Independent contractors are people that are self-employed and work on a project or on an independent contract basis for their clients.

As an independent contractor, keeping track of and controlling your expenses is essential to ensure you maximize your profits and minimize your tax liability.

One way to do this is by using an independent contractor expenses spreadsheet.

An independent contractor expenses spreadsheet is a tool that helps freelancers track and organize their actual expenses.

These spreadsheets are made up of a table that allows contractors to input their expenses, sort and filter their financial data, and perform calculations via formulas and functions.

This data can be used to identify areas where they can cut business costs and increase profits.

What is an independent contractor expenses spreadsheet?

An independent contractor expenses spreadsheet is a tool that helps independent contractors track business expenses.

Expense spreadsheets have a table where you can record the costs incurred while freelancing.

Spreadsheets can be created using Microsoft Excel or Google Sheets, allowing users to sort and filter their financial data.

Manually calculating expenses with a laptop and a calculator.

Independent contractors, since they work for themselves, must manage their finances, including tracking tax expenses and filing taxes.

Using an independent contractor expenses spreadsheet, freelancers can do simple record keeping for the money spent to run their business, including fees for equipment, supplies, transportation, and other miscellaneous costs.

By keeping track of their expenses, independent contractors can accurately calculate their net income.

Using an independent contractor expenses spreadsheet has several benefits, such as:

Organizing and categorizing expenses, making it easier to identify areas where costs can be reduced.

Ensuring that all expenses are accounted for and that the contractor isn’t missing out on any tax deductions.

If they are working with a team, an expense report helps the contractor monitor spending.

Managing finances efficiently and accurately, which helps the contractor maximize their income and reduce their tax liability.

Why is it important to manage independent contractor expenses?

Managing independent contractor expenses is necessary for several reasons.

1. Tax time preparation and deductions

First and foremost, managing expenses helps independent contractors keep track of their financial data and accurately calculate their taxable income.

Independent contractors can claim tax deductions and reduce tax liability by tracking expenses.

Tracking expenses can also help independent contractors identify potential tax write-offs, such as business travel, equipment, supplies, and home office expenses, which reduces their taxable income.

By keeping track of expenses, independent contractors can ensure they’re not missing out on any tax deductions they’re eligible for.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. 30-day full money-back guarantee!

Get Started Today2. Business organization and accurate records

Managing independent contractor expenses can help small business owners and self-employed individuals stay organized and maintain accurate financial records.

Having accurate records of expenses is especially important when it comes to accounting and tax preparation.

By keeping detailed records of expenses, independent contractors can easily categorize expenses for their Schedule C category and provide their accountants with the necessary financial data for tax calculations.

3. A clearer picture of financial standing

Keeping track of independent contractor expenses can provide a clear picture of an individual’s financial situation.

Managing expenses effectively can help independent contractors make informed decisions about their business and identify areas where they can cut costs or increase annual revenue.

By organizing expenses, independent contractors can better understand their cash flow and make more informed financial decisions.

Overall, managing independent contractor expenses is essential for anyone who is self-employed or works as an independent contractor.

By keeping accurate records and seeking professional advice when necessary, independent contractors can ensure that they maximize their tax deductions and maintain accurate financial records.

What are the best independent contractor expenses spreadsheet templates?

Using a spreadsheet is a convenient way of tracking expenses as an independent contractor.

Below are some of the top independent contractor expense spreadsheets available for free download.

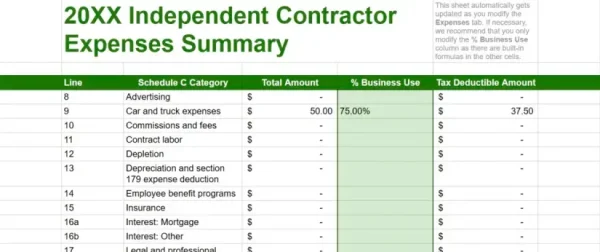

1. Spreadsheetpoint.com‘s independent contractor expenses spreadsheet

An excel spreadsheet with 5 columns showing an independent contractor’s expenses summary spreadsheet, including the total amount and tax-deductible amount.

Spreadsheetpoint.com offers a free independent contractor expenses spreadsheet that’s easy to use and can help freelancers keep track of their expenses.

The spreadsheet includes fields for date, description, category, amount, and notes, making it easy to categorize expenses and track spending trends over time.

The template is available in Excel and can be downloaded for free from their website.

