Expense fraud is a widespread problem that plagues many businesses and organizations, costing them significant amounts of money each year.

This type of fraud can substantially negatively impact a company’s financial health and overall bottom line.

According to the 2022 ACFE Report to the Nations, CFEs estimate that businesses lose 5% of revenue to fraud each year and that 86% of occupational fraud is committed through asset misappropriation.

What is expense fraud?

Understanding the different types of expense fraud and implementing solid prevention and detection strategies can help organizations protect themselves from these fraudulent activities.

Expense fraud occurs when employees or other individuals manipulate expense reports or use company funds for unauthorized personal gain.

What are the different types of fraudulent expenses?

Expense fraud is a common issue small businesses face, costing them time and money.

Companies must recognize different expense fraud schemes to mitigate the risks and losses.

Here, we will discuss five prevalent types of expense fraud: mischaracterized expenses, fictitious expenses, duplicate reimbursements, inflated expenses, and overstated expenses.

Mischaracterized expenses

Mischaracterized expenses are those that have been inaccurately categorized or labeled by employees in an attempt to gain reimbursement for personal expenses.

This occurs when employees submit personal expenses as business-related.

For example, an employee might report a unique vacation as a business trip, submit a receipt for a family meal as a client dinner or business meeting, or claim their private phone bill as a work expense.

This is one of the most common types of expense fraud and can lead to significant financial losses for companies if left unchecked.

To detect and prevent this fraud, businesses should implement a strict expense policy on expense reporting process categorization and routinely audit expense reports.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayFictitious expenses

Fictitious expenses are a more blatant type of fraud involving employees submitting false or fabricated receipts to get reimbursed for costs never actually incurred.

This often includes fake receipts for purchases of corporate credit cards that were never made.

Auditing employees with high out-of-pocket expenses and implementing strict expense documentation requirements can help uncover such fraudulent activity.

This can range from a few dollars of fake receipts to millions if undetected.

Duplicate reimbursements

Duplicate expense reimbursements occur when employees intentionally submit the same expense multiple times for a refund.

This type of fraud creates unnecessary expenses for the company and can be challenging to detect.

This could happen when employees use organizations with weak expense-tracking systems.

Employing an automated expense management system or systems can help identify and prevent duplicate reimbursement, ensuring proper expense tracking and validation.

Inflated expenses

Inflated expenses occur when employees exaggerate the costs of legitimate business expenses to receive higher reimbursement amounts.

For example, reporting a larger taxi fare as a travel expense than what was paid.

This can involve altering receipts, manipulating exchange rates, or changing dates on expense reports to take advantage of exchange rate fluctuations.

This practice can be challenging to identify without proper documentation and validation processes.

To combat inflated expenses, businesses should mandate detailed receipts and implement automated verifications of costs, comparing them to industry averages or previous submissions as a benchmark.

Overstated expenses

An overstated expense is when an employee reports a legitimate business expense but inflates their amounts.

Employees typically report higher-than-actual costs for real business expenses to pocket the difference between the actual cost and the reimbursed amount.

This can occur through various means like modifying receipts or deliberately overpaying for goods or services.

Understanding and identifying the different types of expense fraud is crucial for businesses looking to protect their financial interests.

What are the signs of a fraudulent act?

Expense fraud is an issue that can cost companies a significant amount of money, and it’s crucial to identify the warning signs early on.

Here are some common indicators of possible expense fraud.

Fake or altered receipts

One red flag is the submission of fake receipts or altered receipts.

Employees may create counterfeit receipts or modify the amounts on genuine receipts to claim higher reimbursements.

It’s essential to scrutinize receipts for inconsistencies, such as mismatched fonts, dates, or unusual vendor names.

Similar receipts

Employers should also watch for receipts that look too similar, as they might indicate using the same fake receipt name-generating software.

Another sign pointing to expense fraud is the frequent request for multiple reimbursements.

Employees might try to submit the same expense claim or report multiple times each, expecting the duplicates to go unnoticed in a busy finance department.

To prevent this, companies should implement a robust expense management and tracking system to detect and flag duplicate expense claims easily.

Unusual patterns in expense reports

Unusual patterns in expenses may also signal potential expense report fraud.

