Small businesses are increasingly using virtual bookkeeping services, opening many opportunities for fresh-graduate accountants, professionals with CPA certifications, and people looking for online jobs.

In this article, we take a look at what this position entails, including common duties, and educational requirements.

We’ll also highlight the benefits of a bookkeeping career and give you practical steps that you can take right away to build your skills.

What is online bookkeeping?

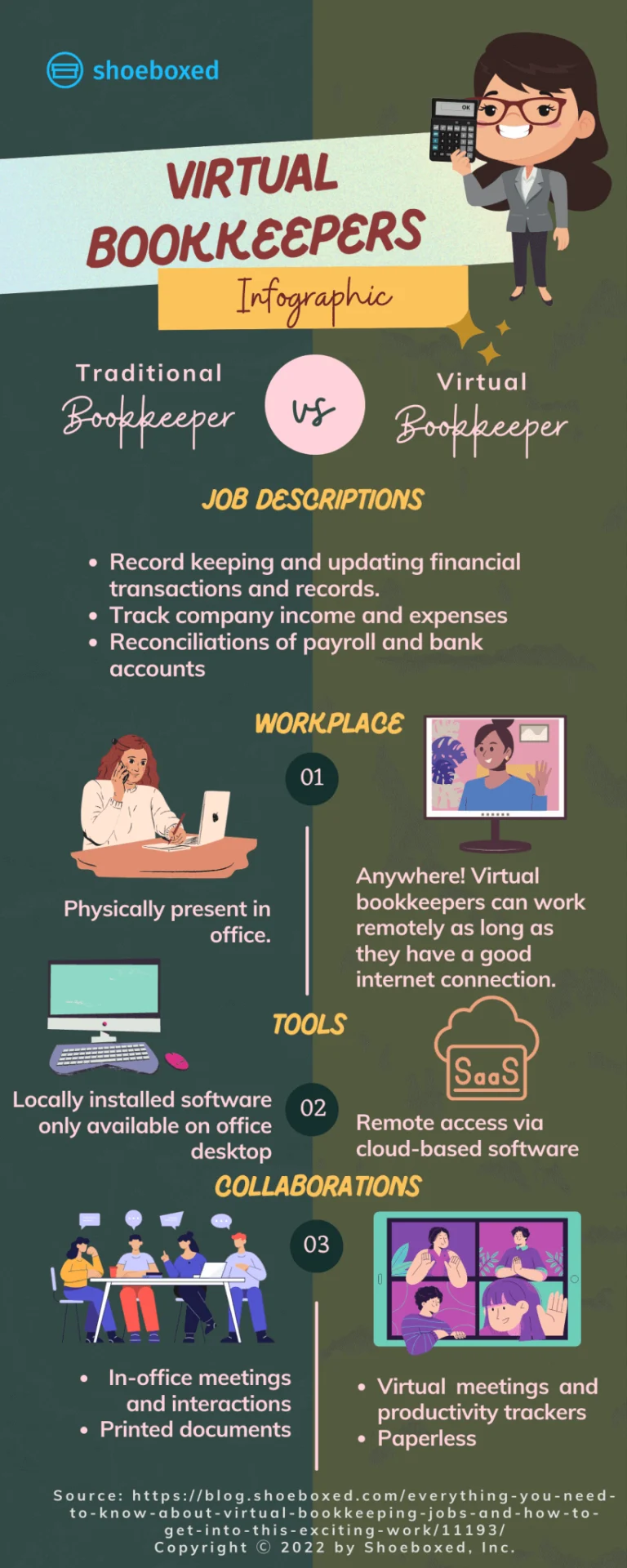

Remote bookkeeping jobs include the same tasks as traditional on-site bookkeeping. The role includes routine accounting duties such as recording and validating transactions, invoicing management, producing and analyzing financial statements, handling accounts payable, receivable, payroll, and managing tax payments.

How does online bookkeeping work?

A traditional on-site bookkeeper must be present in the office, while virtual bookkeeper jobs consist of managing everything remotely using cloud-based software.

What’s in an online bookkeeping job description?

An online bookkeeper is expected to perform all the tasks of a traditional on-site bookkeeper. However, the job description will also include using online software, such as QuickBooks Online, and remote access tools to maintain the financial records of a company, tracking income and expenses, and reconciling payroll and bank accounts.

The job description might specify business administration experience, the need for virtual training, previous experience requirements, and requirements surrounding a background check, such as full identity verification.

Keep in mind that you will be handling a company’s financial details and will work closely with the accounting department, an accounting coordinator, or a certified public accountant.

