Keeping track of business documents seems like an obvious obligation for an independent contractor—because documented proof is the only surefire way to defend against fees and legal claims from the IRS.

Whether you’re keeping track of expenses with a receipt book, a tax expense spreadsheet, or cash receipts journal, do you know what to keep and how long you should keep it for? When you file taxes as an independent contractor, leaving a paper trail to prove independent contracting work is critical.

Here’s a list of what to keep track of as an independent contractor!

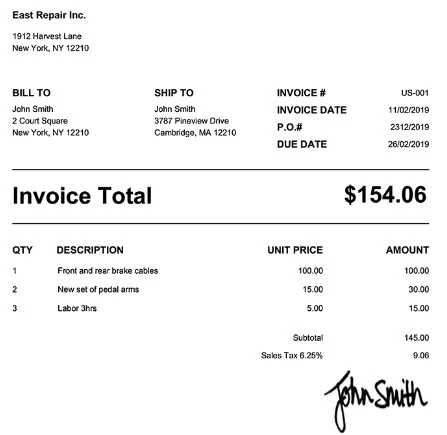

1. Invoices (7 years)

It’s recommended to keep key business ledgers like invoices for seven years, and for good reason, too! It’s the best way to protect your contracted accounts against a conflict with a client project.

Invoice statements also verify that you are subject to profits and losses, which is one of the factors in the Twenty Factor Test for an independent contractor.

In the event of an IRS audit, these invoices will help prove your status as a contractor.

Invoice template by Invoicehome.com

2. Travel mileage logs (3 years)

Like any good expense tracking habit, keeping travel mileage logs ensures protection against tax audits and business disputes. They can also be used for travel-related tax deductions.

There are plenty of travel miles that qualify, including car expenses for business travel to and from airports and hotels, business meals, errands and supply runs, travel to client offices, and to and from business meals.

Regarding car expenses, the gas mileage rate was 62.5 cents per mile for the last 6 months of 2022. The mileage rate for 2023 is 65.5 cents per mile.

3. Business cards (forever)

Being a successful independent contractor requires agile networking skills. At any given moment, there’s a chance that you will stumble across your next great project, partner, or client.

Unfortunately, independent contractors collect dozens of business cards every month that are habitually trashed or misplaced. Keeping business cards can help secure relationships, as you never know when one of those contacts will come in handy.

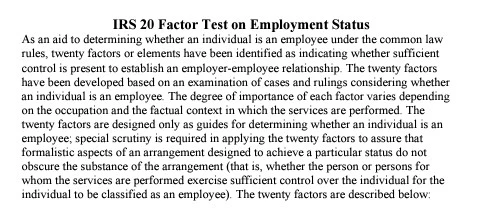

Working for multiple clients is also part of the IRS’s Twenty Factor Test, and business cards provide evidence that you are not controlled by a single employer.

IRS 20 Factor Test, Michigan.gov

Do business cards like a boss ✨

Use Shoeboxed’s app to organize business cards, receipts, and more. 30-day full money-back guarantee!

Get Started Today4. Service advertisements and listings (forever)

Keeping copies of past service advertisements and listings is yet another easy way to formally and legally prove a contractor-client relationship for independent contractors.

The IRS says that making services available to the general public on a regular and consistent basis demonstrates autonomy in the nature of the work. It also confirms your intent of work in the event that a client wants to claim you as an employee rather than a contractor.

5. Project records (7 years)

Independent contractors are required to fill out form 1099-MISC, a detailed document that asks what you made for each individual job.

Project documents, including the contract, change orders, correspondence, logs, monthly reports, and schedules provide the specifications and technicalities needed not only to fill out a 1099, but they also provide detailed insight of your contract work to the IRS if your worker classification ever comes into question.

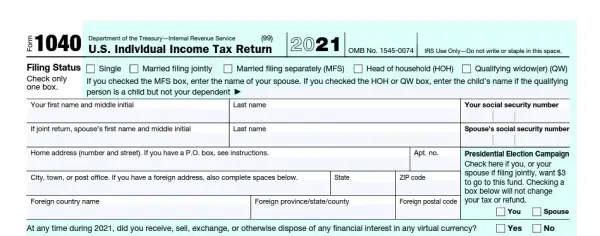

6. Tax returns (3 years)

Due to the IRS statute of limitations, three years from the date of your tax return (or from the date of filing, whichever is later) is typically the standard time to keep business tax returns for tax-related business documents.

The statute states that you have three years to file a claim for a refund, and the IRS has three years to appraise a tax if your income was not accurately reported.