For example, an employee who consistently claims expenses just below the approval threshold might be trying to avoid managerial review.

Similarly, always filing an expense report for claims on weekends or evenings may indicate fraudulent activity meant to circumvent the usual scrutiny of weekday expenses.

Personal expenses categorized as business-related

In some cases, expense fraud may involve mischaracterizing personal expenses as business-related.

Employees may try to claim private expenses, such as family vacations or leisure activities, as work-related costs.

Companies can prevent this type of expense fraud by establishing a clear expense policy on what constitutes a legitimate business expense and regularly auditing expense reports for compliance.

Missing or incomplete documentation

Missing or incomplete documentation can be a warning sign.

Employees engaging in expense fraud might purposefully avoid providing receipts or other supporting documents to justify their claims.

It’s essential to enforce a solid documentation expense policy and require all your employees to submit proper documentation for all expenses.

By being aware of these signs and implementing proper expense management policies, organizations can mitigate the risk of expense fraud and protect their financial interests.

What are prevention and detection methods?

Tackling expense fraud requires a comprehensive approach that addresses both technological and human aspects.

The following outline various strategies to prevent expense fraud, help maintain compliance, and control expenses.

Create an expense policy

Small business owners can potentially prevent expense fraud before it happens by creating an expense policy that details spending guidelines.

That way, employees know exactly what is acceptable, and employers have the policy in writing if discrepancies are found.

Receipt scanner apps

AI-driven expense management curtails the risk of corporate fraud.

One such technological solution is receipt scanner apps, like Shoeboxed, which help employees manage their receipts for company spending.

Shoeboxed, used by over a million businesses, is rated as the #1 receipt scanner app by Forbes

Employing an automated expense management system or systems, such as Shoeboxed, can help identify and prevent duplicate reimbursement, ensuring proper expense tracking and validation.

Shoeboxed is one of the most popular receipt-scanning apps for tracking expenses.

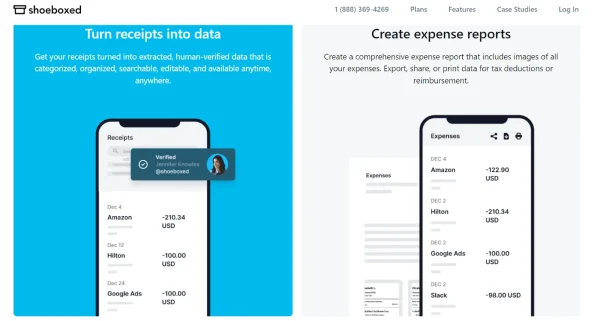

Just scan receipts with your phone app while on the go as the purchases are made, or stuff them into a prepaid Magic Envelope provided by Shoeboxed and have them scan and upload them into your account, where they are all stored in one place.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodayEither way, this is an effective expense management process with internal controls for submitting and recording business expenses that will deter employees from committing fraud.

Shoeboxed also has OCR technology that converts printed text into searchable data, and it automatically categorizes expenses into 15 tax categories, which helps to prevent fraud from mischaracterized costs.

Shoeboxed provides a unique validation-of-cost process that is automated and human-verified to avoid expense fraud.

To combat inflated, altered, or overstated expenses, businesses should implement both automated and human verifications of costs, such as Shoeboxed provides.

These apps make the expense management process more straightforward for the employee and reduce the risk of employee expense fraud by providing a digital paper trail to submit expenses that can easily be cross-referenced during audits.

Shoeboxed Demo by Shoeboxed YouTube

Regular audits

Regular audits play a significant role in maintaining a company’s financial integrity.

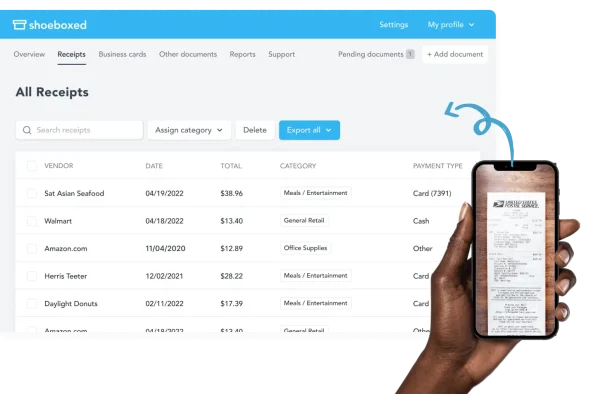

Shoeboxed’s digital images of your receipts are always audit-ready.