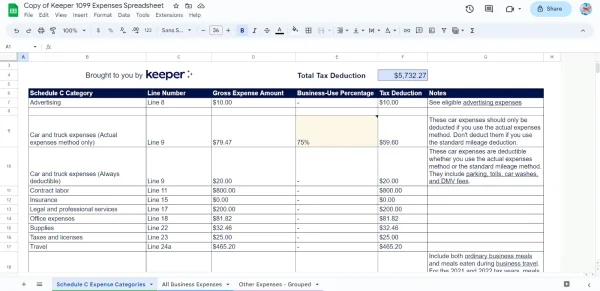

2. Keeper Tax’s independent contractor expenses spreadsheet

Keeper expenses spreadsheet

Keeper Tax’s independent contractor expenses spreadsheet is another great option for freelancers looking to track their expenses.

The spreadsheet is designed to help users easily categorize their expenses and includes fields for date, description, category, and amount.

The template is available in Excel and can be downloaded for free from their website.

Keeper Tax also offers a paid service that automatically categorizes and tracks expenses for users, making it an excellent option for those who want to save time.

3. Freshbooks’ free contractor invoice template

Create invoices with Freshbooks

Freshbooks offers free invoice templates for contractors with various styles to suit your business.

Each template is designed for specific industries and includes details for tracking business finances efficiently, including cells where you can input the item’s description, unit cost, quantity, and total amount.

You can download their templates in DOC, XLS, and PDF.

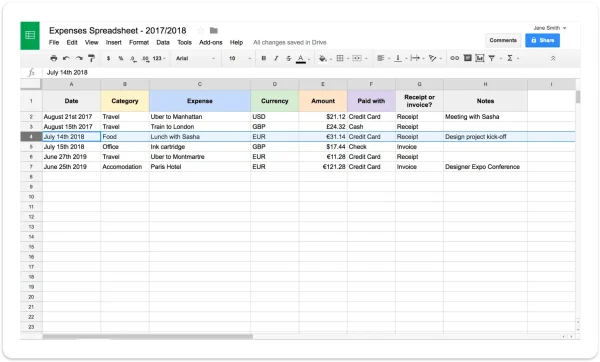

4. Hello Bonsai’s self-employed expenses spreadsheet

Example spreadsheet from HelloBonsai

HelloBonsai offers different expense spreadsheets for bookkeeping, quotes, contracts, proposals, invoices, and forms for various industries.

You can download each template after signing up for an account.

Once you sign up, you’ll receive additional information about each form, the benefits of using HelloBonsai’s templates, and how to create a spreadsheet to maximize your business tax deductions.

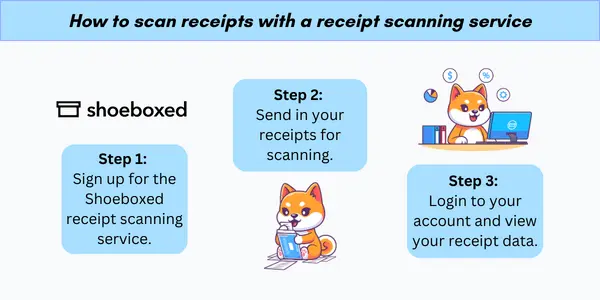

5. Bonus: Shoeboxed to streamline your expense tracking

Shoeboxed is the #1 receipt scanner and management software for businesses

If you’re looking for a way to automate your expense spreadsheet, Shoeboxed is your best bet.

With Shoeboxed, you can outsource your receipt and document scanning using their Magic Envelope.

Shoeboxed’s Magic Envelope allows you to stuff your receipts inside a prepaid envelope, mail it to a scanning facility, and get the expense organization done for you. This feature is especially useful if you have hundreds of old receipts that you haven’t gotten around to organizing.

Once your expenses are scanned into your Shoeboxed account and organized into digital records, you can create and export a CSV file and open it in Excel to track your expenses.

All of your previous expenses will be automatically included in your spreadsheet and categorized into columns for the receipt date, store, notes, currency, totals, payment type, and more.

Links to images of your receipts are also included in the spreadsheet for easy access, should you ever be audited.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 30-day full money-back guarantee!

