Business owners and independent contractors, are you tracking miles for tax deductions? If you aren’t yet, this article is for you!

Tracking miles for tax deductions is a savvy move, but there are things you should know upfront.

When you file your tax return, your business-related mileage tracking must be well-categorized according to the type of activity generated by those miles.

Today, we’ll walk you through how to track mileage for taxes with Shoeboxed, a mobile app that lets you use your phone’s built-in GPS for easy, accurate mileage tracking.

What counts as business mileage?

Before we kick off with Shoeboxed’s mileage-tracking app, we need to clarify what counts as business mileage. There seems to be a common misconception among self-employed workers when claiming mileage for taxes as to whether or not the commute from home to the office or vice versa should be deducted as business mileage.

A commute is not an activity that generates a revenue stream for your company. However, if your home is your primary place of business, then yes, mileage tracking should start from your home as the point of origin, as business mileage is applied for trips while doing business.

According to the IRS, business mileage is “the ordinary and necessary expenses of traveling away from home for your business, profession, or job.” This includes driving to meet clients for lunch or meetings, going to a conference, running errands (i.e., buying office supplies) related to your work, and more.

What is a mileage-tracking app?

When you track your miles during business travel, your tax savings increase in sync with your odometer. Keeping quality records of all that travel consistently, accurately, and tidily (i.e., logbooks, gas receipts, parking stubs, etc.) can be challenging.

Luckily, a mileage tracking app is easy to track mileage for taxes as it creates a mileage log for all of your trips. The mileage tracking app saves those records securely in the cloud, so you never have to worry about losing them. Additionally, you can pull out or print those records years later if you ever have to face an IRS audit.

Who can benefit from a mileage-tracking app?

a. Small business owners

Out-of-town business travel generates tons of paper receipts—from airline tickets, taxis, meals, laundry, accommodation, and more. Receipts verify what you purchased on the trip and act as a travel log of where time and money were spent on the business trip. Some important factors determine eligibility. For example: How much of the trip was personal, if the trip was away from your home, and if the amounts are justifiable.

Small business owners will face an issue when tracking mileage for taxes if the vehicle is a “mixed-use” asset. For example, if the vehicle is used for both personal and business purposes. The mixed-use asset requires extra care to distinguish when the vehicle is being used for business and when it is not. Since only the portion of use for business would be counted as a business expense, keeping clear and detailed records of time, route, and reason is used to help establish what portion of use is business-related. So using a specialized mileage tracking app such as Shoeboxed with your phone’s built-in GPS when traveling to and from business meetings would save you time to sort out different trips and ensure you don’t miss any travel deductions. The app will record the precise start and end location and the date of your trip—taking detailed documentation off your hands.

See also: Is Service Revenue an Asset?

b. Freelancers and independent contractors

As a freelancer, you are 100% in charge of your business. Therefore, organization and tracking important documents is a top priority for successful freelancing.

Like any other good expense-tracking habit, tracking travel mileage ensures protection against tax audits and business disputes. Keeping track of your business mileage is important because it is tax-deductible. This means you can reduce your taxable income based on how much you drive for work. Various travel miles qualify, such as business travel to and from airports and hotels, errands, and supply runs, travel to client’s offices, and to and from business meetings. Don’t skip those valuable deductions!

One effective way to do this is to track your mileage and report those miles to the IRS. However, a freelancer’s line of work is usually busy and stressful since a lot can fall on your shoulders at once.

Using a mileage-tracking app can help take some of the pressure off. This app will consistently track your mileage so you can focus on more important aspects of working or running your business. You can rest easy, knowing you will get back the right amount of money on your tax return.

If you’re curious about the best mileage tracker app, be sure to check out our article Best Mileage Tracker for DoorDash Drivers for a more in-depth look for other apps.

Step-by-step how to track mileage for taxes with the Shoeboxed app

Shoeboxed helps you track mileage using your phone’s built-in GPS for unmatched ease and accuracy.

With its intuitive interface and features, anyone can start using Shoeboxed to track their mileage and other expenses.