Even if these two situations don’t apply to you, keeping recent tax records protects you from any doubts that may be raised against your tax filings in the future. (IRS.gov)

Form 1040, US Individual Tax Return, IRS.gov

Business expense tracking apps, accounting software, or receipt management software is key to having a stress-free tax time.

7. Professional licenses and insurance certificates (forever, or until expiration)

The last item on our list of what to keep track of as an independent contractor are licenses and certificates. Many jobs require contractors to be professionally certified in a given field to complete a client project.

Though the regulations vary state-by-state and city-by-city, having these documents on hand and ready to present to a potential employer streamlines the hiring process, increases the probability of getting hired for the job, and may even increase your potential pay.

Clients want to know they are legally protected and are hiring the right person for the job—it pays off to gain their trust.

How to keep track of important financial documents as an independent contractor

Maintaining a well-organized system for your financial documents is crucial as an independent contractor to ensure accurate record-keeping, tax compliance, and smooth financial management.

Here are some methods you can use to keep track of your important financial documents:

1. Create a filing system

Develop a filing system that works for you, whether it's digital, physical, or both. Use clear, consistent naming conventions for your files and folders to make it easy to locate documents.

2. Go digital

Scan or take pictures of physical documents and store them digitally. Use cloud storage services like Google Drive, Dropbox, or OneDrive to keep your documents accessible and secure. Ensure they are backed up regularly.

3. Use accounting software

Consider using accounting software to help you track expenses, invoices, and payments, and often offer the ability to store or link to digital copies of your documents... Check out Method #4!

4. Shoeboxed's document scanning service!

If you’re looking to go digital and keep all your financial documentation in the cloud, Shoeboxed is your best bet.

With Shoeboxed, you can outsource your receipt and document scanning using their Magic Envelope service.

Shoeboxed’s Magic Envelope allows you to stuff your receipts, warranties, invoices, and more inside a prepaid envelope, mail it to a scanning facility, and get the expense organization and digitalization done for you. This feature is especially useful if you have hundreds of old receipts that you haven’t gotten around to organizing.

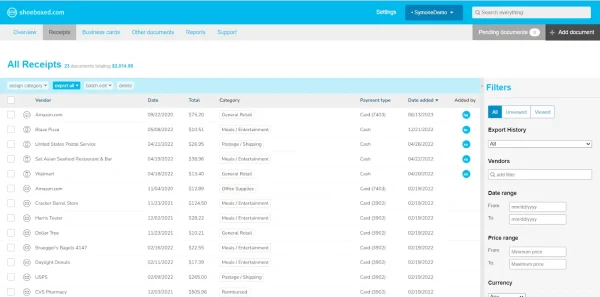

Once your expenses are scanned into your Shoeboxed account and organized into digital records, you can create and export a CSV file and open it in Excel to track your expenses.

All of your previous expenses will be automatically included in your spreadsheet and categorized into columns for the receipt date, store, notes, currency, totals, payment type, and more.

Links to images of your receipts are also included in the spreadsheet for easy access, should you ever be audited.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 30-day full money-back guarantee!

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts, warranties, contracts, invoices, and other documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is the most popular Shoeboxed feature, particularly for businesses, and lets users outsource their receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 30-day full money-back guarantee!

Get Started TodayFrequently asked questions about what to keep track of as an independent contractor

Tracking 1099 expenses: How do I keep track of taxes as a 1099 contractor?

When you’re working as a 1099 contractor, there’s a lot to keep track of. In order to get the largest tax break possible, keep a detailed log of all your business expenses so you can report these when the tax season comes.

There are several ways to manage business expenses:

1. Take pictures and keep track of receipts, both digital and physical invoices, credit card statements, office expenses, and other tax deductible purchases.

2. Keep an independent contractor spreadsheet to track both your income and expenses.

3. Establish an expense tracking process by using a receipt tracking app.

How much should independent contractors be expected to pay in taxes?

This depends on several factors such as which state you stay in or whether you have any kids, but to be safe, if it’s your first contracting year, aim for saving 20 to 30% of your paycheck for taxes.

Start looking into tax deductions and confirm your eligibility for the deductions. Do a good job of tracking your mileage and your business expenses, and you’ll save money in the amount of taxes you’ll need to pay per year when tax time comes around.

In closing

Make sure you don’t lose these important tax documents and you’re protected against new contract work laws by knowing what to keep track of as an independent contractor and saving your documents for secure and easy access.

Shoeboxed offers mail-in services with premium plans, allowing contractors to send in their important documents and never have to worry about being able to find and provide legal supporting documents for their contract work. Focus on working for yourself and doing what you love—we’ll handle the paperwork.

You might also like:

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!