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

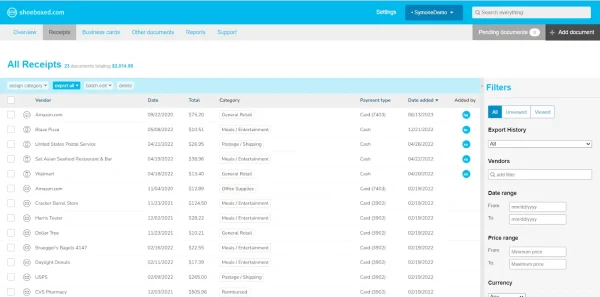

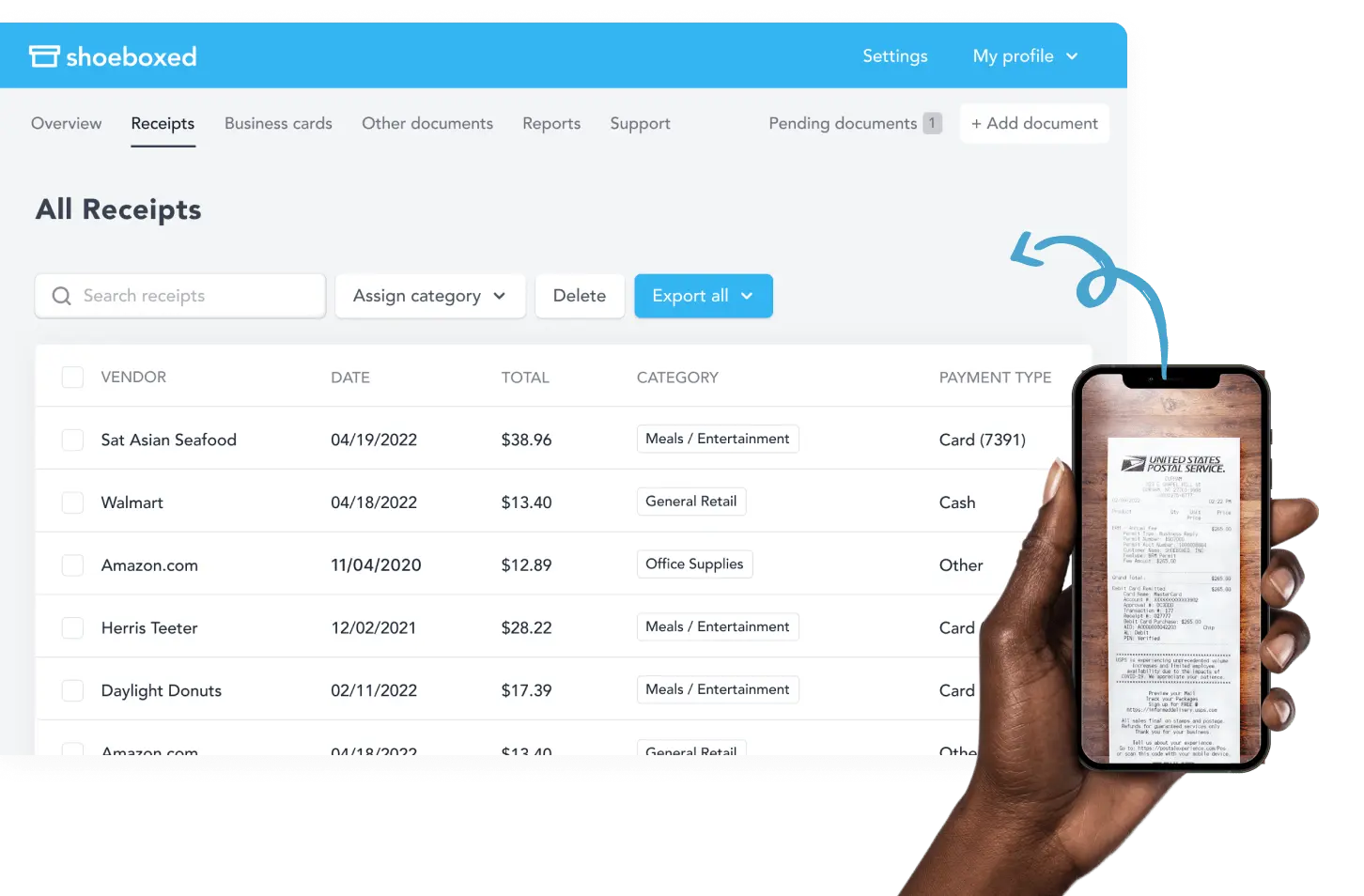

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts, warranties, contracts, invoices, and other documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

Outsource your receipt scanning with the Magic Envelope!

The Magic Envelope service is the most popular Shoeboxed feature, particularly for businesses, and lets users outsource their receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Break free from paper clutter ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 30-day full money-back guarantee!

Get Started TodayHow do you create an independent contractor expenses spreadsheet?