Because you will work closely with information that a company might deem sensitive, be prepared for a background check.

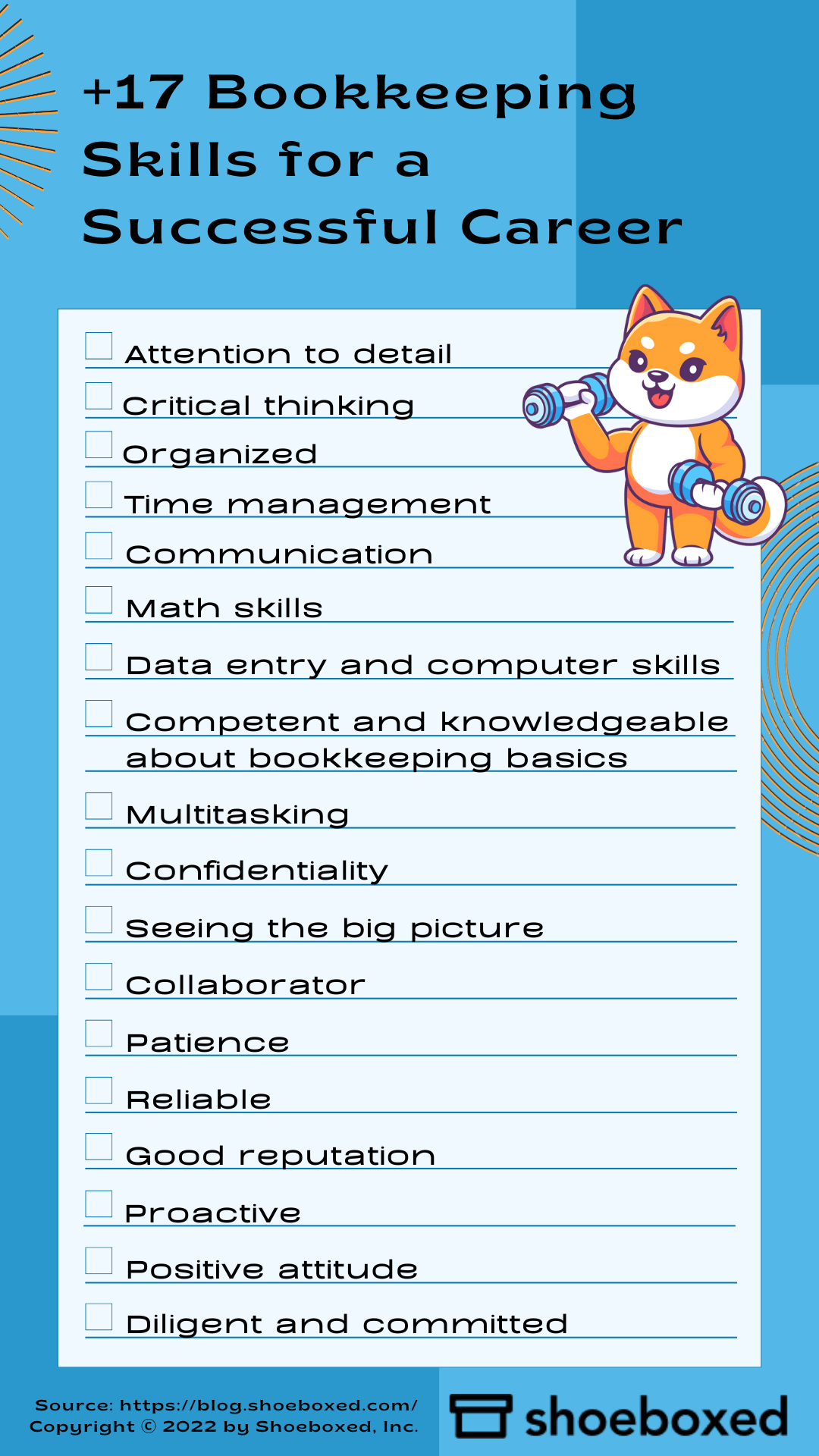

What skills do bookkeepers need?

According to Caryl Ramsey, a veteran bookkeeper and Shoeboxed author, here are the skills that will make you successful in a bookkeeping career.

Attention to detail

Critical thinking

Organization

Time management

Communication

Math skills

Data entry and computer skills

Competent and knowledgeable about bookkeeping basics

Multitasking

Confidentiality

Seeing the big picture

Collaboration

Patience

Reliableness

A good reputation

Proactiveness

Positive attitude

Diligence and commitment

+17 bookkeeping skills for a successful career

What tasks will a bookkeeper be asked to handle?

