Receipts may come in different forms and sizes, but they all share one common issue—they create paper clutter. It’s not unusual to find receipts deep in the pockets of your jeans, hiding within your drawers, or peering out from under stacks of documents. By the time you find them, they’re likely faded or torn, making them nearly unreadable.

Online receipts, on the other hand, don’t take up physical space, but they do take up digital space and can be difficult to keep organized if left in your inbox.

Having to sort through hundreds of emails to find a singular receipt can be a hassle and may leave you thinking, “there HAS to be a better solution!”

You’re right! There are plenty of ways to organize receipts. That’s why we’ve put together this guide on how to store receipts and invoices.

Why should you organize your receipts?

Here are the top three reasons why you should organize all your receipts:

1. To get ready for tax season

For tax purposes as a small business owner, it’s in your best interest to lower your taxable income and increase your potential for a tax refund. Having a system will save time and free you from searching through filing cabinets or your computer folders for that missing receipt.

The good news is most of your business expenses qualify as deductions with the IRS.

However, the IRS will want to see receipts—physical receipts, tax receipts, e receipts, from receipt books, etc.—and other related documents to verify that your declared expenses were truly spent for business purposes.

If you don’t have a business receipt, you won’t get a tax refund!

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic approach to receipt tracking for tax season. 30-day full money-back guarantee!

Get Started Today2. To reimburse expenses correctly

Often your employees have to use their own money to pay for something on behalf of your business. They then fill in an expense report to get reimbursement. How can you verify if their claims are genuine or not?

Receipts—digital receipts and physical receipts—can help you! They let you know exactly when and where the transaction took place. Most importantly, receipts tell you the exact amount you need to compensate. This prevents fraud and unwanted disputes in your workplace.

3. To stay on top of your spending

Sticking to your budget is not an easy job. One effective way to do so is to accurately maintain records of every transaction. By doing this, you can have a clear vision of how much you have spent, what to cut out, and which expenses were not worth the money.

Consequently, your overall cost and cash flow management will also become more efficient.

1. How to organize physical receipts

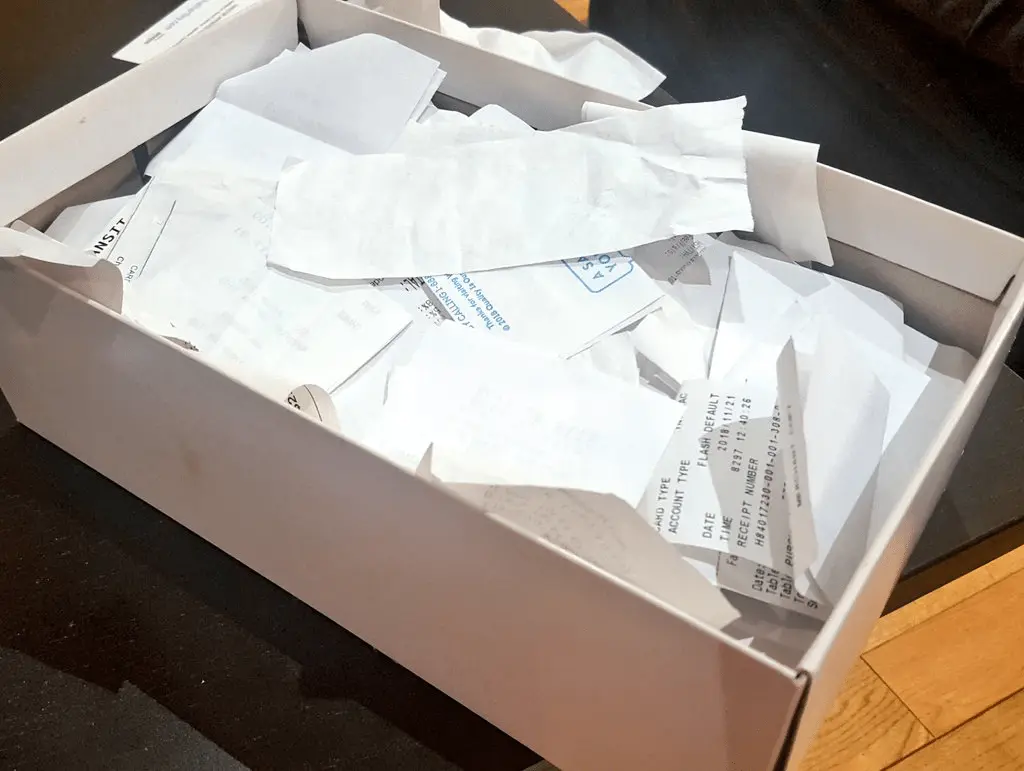

Before smartphone cameras and scanners, there was the good ol’ shoebox. That’s right, back in the day, any container served as an ideal household receipt organizer. And if there wasn’t a shoebox handy, the next best things were jars, envelopes, paper clips, or even elastic bands.

Storing receipts in a shoebox in 2018, Jim Zub

Don’t worry. If you prefer to keep track of physical receipts, there are better options out there to help sort out your slips of paper.

Here’s a quick overview of the best methods for organizing receipts that have worked for many small business owners.

Store paper receipts in binders and folders.

Establish categories for receipts based on spending types.

Each day, process your receipts.

