Whether you’re self-employed or a business owner, choosing the perfect accounting software for your business is crucial.

There are countless receipt management software and business receipt apps on the market with different features, pricing, details, and much more to consider. And not everyone has time to test dozens of solutions.

That’s why we came up with a complete comparison between the top choices for receipt tracking and expense management software: Shoeboxed vs. Expensify.

Shoeboxed vs. Expensify: An overview

1. Cross-platform compatibility

Different people have different needs. Some love iOS, while others are loyal to Android. There are Windows users, and there are people who prefer to access programs through a browser. This is especially complicated when working as part of a team.

Both Shoeboxed and Expensify are available on Android, iOS, and browser platforms. This seamless sync will help you keep your receipts’ data up-to-date anytime, anywhere.

2. Interface

Since most of us use smartphones to scan receipts, the app’s interface is important to consider when choosing the right accounting app. Both apps are easy-to-use, with the basic functions displayed right on the portal. Their interfaces are clean and intuitive with a focus on simplicity and speed.

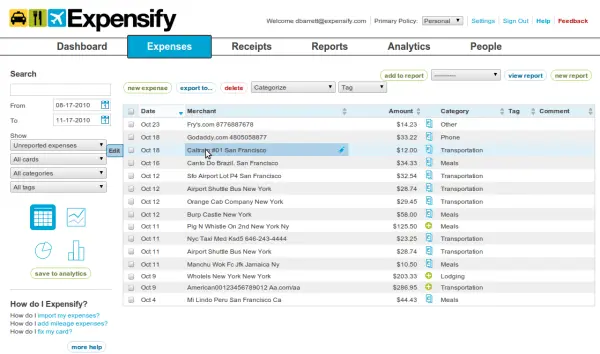

Expensify — Expense report page.

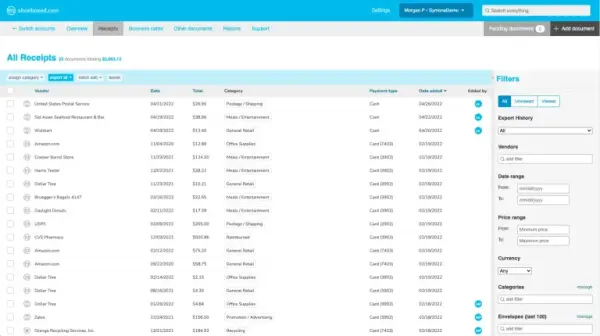

Shoeboxed — Expense report page.

Shoeboxed receipt scanning interface on a mobile device.

Expensify receipt scanning interface on a mobile device.

3. Main features

The basic functionality remains the same across both apps. You scan an expense receipt, and the app will extract the key data such as items, quantity, and price. They will also categorize them by vendor, the total amount, date, and payment type. Various categories to further classify your expenses include Mileage, Groceries, Entertainment, Office Supplies, etc. Then, the apps create a digitized receipt version synced with your cloud account.

Both apps allow you to arrange trip receipts, create a report, and submit it for approval. Users can also track mileage for business trips with both apps. Additionally, Expensify offers a per diem functionality where an individual is given a daily allowance, and you can use the app to track it daily.

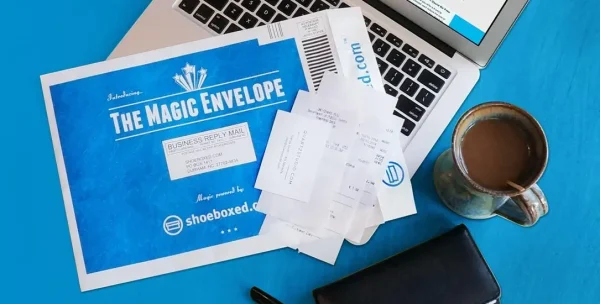

One feature Shoeboxed has that Expensify lacks—if you have a large number of receipts and no time to scan them, you can mail them straight to Shoeboxed’s processing facility for free with the postage-paid Magic Envelope™. Shoeboxed will scan the receipts, turn them into organized and actionable digital data and upload them to your account.

Outsource receipt scanning to Shoeboxed’s Magic Envelope service!

This mail-in feature that Shoeboxed offers helps you clear your desk and drawers and bring you up to speed. This unique service is extremely useful for small business owners or freelancers who have to handle a lot of work independently, including virtual bookkeeping jobs. By doing this, you can free yourself from paperwork and focus on improving your business’s core values.

Moreover, Shoeboxed ensures that all your digital receipts are human-verified and audit-ready. You can rest assured that your receipts are legibly-scanned, clearly categorized, and accepted by the Internal Revenue Service (IRS) and the Canada Revenue Agency (CRA) in case of an audit. Shoeboxed is the best choice for freelancers and business owners during tax season.

If you have a large number of receipts and no time to scan them, you can mail them straight to Shoeboxed’s processing facility for free with the postage-paid Magic Envelope™.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic approach to receipt tracking for tax season. 30-day full money-back guarantee!

Get Started Today4. Third-party integration

Both Shoeboxed and Expensify integrate with various third-party apps and software such as Quickbooks, Intuit, and Xero. Expensify also connects with Microsoft, Oracle, SAP, Bill.com, Uber, and other popular services.

5. Pricing

Pricing is an important factor to consider, especially if you’re looking for a scalable solution.

Shoeboxed offers three primary plans. The Startup plan (for individuals and freelancers) begins at $18/month, allowing you to scan and store up to 900 documents (both physical and digital) per year. If you are a professional or small business owner, we recommend the Professional plan. With $36 for two users, this plan offers you 3600 documents/month. If you own a business with high volume, the Business plan, at $54/month with 7200 documents/month, is the most suitable option.

