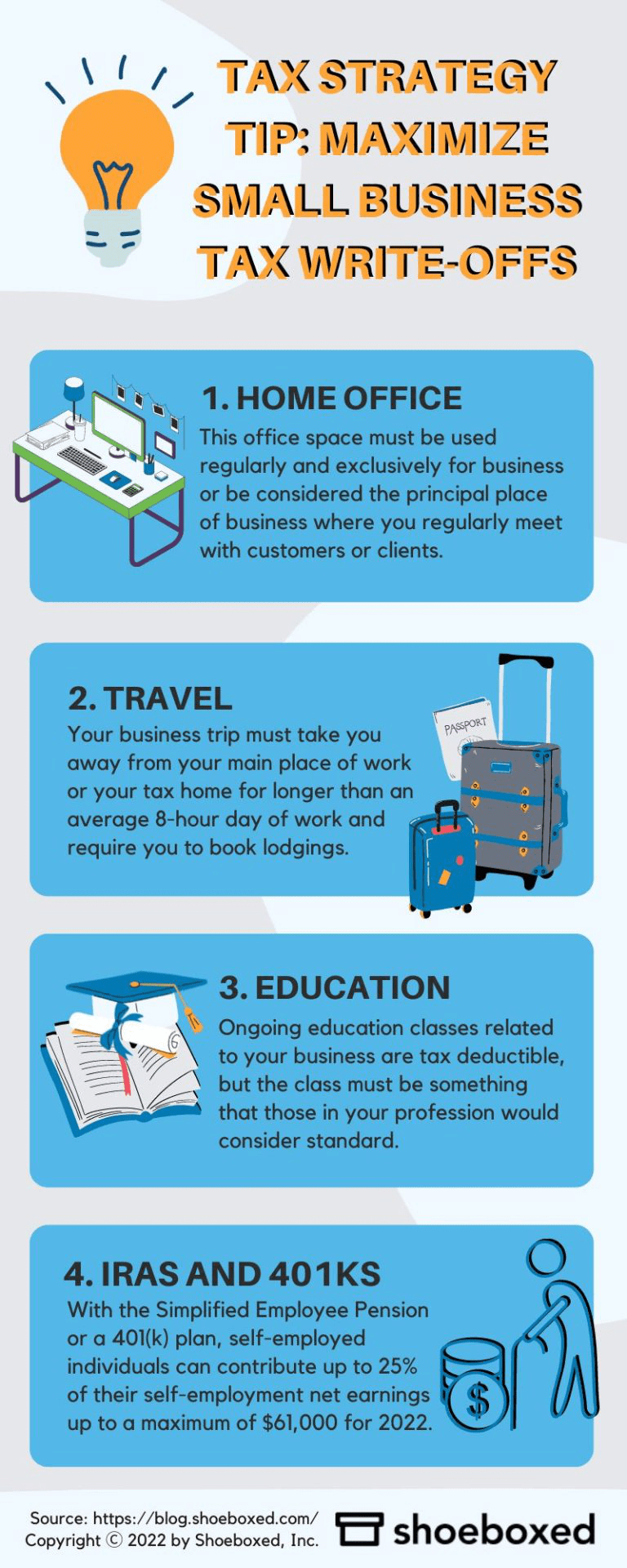

Tax Strategy Tip: Maximize Small Business Tax Write-offs

Home office

There’s a rumor going around that writing off home office space is a good way to get yourself audited. Well, if you’re correctly applying the write-off, you should have nothing to worry about! The trick is in the measuring tape.

If you work from home, you can’t write off your entire monthly mortgage and all of your bills as part of your home office deduction. The first thing to do if you’d like to write off working from home is measure your office. If you don’t have a “dedicated” office but work in the corner of the living room, measure the area of the room in which you work. This office space must be used regularly and exclusively for business or be considered the principal place of business where you regularly meet with customers or clients.

After you’ve determined the total square footage of your home office, then figure out what percentage of your entire living space is taken up by your office. That percentage is how you’ll determine your home office deduction. Let’s say your office and bathroom take up 25% of your entire home. This means that you can write off 25% of your rent or mortgage each month, 25% of your utility bills, and 25% of any repairs you make on the house.

(Note: See this IRS guide on the two methods for claiming your home office as a tax write-off.)

Travel

Travel write-offs seem to fall into the category of deductions everyone knows to take, but few know how to take and lower overall tax obligations.

For starters, here are IRS’s travel criteria for claiming travel expenses as tax write-offs, published in July 2022:

Your business trip must take you away from your main place of work or your tax home.

The business trip must take you away from your tax home for longer than an average 8-hour day of work; it must also require you to book lodgings to meet your needs for rest during your trip.

Your expenses must be normal and regular in your line of work. That is, they can’t be excessive or luxurious.