Bookkeepers are responsible for the following tasks:

Entring data

Bills and invoices

Payroll management

Monthly financial reports

On a monthly basis, a bookkeeper running a bookkeeping business will be expected to handle month-end accounting tasks, such as the following:

Recording and categorizing revenue and expenses

Reconciling accounts

Reviewing and following-up on past due payments

Recording and issuing payroll

Taking care of any tax obligations

Updating W-9 information if needed

Performing the month-end closing process

Monthly bookkeeping checklist by Shoeboxed

Occassionally, the role includes business administration, knowledge of Quickbooks Online, etc.

What’s the difference between on-site bookkeepers vs. virtual bookkeeper jobs?

The infographic below illustrates the key differences between traditional and virtual bookkeepers’ work.

On-site traditional bookkeepers vs. virtual bookkeepers.

What are the benefits of bookkeeping from home?

The benefits of online bookkeeping jobs from home include the following.

a. It’s easy to learn

The good news is bookkeeping isn’t only for those with an accounting background; this job is an open opportunity for both the experienced and inexperienced in accounting.

Entry-level bookkeeping mainly involves categorizing things correctly and entering financial information into accounting systems. No formal education is required to be a bookkeeper, and only basic math is needed. Although, it would be a huge plus if you’re detail-oriented, highly organized, and have experience in business-related administrative work.

b. You can work at any time

Typically, most bookkeeping jobs offer the flexibility to work at your own schedule. As there are no fixed work hours, clients call you only when needed, allowing you to enjoy flexibility. You can start your day whenever you want, set your own schedule, and take breaks any time. However, keep in mind that you will need to stay on top of your client’s daily financial transactions thoroughly in order not to be overwhelmed later on.

There may be, of course, times that your clients need you to work extra hours in a day, like during the tax season. However, if you are excellent at time management, this won’t be stressful.

Want to earn extra? You can also do bookkeeping part time aside from your 9-5. This will give you an added source of income and grow your client base once you decide to commit to doing online bookkeeping full-time.

c. You can work from anywhere

Professional bookkeepers who work virtually have freedom of movement. All you need is a good laptop equipped with accounting software and a stable internet connection.

If you have young children, flexible jobs allow you to work from home and care for your kids at the same time. If you have school-aged kids, you can do your tasks from any computer, including outside your home, such as in a coffee shop or a co-working space, while waiting for them to finish school.

Being employed as a virtual bookkeeper offers you more freedom as you can bring your work with you, making sure your job doesn’t consume your entire life. Not to mention, working in different environments can help you stay motivated and focused on tasks.

Other good reasons to work from home include greater flexibility, increased productivity and motivation, and reduced need for office space.

Working from home as a bookkeeper by Bookkeeper Bootcamp

d. You can have a healthy work and life balance

If you’re wondering whether bookkeeping is a stressful job, you don’t have to worry! Bookkeeping online offers flexible working hours, allowing you to maintain the work-life balance you want and need. Since you don’t need to travel long distances and hours to work and don’t necessarily have to work exactly from nine to five, you’ll have more time for family, friends, and other habits.

However, do keep in mind that even though your virtual bookkeeping job might be flexible regarding when you perform your work, it’s still important to use good time management.

e. It pays well

So you may be asking, how much can you earn as a virtual bookkeeper? As reported by the US Bureau of Labor Statistics, the annual median wage for professional bookkeepers is $40,240, or $19.35 per hour, as of 2021. Although actual numbers still vary based on the employee’s qualifications.

A virtual bookkeeper can either work exclusively for a bookkeeping firm to manage their clients or work directly with companies who need to outsource their bookkeeping as an independent contractor.

Your income as a virtual bookkeeper running a bookkeeping business will highly depend on the scale of the project, the size of your client base, as well as your credentials and expertise.

Working as a virtual bookkeeper also brings you some economic benefits depending on certain factors. By making your home your office, you may be able to reduce commuting or lunch costs. Some virtual jobs even allow you to claim certain work-from-home expenses.

You can also work as a freelance bookkeeper while working remotely, which is an extra bonus! Running your own bookkeeping business allows you to handle more clients with the potential to make $50 per hour. You can even do this as a side hustle to boost your income.

How Much $ Can You Make With Your Own Bookkeeping Business? by Bookkeeping Life

How do I start bookkeeping with no experience?

1. Take an online certificate course.

There are a lot of online certificate courses available that will provide you with bookkeeping training. For example, sites like Coursera and OpenLearn offer a variety of bookkeeping training.