-

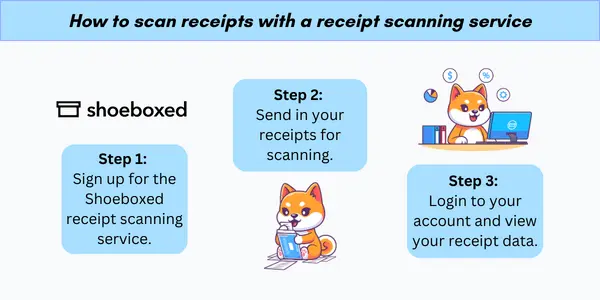

Immediately eliminate receipt clutter by using Shoeboxed’s Magic Envelope service

Add notes to paper receipts for more accurate company expense tracking.

Sort paper receipts into a folder by date.

For a deeper dive into each of these methods, check out our handy list of storage organization ideas.

2. How to store digital receipts

The best way to avoid losing or damaging receipts is to forego paper and digitize them instead. Most businesses, both in-store and online, now offer email receipts as an alternative to printed copies. This makes it easier to retrieve your receipts anytime, anywhere.

For any printed receipts and invoices, we suggest investing in a receipt scanner, a document scanner, or using a receipt scanning app. You may need to learn how to convert from PDF to JPG if your receipt files are taking up too much space on your computer.

Both options usually come with transcription capabilities so that you can still search for and retrieve information as easily as you would with an e-receipt.

3. How to store receipts on an iPhone

If you’re truly looking to optimize and keep your desk minimalist and you don’t want to invest in a receipt scanning machine, we recommend you use a receipt scanning app. Imagine having a portable receipt scanner, right in your pocket!

To organize receipts electronically, Shoeboxed is the perfect receipt scanner and organizer. All you need to do is take a photo with your phone’s camera and the app will do the rest.

Scan your receipts with Shoeboxed and the app will be added to your account

It uses optical character recognition (OCR) to transcribe the text in your photo—combined with a human verification team, so you can easily search for, retrieve, and create reports to use as accounting information later. Shoeboxed’s receipt software also seamlessly integrates with accounting apps such as Xero and Quickbooks so you can streamline any bookkeeping process even more.

Turn your receipts into data and deductibles!

Do you have too many receipts and not enough time to scan them? Simply stuff them into one of Shoeboxed’s Magic Envelopes and let Shoeboxed scan them for you! It couldn’t be any easier.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Never lose a receipt again 📁

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayFor those who prefer to receive e-receipts, you can also auto-import receipts from Gmail into Shoeboxed to keep track of all of your documents together in one place!

See also: Shoeboxed vs. Dext Prepare: Which Is The Best Receipt Tracking App?

4. How to store receipts for business use

Depending on the size of your business, you may need to sort through hundreds of business receipts, credit card statements, or other paperwork at the end of every month. This is a mammoth task that you may not always have time for. We recommend filing receipts right away to save yourself time and energy.

If you are using a traditional receipt storing method, make sure you place your receipts in their respective folders on time. This also goes for those using receipt scanning machines or apps. If you’re using apps, you could even scan them as soon as you get them. Ideally, you should be sorting your receipts daily into an electronic receipts folder to avoid losing or damaging them, but if this is not possible, you can also do this weekly.

Shoeboxed can help you get your receipts in order and create reports that will help you better understand your business. Check out this easy guide to using the Shoeboxed receipt scanning app.

5. How to store personal receipts

One of the most important reasons to keep your receipts organized is to avoid stress during tax season.

Many people don’t know how to store receipts for tax time. While there are many methods available, it’s important to choose the one that works best for you. We don’t recommend putting them in a shoebox, as mentioned above (although it’s better than leaving them loose!). Instead, check out this video for some great strategies:

How to store and organize receipts by The Gold Project

6. How to store receipts so they don’t fade

Modern receipts are most often printed on thermal paper, which is activated by heat. While this method is cost-effective and fast, these receipts are prone to damage. It’s important to take precautions when storing paper receipts so they don’t fade.

Faded receipt example, CNET

To store receipts so they don’t fade, keep them in a sleeve that is not made of plastic. You should also avoid touching them as much as possible, or clean your hands beforehand because the oils on your skin can damage them.

Finally, keep them away from heat and moisture—ideally in an environment that is not prone to temperature changes.

The best way to avoid fading receipts, however, is to digitize them using the tools listed above. Digital copies saved to the cloud are safer and easier to access in the future.

If you need to restore a faded receipt, check out this useful hack:

How To Reactivate Faded Receipts by Neon Watermelon

7. How to store invoices

The best way to store invoices is to digitize them. Digitally storing invoices has several advantages, including cloud-based access, which means 24/7 accessibility anytime, anywhere. One of the best ways to organize is to use a digital filing system such as Google Drive, which gives you a central location for all your document needs.

Additionally, by storing your invoices digitally, you can easily forward invoices to your accounting department or download the invoice in the file format of your choice.

Furthermore, digitally archiving invoices gives you a panoramic understanding of expenses for projects, as you’re able to compare costs with other digitized invoices.

To store invoices digitally, use a scanning app that provides OCR technology, which will capture not only the picture of your invoice but also the text on the image.

An OCR-scanned digital copy of your invoice means that you’ll be able to pull it up using your computer or software’s search feature. Search for the contractor by name or some other line item, such as date, cost, etc., and you’ll get a hit!

In closing

Although storing receipts may not be the most exciting part of running your business, it is an important part of the accounting process. Keeping your receipts organized will not only save you time—your accountant or bookkeeper will thank you later! We hope this guide has given you the tools needed to better store your receipts and invoices.

About Shoeboxed!

Shoeboxed is a receipt scanning service that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!