If you drive frequently for business reasons, you can either keep track of every dime you spend on your vehicle (oil changes, repairs, upkeep, etc.), or you can take a standard deduction from the IRS. This deduction is based on average gas rates throughout the country, and while that may average out to a lower amount than what was spent, it saves you the time and pain of tracking every mile on your journey. However, if you do need to track your business miles, Shoeboxed offers a free mileage tracker on their app that tracks location and miles, making tracking business miles a cinch.

Education

Ongoing education classes related to your business are 100% tax deductible, but keep a few things in mind. First, the class you’re taking must be a regular and necessary class that most people in your profession would consider standard. If you’re a restaurant owner, a botany class may be pushing the envelope, even if you plan to install a bonsai garden in the restaurant lobby. A cooking class or a class on sustainable fish farming practices would be a safer bet.

Second, timing is of the essence, especially for SMBs in their first year of business. Let’s say you’re currently employed full-time and are getting ready to become a small business owner. You’ll need time to prepare before quitting your job and starting your business. During this interim time, however, the IRS still considers you an employee of your company, so any ongoing classes taken while still a full-time employee can’t be written off as part of your small business deductions. Suppose you work at an accounting firm but plan to open a dog grooming business. In that case, your grooming education classes are not a business expense that can be taken as a write-off until the new business is open and generating revenue.

(See “Topic No. 513 Work-Related Education Expenses,” IRS.gov.)

IRAs and 401(k)s

If you’re self-employed and own a business, retirement plan contributions are tax deductible. This is a huge benefit that many small business owners don’t know about.

With the Simplified Employee Pension or a 401(k) plan, self-employed individuals can contribute up to 25% of their self-employment net earnings up to a maximum of $66,000 for 2023 into their retirement account. (See “Retirement Plans for Self-Employed People,” IRS.gov.)

You’re even allowed to defer your salary and put it towards your retirement account or retirement plan, much like regular employees do. Because of its large tax-saving potential, the self-employed retirement deduction is considered one of the most beneficial deductions a small business owner can take.

Learn how to pay less to the IRS with this webinar from Bench. Sign-up to Bench using this link, and get 30% off your first 3 months!

Step 4. Utilize cloud-based bookkeeping

Receipt software and cloud-based accounting software provide small business owners with robust tools for implementing the small business tax savings strategies discussed in this guide. The next step in business tax planning for 2024 is determining which tools are right for your business.

Track expenses on the go with Shoeboxed

Don’t wait until the second week of April to begin working on your tax return from the previous year.

Cloud-based bookkeeping is the most popular method for a small business owner to track business expenses on the go and in real-time. With services like Shoeboxed that have dedicated receipt scanning technology, you’ll be free of overwhelming piles of office clutter.

For accounting professionals, bookkeepers, and busy small businesses, a Shoeboxed account is an absolute necessity. If you have large stacks of paper clutter and the thought of scanning everything yourself gives you a rash, Shoeboxed will scan everything for you.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodaySee also: The Total Receipt Organization Guide

Use a receipt-scanning service to turn paper receipts into tax write-offs

When you sign up for a Shoeboxed account, you’ll receive a few Magic Envelopes in the mail a few days later.

What’s so magical about shiny blue envelopes? You can stuff stacks of paper inside, put them in the mail, and never worry about them again. Once the Shoeboxed team gets their mitts on your receipts (and business contacts and bank statements and…), they scan and upload everything to your account, extract and human-verify the data, and automatically categorize your documents.

When you log into your account, you’ll get a snapshot of your total expenses, be able to generate expense reports with one click, and search for individual receipts in an IRS-approved archive.

Shoeboxed provides IRS-approved receipt scans, so your Shoeboxed account eliminates the need to hang on to paper receipts.

Prevent paper buildup with a receipt app

Mailing in your backlog of paper receipts is a fantastic way to clear office clutter and prevent paper buildup around the house. But what about the receipts you collect while you’re out and about? Happily, there’s an app for that. You can use the Shoeboxed app for iOS and Android to upload receipts to your Shoeboxed account. Or forward an e-receipt to your Shoeboxed email address.

Within your Shoeboxed account, you can then create business expense categories, making tax write-offs a breeze. Export all of your receipts as a PDF or Excel report that will make your accountant’s life a whole lot easier. Create expense reports, organize categories by payment type, and work with your data in the way that’s most meaningful to you and your business.

Step 5. Work with tax professionals

Your accountant and your cloud-accounting software: A match made in heaven? If you’re currently utilizing QuickBooks Online or Shoeboxed for your small business accounting needs, does that mean you don’t need an accountant? Many small businesses cannot afford an in-house accountant, let alone an accounting department, but that doesn’t mean your cloud-based software is a complete replacement for the real thing.

What are the benefits of working with a tax professional?

Choosing a tax professional to work with you throughout the year is an important investment in your business and extends far beyond tax preparations and payments.