2. Graduate with an Associate’s or Bachelor’s Degree.

If you’re interested in completing and have college training, you can pursue higher education in Accounting.

3. Sign up for internships or training.

You can also look for remote bookkeeping opportunities that offer on-the-job training through internship programs to get hands-on experience.

How to Start Virtual Bookkeeping with no Experience by Bookkeeper Bootcamp

How to find online bookkeeping jobs

After gaining all the necessary skills and aptitudes to become a successful virtual bookkeeper, how can you find your dream job?

Scout across job sites

There are many job sites for virtual bookkeeping hopefuls. The following sites provide accounting and bookkeeping on-site roles, as well as remote job opportunities.

FlexJobs.com

AccountingDepartment.com

BelaySolutions.com

ClickAccounts.com

TwoRoadsco.com

RobertHalf.com

1800accountant.com/careers

Upwork.com

Join communities and forums

Search Facebook groups for virtual assistants or remote work-from-home jobs to look for job opportunities. Consider serving a niche sector, such as bookkeeping for truckers or bookkeeping for the real estate industry.

Keep up to date on the forums or communities for bookkeeping to stay on top of trends and also access job postings from potential employers.

Network

Utilize LinkedIn! Build your business profile and network with people. You might just find someone in need of your services or can point you in the right direction.

Don’t forget to foster good relationships with your clients. This might lead to potential referrals from them too!

See also: How to Get Bookkeeping Clients: An Easy Step-By-Step Guide

A Bookkeeper’s Best Friend ✨

Professional bookkeepers use Shoeboxed’s scanning service to scan receipts and stay on top of client accounts. 30-day full money-back guarantee!

Get Started TodayFrequently asked questions

Where are the best places to find virtual bookkeeper jobs?

You can find online accounting and online bookkeeping jobs on the following job sites:

FlexJobs.com

AccountingDepartment.com

BelaySolutions.com

ClickAccounts.com

TwoRoadsco.com

RobertHalf.com

1800accountant.com/careers

Upwork.com

How do I start virtual bookkeeping with no experience?

If you don’t have any bookkeeping experience, search online groups and forums for internship opportunities, which will allow you to grow your skill while also giving you on-the-job experience. Join forums so you can network and meet potential clients. Consider taking an online bookkeeping course or getting certification for your skills, which will improve your chances of getting hired. Here are a couple of options that you may wish to consider:

Bookkeeping Certification by the National Association of Certified Bookkeepers

Certified Bookkeeper (CB) Program by the American Institute of Professional Bookkeepers

In closing

Now that you know all about online bookkeeping and you’re interested in starting, here’s a quick recap of how to succeed as a virtual bookkeeper for those just getting started:

Have a solid foundation—It is good to have knowledge of fundamental accounting and financial principles.

Master financial tools and accounting software—For instance, proficiency in financial tools such as Excel and Google Sheets for balance sheets and data analysis. And experience in using accounting software such as Xero, QuickBooks Online, etc.

Hone your time management and organizational skills—Good time management and organization skills are also important for a virtual bookkeeper-to-be. Write a thorough and organized to-do list and check it as you go; this small action will help you manage your time and work much more efficiently.

Sharpen your eye for detail—Bookkeeping is a game of numbers, so there’s no room for error! A single wrong number can throw off all the work that you’ve already done, making things more difficult and making you untrustworthy to your clients.

There are many advantages and possibilities that online bookkeeping can bring to fresh-graduate accountants, those who earned a CPA certification, and even individuals without bookkeeping experience who are looking for a remote job.

Don’t forget to fully use all the amazing bookkeeping resources available to you! The Shoeboxed app is a tailored accounting app with receipt software for freelancers, accountants, bookkeepers, and small business owners to simplify their accounting and any type of bookkeeping process. Shoeboxed helps users free their desks and drawers from piles of receipts and turn them into digital, clearly categorized data. You can easily scan your receipts, manage expenses, store business cards, track mileage to claim miles on your tax returns, and so much more with the Shoeboxed app.

Additionally, Shoeboxed’s OCR (Optical Character Recognition) function and human verification feature ensure that your receipts are clearly scanned and well categorized, resulting in human-verified data that are legibly accepted by both the Internal Revenue Service and the Canada Revenue Service.

Try Shoeboxed for free today!

You might also like:

Bookkeeping for Nonprofits: Best Practices, Tips, Resources, FAQs

What to Keep Track of as an Independent Contractor: 7 Document Types

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!