Throughout the past decades, many industries have undergone a digital transformation worldwide, and the financial sector is no exception. A while ago, businesses hired accountants to record and analyze all financial data within the institution, but errors were common, costing companies quite a bit of money.

Digital accounting is the solution companies need to keep up with the times of digital transformation. But you might wonder what digital accounting is, what the benefits are, and how to transition.

In brief, here’s a summary of our key takeaways regarding digital accounting:

Digital accounting involves electronic storage and management of financial data.

Benefits include time and cost savings, increased accuracy, scalability, collaboration, data security, and productivity.

Transitioning involves preparing, using OCR scanning, implementing storage solutions, and discarding paper copies.

Accounting software empowers accountants and improves efficiency.

Digital accounting is crucial for business growth and effective financial management.

Read on for more.

What is digital accounting?

Simply put, digital accounting encompasses creating, representing, transferring, and storing financial information in an electronic format. With digital accounting, financial data is no longer stored on paper. Yet, that does not mean the accountant’s role is no longer needed. Rather, digital accounting empowers accountants to use software and make the accounting cycle more efficient and error-free.

Introduction to Digital Accounting by Business SupportWhat are the benefits of digital accounting?

Accounting software is the key to digital accounting as it gives companies the benefits of using technology rather than paper.

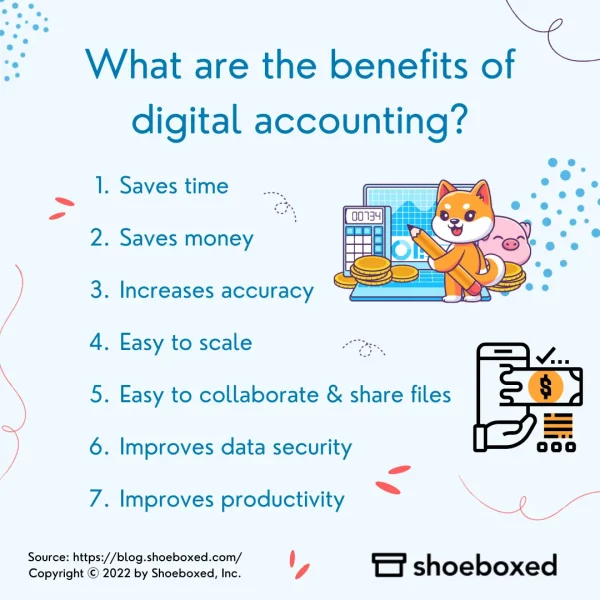

Benefits include the following:

The benefits of digital accounting

Saves time

Digital accounting saves time by providing solutions to plenty of the manual work accountants used to perform, such as data entry. So, rather than focusing on mundane tasks, accountants can focus on the more important aspects of their job.

Stop doing manual data entry 🛑

Outsource receipt scanning to Shoeboxed’s scanning service and free up your time for good. 30-day full money-back guarantee! ✨

Get Started TodaySaves money

The ability to control financial information electronically can become a money saver. Saving files on paper is no longer necessary, nor is storage space. The accuracy of digital accounting means fewer errors to fix that could have led to a loss of funds. Salaries for accountants are also better allocated, as they focus on the harder areas of their role.

Increases accuracy

Traditional accounting practices are less reliable than digital accounting since people are prone to making errors despite their best efforts. Although a small business might function well using manual accounting practices, as the business grows, so should this aspect of the company. Digital accounting can help enterprises grow and achieve business goals by providing quick and accurate financial information.

Easy to scale

Digital accounting makes it easy to scale a business and its accounting practices. As a result, companies can focus on something other than hiring more accountants to manage an increased workload. Instead, they can focus on sustaining scalable software to help drive more work.

Easy to collaborate and share files

Electronically maintained files are easier to share with employees across the company. In addition, more individuals who need access can review files simultaneously rather than having to pull them on paper from filing cabinets. Financial documents can be shared easily across the organization with key individuals who need them in a timely fashion before making important business decisions.

Improves data security

Cyberattacks are more common than ever before. Companies in every industry worry about getting hacked. However, accounting software provides a high level of security. This type of software offers access restrictions, encryption, and backup to cloud storage. Paper-based documents are inherently at risk of physical damage, theft, or loss.