A good accountant can offer important advice about working with contractors, incorporating your business, hiring employees, paying quarterly taxes, and informing you of legit tax law and tax avoidance strategies for small business owners. They should be able to help you with money management and planning, numbers analysis, all aspects of federal and state employment laws, and even obtaining business financing. While an accountant may not be able to get you approved for a small business loan, he or she will be able to clarify the application process and help you frame your finances in a most appealing way to lenders.

It may seem counterintuitive but finding a great accountant when first starting is even more important than having one as an established company. In the beginning, you’re dealing with all sorts of rules, regulations, and laws that are completely foreign to you. And it’s when you most need assistance and advice about becoming a business entity, paying self-employment taxes, saving for quarterly tax payments, hiring contractors and employees, and a host of other unforeseen issues.

We recommend seeking out personal recommendations from other small business owners. It’s a great idea to review financial advisors who specialize in self-employed small business owners. Such expertise will save money and time during year-end tax planning.

What’s the difference between a CPA vs. an EA?

Two common certifications for tax professionals are the titles of CPA (Certified Public Accountant) and EA (Enrolled Agent).

CPAs—Certified Public Accountants—are certified by their home states in much the same way lawyers are. They must participate in ongoing education courses to ensure they’re up to date on the latest tax laws. A small business that has recently transitioned from LLC to corporation status may wish to consider employing a Certified Public Accountant. CPAverify.org contains a database of active CPAs generated by each state’s Boards of Accountancy.

EAs—Enrolled Agents—are certified by the Federal Government to represent taxpayers or tax-paying entities before the IRS. They can advise you if you’re audited, help you prepare your tax filings, create and manage partnerships, and assist you in navigating collections and business debts. Enrolled Agents pass extensive background checks and must also pass an extremely comprehensive test that covers every area of the United States tax code in intricate detail. The IRS.gov site maintains a list of all the active Enrolled Agents that is updated twice a year.

What’s the best way to work with a CPA or EA to prepare for tax season?

Software can certainly do a lot of the heavy lifting for you, but having a set of trained eyes is always helpful to ensure your books are accurate. When you use cloud-based accounting software, you can generate reports that save your accountant time—and that means saving you money.

There are several ways that your accountant can access the information you’ve tracked within your online account. According to Enrolled Agent Patrick Tuttle of Monument Tax Solutions, most small business owners should utilize their program’s report-generating application and send their reports to their tax professionals.

“I always ask my clients to generate reports for me. I do have an occasional client or two who, if they are using QuickBooks (which is my accounting software), prefer to email me their ‘Accountant’s Copy’ file so I can work inside it myself,” said Tuttle. Keep in mind that the more work your accountant is doing on your behalf, the more you’ll end up paying, so maintaining organization and clarity throughout the year is always in the best interest of your pocketbook.

Cloud-based accounting software is essential to any small business’s operations, but so is having a live person to advise and protect you and your business. As you conduct business throughout the year, accounting software allows you to track and organize those documents used by your tax professional to prepare your tax returns and take as many applicable deductions as possible.

The reports generated in applications like FreshBooks, Shoeboxed, and QuickBooks Online will allow your accountant to ensure accuracy on your tax forms and reduce the amount of taxes owed by your small business at the end of the year.

Which business entities can deduct up to 20% of their qualified business income under Section 199A when determining their personal tax under the Tax Cuts and Jobs Act?

In a deduction that started in 2018, S corporations, limited liability partnerships, partnerships, and sole proprietors can possibly deduct up to 20% of QBI under Section 199A up until the year 2025.

What are the 4 types of small business strategies?

The four types of small business strategies include:

Organizational

Business

Functional

Operating strategies

Frequently asked questions

What are some of the most overlooked tax write-offs for small business owners?

Each business, no matter the size, should look for larger tax deductions. Some of the most overlooked small business tax deductions are internet expenses related to business or a home office deduction, retirement savings, bad debt write-offs, bank fees & charges, credit card fees, business memberships & dues, and subscriptions to trade journals.

What factors should be considered when choosing accounting software for your small business?

The three primary factors that should be considered when choosing accounting software for your small business are cost, price, usability, and features such as assistance in filing tax returns and collecting data.

In closing

Your business strategies should incorporate a combination of organizational practices, a thorough knowledge of possible deductions, and the opinion of a tax expert you trust. If you’re wondering where to start, here are some straight-forward next steps to take:

Ask your tax professional if he or she has a cloud-based accounting application they like best and will utilize for future tax years.

Eliminate overflowing stacks of hard-copy documents by signing up for a Shoeboxed account.

Download smartphone apps that will help you consistently track your expenses as you go about your day and prevent paper buildup from the get-go.

Then, organize your receipts with Shoeboxed.

When it’s time to file taxes, you’ll be able to generate comprehensive reports with just a few clicks, submit them to your accountant, and sit back and relax, knowing that all your bases are covered. And don’t worry if the IRS lost your tax return or if you sent two tax-returns, we got you covered for that as well.

About Shoeboxed!

Shoeboxed is a receipt scanning service that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!