Running a business is never easy, but keeping track of business finance can sometimes be the hardest part. It’s also the most important.

Maintaining precise records of all financial transactions keeps a business compliant with regulations and standards, but more importantly, keeping accurate records of all business income and transactions is critical for smooth tax preparation.

Despite what many may think, some of the best financial record-keeping systems are those that are simple and easy to maintain.

Today, we’d like to show you 6 simple record-keeping best practices for small business owners that will help you streamline your bookkeeping and keep your business documents in order!

See also: Bookkeeping Resources: 45+ Courses, Tools, Sites, and More!

What kind of records should a small business keep?

Whether you manage your records with a software program or a manual form of record-keeping, it is important to know which types of records you should keep.

Documents like receipts, gross receipts and small business expenses, debits, and credit statements should be stored for easy retrieval.

The table below categorizes the three types of documents to keep as a small business owner:

Expense related |

Gross-receipt related |

Purchase related |

|

-Invoices -Account statements -Cash register tape receipts -Canceled checks or other documents proving payment electronic funds transferred |

-Receipt books -Forms 1099-MISC -Cash and credit sales -Cash register tapes -Invoices |

-Invoices -Transaction receipts -Cash register tape receipts -Credit card receipts and statements |

Example categories of documents that a small business owner should keep

6 simple record-keeping best practices for small business owners

1. Incorporate a good document management system into your business

As your business grows, then and now, you’ll need to keep track of an ever-increasing number of business documents and files. Instead of having paper records in your drawers and clogging up your desk, try going paperless so you can access your records easily, at any time, from anywhere.

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 30-day full money-back guarantee!

Get Started TodayYou can set up a digital document management system to help keep track of all your business documents. It’s even possible to install a document control system that determines how often documents are reviewed and updated.

This type of management system protects your sensitive documents with passwords and verification, can be easily backed up to prevent loss or damage to documents, and can be semi-automated to ensure everything is kept up to date.

2. Back up and secure your business records

There are many ways in which our important records can be lost or damaged, like natural disasters, electrical fires, or even malicious intent. Therefore, having backup copies of your important documents in a safe place ensures you won’t lose them if something bad happens.

Be sure to store your records in at least two places. For example, you could have your important documents on paper and on a hard drive, or on one of the previous and on the cloud. The more copies you have, the less chance there is of you losing the documents.

Remember, if you have more than one copy of something, keeping each copy in a different place is essential. That way, you’ll still have the others if something happens to one of them.

Storing your important documents in digital form is a good idea as it protects them from being lost, damaged, or destroyed. However, storing records digitally also increases the risk of data breaches, which can result in them being stolen or seen by the wrong eyes.

So be sure to secure your online business records with a strong and unique password and enable two-factor authentication. Also, be wary of who you give access to.

3. Understand the lifecycle of business records

Business owners must keep some important financial documents for a certain period of time for tax filing and auditing purposes. It is important to ensure that all retention and disposal schedules are followed correctly for each type of record.

The following are other documents that are essential to keep, and the timeframes for keeping them are as follows.

a. Longer than a 7-year period

Tax files in filing cabinet

You must keep your tax records for at least seven years. This will ensure that you have all the information you need in case of an audit. The IRS mandates 3 years for the statute of limitations for an audit.

However, in some situations, the IRS can go back six or seven years to audit your taxes. The time limit for filing a state tax return varies from state to state, so work with a tax professional to get tax forms and determine the time limit in your state.

You should also keep records of any business transactions that support your income statement and the information on your taxes for up to seven years. This includes your W-2 and 1099 forms, receipts, and payments.

Additionally, keep records of any assets you own, like receipts for home renovation work, for as long as you own those assets.

b. One-year period

Records that you need to keep for at least one year include the following:

Medical bills

Investment statements

Non-tax-related bank and credit card statements

Receipts for large purchases

Paycheck

Keep in mind that if you pay yourself a salary, you can generate pay stubs to show proof of income to banks and the IRS.

Also, don’t throw away any records related to your current year’s tax preparation or any unresolved health insurance premiums or disputes for at least a year.

Most financial institutions, including credit card companies and banks, send customers electronic statements, so keeping paper versions on hand may be unnecessary. However, if you do want to keep a copy of those records, you can digitize them by scanning them with a receipt scanner or a document scanner or a bulk document scanning service before discarding the original paper documents.

This video compiles a list of documents you will need to file your taxes. If you’re looking for information on how to maintain documents as an independent contractor, check out “7 Useful Documents Every Independent Contractor Should Keep.”

c. Less than a year

There are some types of documents that you won’t need to keep for very long. For example, you don’t need to worry about keeping receipts unless they’re related to something important, such as:

Insurance claims

Your tax returns

Product warranties

You can typically dispose of your monthly bills either after you’ve paid them or once they’ve been reflected on your bank transaction statement. If you need to check up on anything later, see if you can access past invoices through your online account.

Many service providers store records of past bills and invoices online for some time. This period could range from a few months to a number of years.

4. Start a new digital file for your records after each year

Creating a new file at the beginning of each year is a helpful way to save time and organize your information. This will make it easier to delete records you no longer need, like when the seven-year retention period has ended.

It also helps keep your records in a simple and easy-to-use format. That way, you won’t find yourself going through years of business transactions to find the one file you need.

5. Keep records of transactions for bank reconciliations

Bank reconciliations help small businesses find mistakes in their records and better understand their financial situation.

It’s a good idea to check that you have records for everything your business does. Making all your purchases and payments through a single business bank account can make it a lot simpler to keep track.