On the other hand, Expensify has a limited number of plans available. The individual plan begins at $5/month with no limit on receipt scanning. If you’re working in a team, Expensify offers a $9/user/month plan and a corporate plan that begins at $18/user/month. They also have an enterprise solution customized based on your business’s demands.

Shoeboxed vs. Expensify: A comparison chart

To help you better visualize the differences between Shoeboxed and Expensify, we’ve made this handy chart for you:

Expensify |

Shoeboxed |

|

Overview |

Expensify is an expense management system for personal and business use. Expensify helps users scan receipts, track expenses, and book travel all in one app. |

Shoeboxed is a painless solution for freelancers and small business owners to track and digitize their receipts, maximize tax deductions and prepare audit-ready reports. |

Platforms supported |

– Web-based – iOS – Android |

– Web-based – iOS – Android |

Language supported |

English |

English |

Targeted customers |

– Freelancers – Small businesses – Mid-sized businesses – Large enterprises |

– Freelancers – Small businesses – Mid-sized businesses |

Customer support |

– Phone – Live support – Video tutorials |

– Phone – Online – Video tutorials |

Features |

– One-click receipt scanning – Credit card import – Multi-level approval workflows – Corporate card reconciliation – Accounting, HR, and travel integrations – Multi-level coding – Advanced tax tracking – Audit and compliance – Delegated access – Automatically identify currency |

– Receipt scanning – Optical Character Recognition – Human data verification – Unlimited scanned receipts storage – Unlimited users can be added to your account – Receipt search – Mobile receipts tracking – Mileage tracking – Data digitization service – Gmail receipts archiving – 15 automatic tax cateogries – Tax filing – Expense reports – Multiple international currencies |

Integrations |

Expensify integrates with various accounting software as well as HR, travel, and accommodation systems and applications: – Accounting: Bill.com, FinancialForce, NetSuite, QuickBooks, Sage, Xero, Scan Snap – Transport: Automatic, Grab, Lyft, Trainline, Uber – Accommodation: Hotel Engine, HotelTonight, Roomex, TripActions – Travel Bookings: Flight Sugar, Gallop, Jettly, Lola, Pana, TravelPerk – Travel: NexTravel, TripActions, Trip Catcher – Other Integrations: Accelo, Global VATax, PayPal, RevelPOS, Microsoft Dynamics, Financial Force, Workday, TSheets |

Shoeboxed integrates with the following third-party solutions: – QuickBooks – Xero – MYOB – Dropbox – Evernote – GoDaddy Online Bookkeeping – WaveAccounting – FreshBooks – OneSaas – Saasu – WorkingPoint – Bench – ScanSnap |

Pricing |

Along with the free version, Expensify offers two pricing plans: – The Collect plan at $5/user/month – The Control plan at $18/user/month |

Shoeboxed offers a variety of pricing plans: – The Startup plan at $18/month – The Professional plan at $36/month – The Business plan at $54/month Additionally, the following Digital Only plans are available from Shoeboxed’s mobile app. – Digital Only Starter Plan at 4.99/month – Lite Plan at 9.99/month – Pro Plan at 19.99/month |

Shoeboxed vs. Expensify – A comparison.

See also: 4 Easy Ways To Upload Your Receipt Images To Shoeboxed

How does Shoeboxed compare to other receipt scanner apps?

Shoeboxed |

Expensify |

Dext |

Rydoo |

Neat |

Wave |

Quickbooks |

|

|---|---|---|---|---|---|---|---|

Capterra rating |

4.4 |

4.5 |

4.2 |

4.4 |

4 |

4.4 |

4.3 |

Physical receipts |

✔️ |

❌ |

❌ |

❌ |

❌ |

❌ |

❌ |

Digital receipts |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

Document storage |

✔️ |

❌ |

✔️ |

✔️ |

✔️ |

❌ |

✔️ |

Unlimited free users |

✔️ |

❌ |

✔️ |

❌ |

❌ |

❌ |

❌ |

Mileage tracker |

✔️ |

✔️ |

❌ |

✔️ |

❌ |

❌ |

✔️ |

Expense reports |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

❌ |

❌ |

Human verification |

✔️ |

❌ |

❌ |

❌ |

✔️ |

❌ |

❌ |

Automatic categorization |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

Business contacts organizer |

✔️ |

❌ |

❌ |

❌ |

❌ |

✔️ |

✔️ |

iOS app |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

Android app |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

Free version |

✔️ |

✔️ |

❌ |

❌ |

❌ |

✔️ |

❌ |

Free trial |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

❌ |

✔️ |

Credit card reconciliation |

❌ |

✔️ |

❌ |

✔️ |

✔️ |

✔️ |

✔️ |

Starting price per month |

$18 |

$5 |

$30 |

$9 |

$200 |

$16 |

$18 |

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 30-day full money-back guarantee!

Get Started TodayFrequently asked questions

Does Shoeboxed have a free plan?

Shoeboxed’s 100% free plan is called the DIY plan. With the DIY plan, users manually extract and input data into Shoeboxed’s receipt management software. (Automatic data extraction with human verification is not included in the free plan.)

Does Expensify have a free plan?

Expensify has a free plan where businesses set up Expensify Cards for their staff and then managers can use their platform to refund cash costs, submit invoices, and handle bills.

What’s a good Expensify alternative for receipt and expense tracking?

Expensify does a great job of streamlining the expense reporting process. It allows users to easily submit, approve, and track expenses, as well as store receipts and other important documents. It’s great for enterprise businesses that must handle a great deal of reimbursement requests.

There are many Expensify alternatives, such as Concur, but Shoeboxed is ideal for bookkeepers, accountants, contractors, and small business owners who are looking for a receipt scanner organizer that also provides receipt scanning services.

Try Shoeboxed for free!

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!