Improves productivity

Digital accounting solutions increase productivity and collaboration among employees and divisions within a company. Information is also readily available without spending the necessary time looking for files. Digital accounting will also improve productivity in the right area since accountants will have time to focus on key tasks rather than day-to-day data entry into ledgers.

Digital Accounting and its benefits by focusandsomar accountantsStep by step how to transition to digital accounting systems

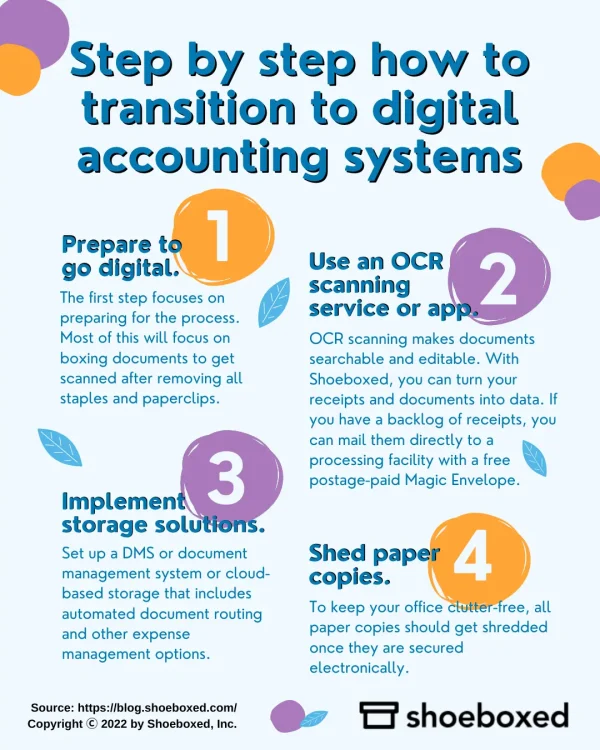

Accountants and companies using paper accounting might find the transition to electronic accounting a daunting task. Quite often, accountants find themselves strapped for time to complete their work, and giving them more work to make the transition is hard to fathom. The transition, however, can be accomplished easily by following the steps outlined below.

Step by step on how to transition to digital accounting systems

Step 1. Prepare to go digital.

The first step focuses on preparing for the process. Most of this will focus on boxing documents to get scanned with their retention times after removing all staples and paperclips. Some of these preparatory steps will help smooth the process and cut down on potential costs.

Step 2. Use an OCR scanning service or app.

Optical character recognition, OCR, makes the document searchable and editable. In addition, OCR changes any handwritten notes to machine-encoded texts, making it like any other electronic document.

With Shoeboxed, you can turn your receipts into data that will be stored on this receipt tracking platform by capturing receipt images from your phone or email. If you have a backlog of receipts, you can mail them directly to a processing facility with a free postage-paid Magic Envelope.

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 30-day full money-back guarantee!

Get Started TodayStep 3. Implement storage solutions.

Set up a DMS or document management system or cloud-based storage. When looking for the best storage, ensure it has some of the following functions:

Automated document routing

Paperless bill, expense, statement, and other report management

eSignature options for signing electronically

Step 4. Shed paper copies.

To keep your office clutter-free, all paper copies should get shredded once they are secured electronically. You can use an industrial shredder or hire a professional service to help with the shredding process.

In closing

Digital accounting is the way ahead for any company hoping to scale its business. The accounting software available on the market allows accountants to easily create, store, and disseminate financial information. Countless benefits help make the transition to digital accounting easier.

Accounting software helps companies maintain and store all financial-related data, saving time and money in the long run. Accountants are not replaced by such software but can use it as an essential tool in completing their tasks. Using such electronic software minimizes the number of errors and frees up accountants’ time to focus on performing key improvement pieces for their company.

Also check out:

Everything You Need to Know about E-receipts for Businesses & Customers

How to Organize Receipts Electronically: A Comprehensive Guide

Agata Kaczmarek has held a passion for writing since early childhood. A professional writer for many years, Agata specializes in writing articles and blogs focused on finance as someone who holds a Masters Degree in Accounting and Finance.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt app (iPhone, iPad, and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more with Shoeboxed.

Try Shoeboxed today!