Some accounting software allows users to add documents to each transaction. This way, anyone who looks at your books can see the related records.

Also, compare every transaction in your accounting software to your records when you’re doing your monthly bank reconciliation, just to make sure it’s all there.

See also: Small Business Finances 101: 6 Dos and 9 Don’ts

6. Choose accounting software that can generate records

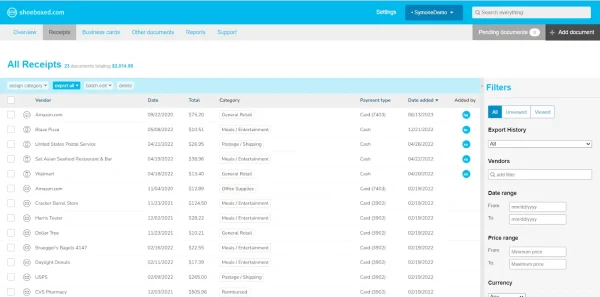

Shoeboxed receipt scanner

Today, there is a variety of software programs that can create reports from customers’ invoices.

Shoeboxed is a receipt scanning and expense management app that allows freelancers and small business owners to keep track of their business expenses in a simple way. This app can help you with your reports by doing some of the work for you.

After scanning your receipts, Shoeboxed will create reports that you can send for approval immediately. Shoeboxed saves small business owners time and effort by automating certain simple but time-consuming tasks, leaving the business owner more time to spend on more important things.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. 30-day full money-back guarantee!

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts or documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

Shoeboxed makes it easy to export your yearly expenses into a detailed report. All expenses come with receipts attached.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is the most popular Shoeboxed feature, particularly for businesses, and lets users outsource their receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 30-day full money-back guarantee!

Get Started TodaySee also: The Accounting Cycle Explained

Watch this video on “Bookkeeping Basics for Small Business Owners” from Bench for more tips on bookkeeping best practices! Sign-up to Bench using this link, and get 50% off your first 6 months!

Frequently asked questions

How do I start keeping records for my small business?

Here are five steps to simplify the process of keeping records for any new small business owner. First, capture business transactions relevant details. Second, ensure accuracy by double-checking your work. Thirdly, finalize the record by inputting data into accounting software or sharing it with a bookkeeper. Fourthly, compare monthly reports to gauge business performance. Lastly, utilize the recorded information, including income, expenses, and other key factors, to identify areas for improvement. These steps will help establish effective organizational habits.

What is the most important step in small business record-keeping?

The most important part of the process is the “capture” step, which is also the most difficult. You need to keep track of all your business expenses and all the money you make from sales. This will ensure that you know how much money your small business is making or losing. See also: What to Do if You Have a Lost Receipt

What is a financial record-keeping system?

A financial record-keeping system is a system that helps you monitor all the money your business makes and spends. This includes processing payroll and documenting bills and sales from vendors. It helps you oversee all the money going in and out of your bank account.

What are some accounting best practices for small businesses?

In your daily business accounting tasks, it’s important to regularly review your cash status and business expenses, record transactions, keep track of documents and receipts, and review unpaid bills from vendors weekly. Conduct monthly book reviews, focusing on transaction reconciliations, past due accounts, and balance sheet comparisons. Remember to perform a quarterly check-in on sales and estimated income tax. Double-check past-due receivables, inventory, and income to file taxes and assess business growth. These steps will provide a comprehensive understanding of your business’s financial health and progress over the past year.

See also:

Tax Checklist: What to Know, Do, & Prepare for Tax Filing Day

Business Expense Tracker Apps: 8 Money-Saving Reasons to Start Today

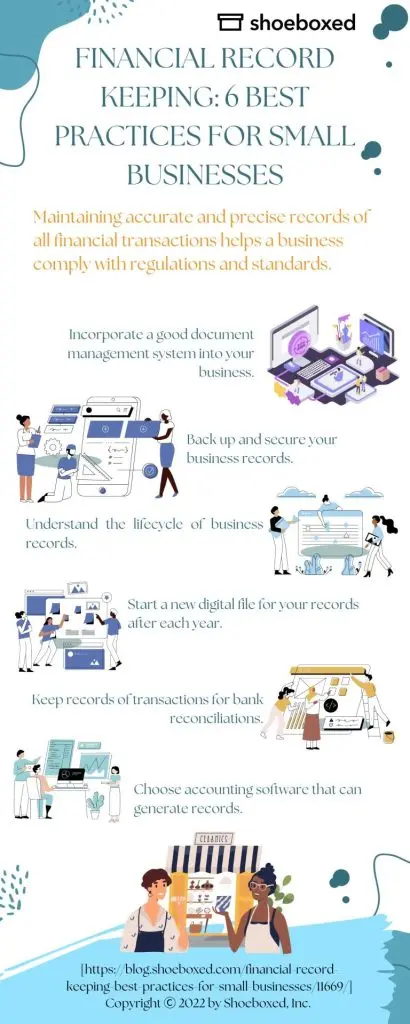

Bonus infographic: 6 best practices for small businesses on simple financial record keeping

The bottom line

It can be difficult to keep track of your finances in the beginning, but doing so is essential for maintaining a healthy business. Even if you don’t have an accounting background, you can still run your business smoothly if you follow some simple financial record-keeping best practices. The most difficult part of financial record keeping is getting all the information one needs.

Shoeboxed can help!

Shoeboxed is the complete receipt tracking and expense management solution for small business owners who are looking for an expense-tracking app.

Turn your receipts into data and deductibles!About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!