Income taxes never rank high on anyone’s fun list, even if they expect a tax refund. Small business owners find tax preparation exceptionally tedious and take precious time away from their company.

Therefore, efficiency during tax time becomes paramount for business owners who have to prioritize what little time they have.

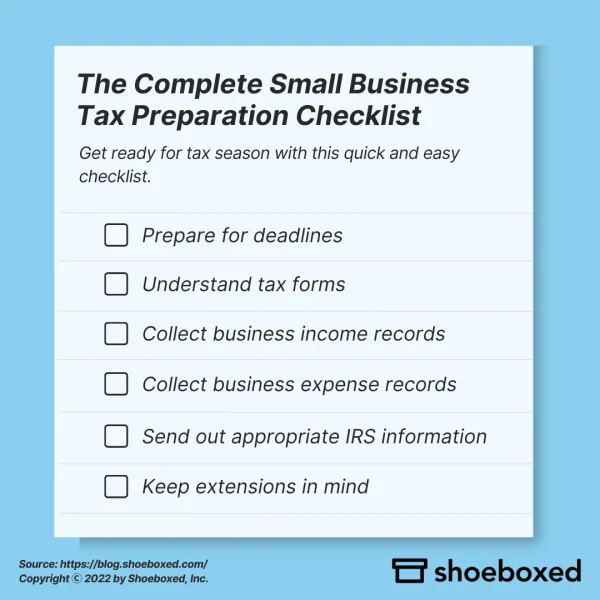

A thorough tax prep checklist will help walk business owners through the task of filing their taxes. In addition, following the checklist will give business owners the confidence that everything was completed as expected by governing bodies.

The complete small business tax preparation checklist

A tax return checklist is a perfect way to start the tax filing process so as not to miss anything. Completing the six items below—preparing for deadlines, understanding the appropriate tax forms, finding income and expense information, sending out IRS information, and asking for extensions where needed—will ease any business owner’s mind.

The Complete Small Business Tax Preparation Checklist

1. Prepare for deadlines

April 15th is the date that will most often come to mind when tax deadlines are mentioned. And for many small business owners, April 15th is still the date, though that can change depending on the type of business.

For example, a small business set up as an S corporation or a partnership has a filing deadline of March 15th. However, sole proprietorships, single-member limited liability companies, and C corporations abide by the April 15th deadline. At the beginning of the year, it’s important to note which deadline to aim for.

See also: What If I Miss the Tax Deadline for My Tax Return?

2. Understand tax forms

Apart from deadlines, many ask, “What documents do I need to file taxes”?

The type of forms needed depends on the type of business filing taxes. Business tax forms will include a summary page with a high-level review of the taxes being filed and supporting schedules and attachments that provide further details.

Of course, filing the correct document is paramount:

Sole proprietorship: 1040 Form with a Schedule C

C Corporations: Form 1120

S Corporations: Form 1120-S

Partnerships: Form 1065, then a Schedule K-1 with individual partner information

Each of these documents generally does the same thing: calculate the estimated tax payments due to the individual, business, or to the IRS.

One important piece of information is the provider’s tax ID number—a necessary piece of data for filing correctly. For those filing the 1040 form, this is the social security number, but for businesses, it is the EIN.

3. Collect business income records

Of course, no matter the document, supporting documentation is important for filing correctly. The IRS will want to know the amount of income from the business, and there are ways they verify that information independently. Companies need to focus on gathering records showing income to provide documentation correctly.

Taxable income can include the following:

Income from sales or services

Mortgage interest

Rental income

Royalties

Dividends/interest

Sale of capital assets

Acceptable income documents can vary but includes:

Separate documentation for any refunds or returns

Documentation to show interest or investment income with the name of the business

Rental income records

Recaptured depreciation record

4. Collect business expense records

Business expenses are just as important as revenue. Tax breaks, something any tax filer—business or individual—look for the most, are found in those expenses incurred over the tax year. Expenses related to supporting the business are the ones you’ll need to collect when you need to file taxes.

You should always have supporting documents to backup these expenses in order to claim certain tax deductions, and evidence will always need to be readily available in case of an audit. Usually, receipts are sufficient enough to prove expenses.

Business expense category examples:

Home office

Insurance

Supplies

Travel

Professional services

Documentation examples:

Receipts

Bills

Credit card statements

Charitable organizations’ records

Account statements

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic approach to receipt tracking for tax season. 30-day full money-back guarantee!

Get Started Today5. Send out appropriate IRS information

Certain information gets reported to the IRS by businesses. A good example is W-2 forms for companies with employees. These documents must be mailed out by the end of January. Copies of the form go to the employee and the IRS. Likewise, form 1099-NEC for independent contractors hired by the company also promptly goes to the contractor and the IRS.

Documents companies send to IRS

W-2 Form

1099-NEC

1099-MISC

-

Social security and medicare tax paperwork

Form 941

Form 943

Form 944

Form 945

-

Unemployment tax

Form 940

6. Keep extensions in mind

Should the need come up, there is no harm in filing with the IRS for an extension on taxes. Keep in mind that filing for an extension has to be completed by a certain date, and any taxes owed are paid on time. The extension is only for filing the paperwork rather than putting off any payments.

The extension is usually granted automatically once the paperwork is filed, though the documents might differ depending on the business entity.

For sole proprietorships, single-member LLCs, and C corporations, an extension is granted for six months making the new deadline October 15th. Partnerships and S corporations also get a six-month extension, but since their original deadline is in March, the new one becomes September 15th.

See also: When Uncle Sam Screws Up: What to Do If the IRS Lost Your Tax Return

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. 30-day full money-back guarantee! ✨

Get Started TodayFrequently asked questions

What forms do small business use to file taxes?

Many Individuals are familiar with IRS Form 1040. Companies also go through a tax filing process, though some of the documents are different: • Sole proprietorship: 1040 Form with a Schedule C

• C Corporations: Form 1120

• S Corporations: Form 1120-S

• Partnerships: Form 1065, then a Schedule K-1 with individual partner information

What information is necessary to file business taxes?

Revenue and expenses will comprise the bulk of the information provided on tax documents, no matter the form used. Keep in mind the form will require a social security number or EIN for identification purposes; the number provided is solely determined by the type of business. Various types of documentation will be used to prove the revenue the business brought on and the expenses spent to keep it running. In addition, expenses incurred are used to claim deductions on taxes, potentially lowering the tax liability. The important thing to keep in mind is to collect this data throughout the year rather than attempting to find it right before tax season rolls around. Proper accounting and document cataloging will make the process move smoothly. Proper tax software such as Shoeboxed that scans, organizes, and stores your data helps maintain records and provides assistance with filing documentation.

In closing

Filing your taxes for the year 2023 is right around the corner. Companies and individuals will start gearing toward filing all of the appropriate paperwork with the IRS as tax prep begins.

Keeping up during tax time comes down to how well organized a company has its accounting documents. The IRS will need income and expense information and documentation to support the numbers that the company has filed.

The process to file your taxes doesn’t have to cause headaches. Whether you as an individual or business owner get a refund or not. Following a checklist will help keep you on track as you list all income and tax expenses.

Agata Kaczmarek has held a passion for writing since early childhood. A professional writer for many years, Agata specializes in writing articles and blogs focused on finance as someone who holds a Masters Degree in Accounting and Finance.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!