Here is a step-by-step guide on how to track mileage for taxes with Shoeboxed:

Step 1. Get Shoeboxed for iPhone, iPad, or Android.

Step 2: Sign in or sign up for Shoeboxed’s Receipt & Mileage Tracker.

You can sign in/sign up with your Facebook or Google account.

Step 3: To start tracking, navigate to the “Trips” area of the app.

Click the “Start Mileage Tracking” button to begin a new trip. The app will start saving your location as soon as you drive.

Shoeboxed mileage tracking app

Step 4. When you reach your destination, click “Stop Trip.”

The app will generate a trip summary, including the date, the ability to name the trip, editable mileage, and deductible rate information. It will even show you the route you took.

Step 5. Once you’ve edited and approved the information, click “Done.”

The trip info (along with the map) will be submitted to Shoeboxed as a receipt with an automatic category assignment for mileage.

But what if you have to stop on the way for business purposes, perhaps for a lunch meeting? No worries! You can still submit a receipt for your meal without interrupting your mileage trip.

You can create a mileage or a combination report, including mileage and any receipts incurred during this trip. After that, you can submit the report to your employer to be reimbursed.

Additionally, you can filter for all mileage during the tax year and ensure you get all the deductions for which you qualify.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. Expense reports don’t get easier than this! 💪🏼 Try free for 30 days!

Get Started TodayStill unsure what should be reimbursed and what should be deducted? Check our Tax Deductions Cheat Sheet to discover the most common deductions and how they can help you save on your taxes.

Track miles for taxes in 7 simple steps

Step 1. Check if you’re eligible for mileage deduction.

Generally speaking, if you’re using your vehicle for the following purposes, you may be eligible for deductions:

Carry out business-related trips

Use the vehicle for a medical expense-related trip, such as a trip from and to a hospital for medical appointments.

Transport between different work posts if you’re an active military member.

Conduct errands and work trips for charitable organizations.

Step 2. Select a preferable method for calculating your mileage.

Select one of the two accounting methods for calculating your mileage deduction. The first method is recording how much you travel by car in that tax year. The other method is requesting deductions for transportation expenses for eligible activities. The standard mileage deduction’s main requirement is your qualified driving mileage log.

Please note, as of June 2022, the IRS has adjusted the standard mileage rate for business travel to 62.5 cents per mile for the final 6 months of 2022.

Step 3. Write down your odometer at the beginning of the tax year.