With Shoeboxed, receipts are accepted by the Internal Revenue Service and the Canada Revenue Service in case of an audit.

Instead of having to flip through a pile of receipts manually, a receipt can be pulled up immediately with a filtered search by vendor, date, amount, or type of expense.

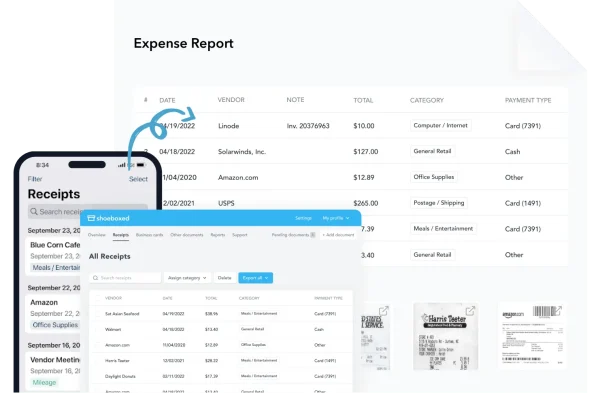

Comprehensive expense reports can be created from the web or your mobile device and exported, shared, or printed for tax deductions or reimbursement.

Frequently examining expense reports and their associated documentation makes it easier to identify inconsistencies and potential expense report fraud cases.

Robust internal controls

It’s essential to provide clear guidance for managers and supervisors on reviewing and approving expenses.

This will enable them to spot potential warning signals and consistently apply the company’s policies.

Implementing robust and solid internal controls can strengthen internal defense against expense fraud.

For example, requiring pre-approval for major expenses can help deter fraudulent spending.

Additionally, ensuring a separation of duties in approving and processing expenses reduces the risk of collusion and deception.

Comprehensive training programs

Implementing comprehensive training programs for employees is another crucial preventive measure.

Ensuring employees understand company expense policies and best practices minimizes the likelihood of accidental non-compliance and makes intentional employee expense fraud more difficult.

This includes educating employees on what constitutes expense fraud, how to report suspected expense fraud cases, and its consequences.

Businesses should invest in fraud prevention through regular audits, technology, employee training, and transparent company policies.

These measures help detect expense fraud and foster a culture of integrity and transparency within the organization.

Don’t Reimburse a Fraudulent Expense! | Avoiding Expense Fraud by GrowthForce

Frequently asked questions

What are common red flags for expense reimbursement schemes?

Several red flags may indicate expense reimbursement fraud, such as:

• Expenses consistently rounded up or many exact amounts.

• Unusual patterns, like an employee filing expense claims during weekends or holidays

• Duplicate expenses or multiple claims for the same item

• Missing or altered receipts

Being aware of these red flags can help identify potential fraud.

What are examples of expense reimbursement fraud cases?

Examples of expense reimbursement fraud cases include:

• Employees submit fake receipts to obtain reimbursement for personal expenses.

• Inflating the cost of legitimate expenses for personal gain

• Claiming reimbursement for non-existent business trips or expenses

These cases can have severe financial and reputational consequences for employees and companies.

How can individuals submit fake receipts for expense reimbursements?

Some methods used by individuals to submit fake receipts include:

• Using software or apps that generate fake receipts

• Altering genuine receipts to increase the expense amount

• Physically tampering with the details on a paper receipt

Companies need to implement robust verification processes, such as those offered by Shoeboxed, to detect and prevent receipt fraud.

Understanding and addressing the risks associated with expense fraud is crucial to maintaining financial integrity within an organization.

Conclusion

It is the responsibility of both employees and organizations to maintain ethical behavior and strive to create a fraud-free environment.

Implementing stringent controls to prevent employee expense fraud, conducting regular audits, employing automated expense management systems such as Shoeboxed, and promoting a culture of integrity and transparency within the organization can help detect and prevent these fraudulent activities, ensuring the organization’s financial integrity.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!