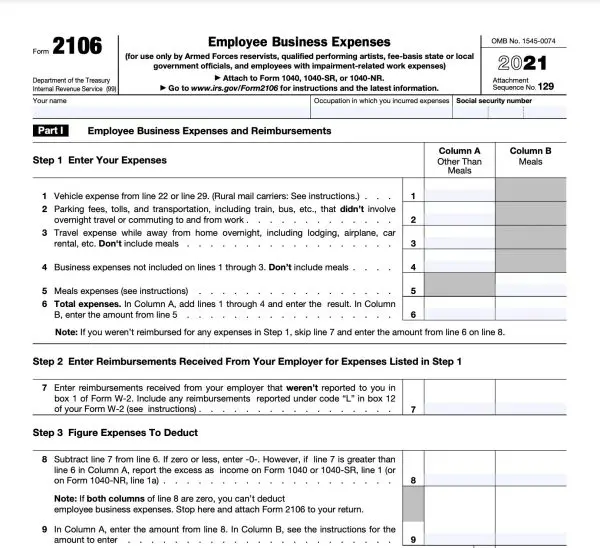

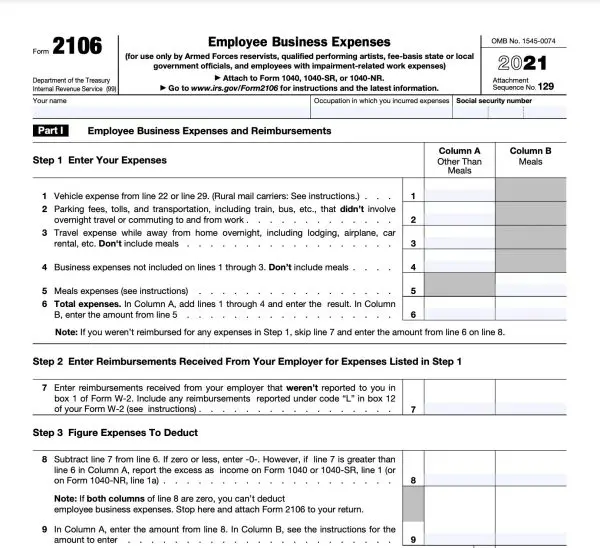

You may want to use Form 2106 for your deduction. Form 2106 is a tax form that employees use to deduct expenses related to their jobs for ordinary and necessary expenses.

Step 4. Keep and update your driving logs and related expense receipts.

Step 5. Write down your odometer at the end of the tax year.

Step 6. Document mileage on a tax return.

When filing your tax returns, write down the total miles driven on Form 2106, Line 12. This amount is determined based on the standard mileage rate of the year.

Image. Form 2106. IRS.

If you’re using the actual expenses method, you should categorize the receipts of the expenses into separate groups such as repairs, insurance, vehicle rentals, gasoline, oil, and depreciation.

Step 7. Keep the required documents in a safe place.

The IRS requires 3 years of documentation to retain regarding mileage deduction. The IRS may request to see your documents that show how much you drove for work. Be sure to make a copy of your records and keep them in a safe place. Quick tip for staying organized: Create a new mileage log for each tax year.

Try using auto-scanning and document-storing services like Shoeboxed’s Magic Envelopes, which is the perfect way to organize your receipts, business cards, invoices, work orders, and other important business documents. Simply stuff the Magic Envelopes with your important documents for tax purposes and mail them to Shoeboxed. The team will scan every single document into your Shoeboxed account.

Simply stuff the Magic Envelopes with your important documents for tax purposes and mail them to Shoeboxed.

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 Try free for 30 days!

Get Started TodaySee also: The Official Shoeboxed Magic Envelope Starter Guide.

What does a mileage log example look like?

Ensure that you have the latest mileage standard rate announced on the IRS website. Then, download and print out a mileage log PDF. Check out the following image for a good mileage log example:

Image. Driversnote mileage log template.

Frequently asked questions

What do I need to know about the self-employed mileage deduction?

The IRS stated that the mileage deduction for self-employed individuals would increase starting July 1, 2022. The new mileage rate for the last 6 months of 2022 will be “62.5 cents per mile, up 4 cents from the rate effective at the start of the year.” (IRS)

How to log mileage for work and business-related travels?

According to the IRS, you are required to provide the following documentation for your mileage logs:

1. Travel dates, destination locations, and purposes of your business trips.

2. A separate mileage log for each business trip.

3. The total mileage for that tax year.

You can track your mileage with an app or manually using a tracking spreadsheet or a paper logbook. Make sure you log mileage in a timely manner. Ideally, you should log your mileage immediately after your trip. Keep in mind that as a business owner, you must keep records that the IRS considers essential, and this applies to any expenses related to transportation.

How should you be keeping track of mileage for taxes on your tax return?

Follow these 4 steps to claim mileage for your tax return:

Step 1: Keep your receipts.

Step 2: Calculate your total deduction.

Step 3: Claim your gas deduction on your tax return.

Step 4: Retain your receipts and documents.

I’m looking for an app to track mileage. What would you recommend?

Many apps can help track how much mileage you’re getting on your car. Some of these apps can also help track your fuel costs.

Check out the best-recommended apps from Forbes Business Advisors:

1. Best for manufacturing, technology, and construction: Rydoo.

2. Best for independent contractors and freelancers: Quickbooks.

3. Best for miles and receipt tracking: Shoeboxed.

4. Best for users who love customized plans: SAP Concur Expense.

Bonus infographics on tracking mileage for taxes

Final thoughts

Now that you know how to track mileage for taxes with the Shoeboxed app, you’re well on your way to becoming a pro at tracking your business expenses! Download (or update) the Shoeboxed Receipt and Mileage Tracker app for iOS or Android now to get the 30-day trial.

See also:

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!