You can use Microsoft Excel or Google Sheets to create an independent contractor expenses spreadsheet using the actual expense method.

Excel and Google Sheets offer a range of features that can help freelancers and independent contractors track expenses and manage their finances.

Follow the steps below for creating an effective spreadsheet:

Step 1. Set up the spreadsheet

Create a blank spreadsheet and add columns for the different types of expenses you want to track.

Common categories include office supplies, travel expenses, and professional development.

You can also include columns for the expense date, the amount, and any notes or comments.

Step 2. Use formulas and functions

One of the benefits of using a spreadsheet is that you can perform calculations automatically using formulas and functions.

For example, you can use the SUM function to add up the total expenses for each category or the AVERAGE function to calculate the average cost per expense.

Step 3. Sort and filter data

Another advantage of using a spreadsheet is that you can sort and filter your data to make it easier to analyze.

For example, you can sort your expenses by date to see how much you spent each month or filter by category column to see how much you spent on travel versus office supplies.

Step 4. Keep the spreadsheet up-to-date

To get the most benefit from your spreadsheet, it’s important to keep it up-to-date.

Make sure to record your expenses on a regular basis and review the spreadsheet periodically to ensure that everything is accurate and complete.

By following these steps, freelancers and independent contractors can create an effective expense spreadsheet to help them manage their finances and stay on top of their expenses.

See also: Small Business Expense Spreadsheet: 5 Free Templates

What expenses should be tracked in an expense spreadsheet?

When tracking expenses as an independent contractor, it’s essential to record all relevant costs accurately.

Doing so allows you to claim the maximum tax deductions, calculate your net income, and keep your finances in order.

Below are some of the expenses that should be tracked in an independent contractor expenses spreadsheet:

1. Travel expenses

You can deduct expenses when traveling for work.

If you travel for work, expenses such as airfare, lodging, and rental car expenses should be recorded in your spreadsheet.

You can also include other expenses like parking fees, tolls, and public transportation costs.

2. Receipts

Any receipts, including digital receipts, related to your business—such as those for office supplies, equipment, or business meals—should be kept and recorded in your spreadsheet.

It’s a good idea to categorize receipts based on the type of business expense they represent.

3. Equipment

If you need to purchase equipment or tools to perform your work, such as a computer or specialized software, you can record these expenses in your spreadsheet.

Your spreadsheet can also include the cost of repairs or upgrades to existing equipment.

4. Home office

If you work from home, you can track expenses such as rent or mortgage payments, utilities, and internet bills.

It’s important to note that the IRS has specific rules around what can be claimed as a home office deduction, so it’s crucial to consult with a tax professional to ensure compliance.

Watch this video for a detailed explanation of home office deductions:

Explaining home office deduction, LYFE Accounting5. Business insurance

If you have business insurance, such as liability or professional insurance, you can track the cost of insurance premiums in your spreadsheet.

6. Merchant fees

If you accept payments through credit card processors or other merchant services, you can record the fees associated with these services in your spreadsheet.

7. Supplies

Any office supplies you purchase for your business, such as paper or ink, can be recorded in your spreadsheet.

8. Internet bills

If you use the internet for your work, you can track the cost of your internet bill as an expense.

9. Training

If you attend training or conferences related to your work, you can record the cost of these events in your spreadsheet.

10. Gifts

Gifts to clients or business partners can be deducted from your taxes

If you give gifts to clients or business partners, you can track the cost of these gifts in your spreadsheet.

11. Business meals

If you have business meals with clients or partners, you can track the cost of these meals in your spreadsheet.

Keep in mind that the IRS has specific rules around what can be claimed as a business meal deduction, so it’s crucial to consult a tax professional to ensure compliance.

Tracking expenses in an independent contractor expenses spreadsheet can help you stay organized and ensure that you’re claiming the maximum amount of deductions on your taxes.

By recording all relevant expenses, you have a clearer view of your finances and can make informed decisions about your business.

How do you categorize and calculate expenses in spreadsheets?

When categorizing and calculating expenses in an independent contractor expenses spreadsheet, it’s important to be organized and consistent.

An organized spreadsheet will help you keep track of your expenses and make it easier to calculate your total expenses at the end of the year.

Follow the steps below to categorize and calculate expenses in your spreadsheet:

Step 1. Categorizing expenses

The first step to categorizing expenses in your spreadsheet is to create categories that make sense for your business.

This could include categories such as office supplies, travel expenses, and equipment costs.

Once you set up your categories, you can enter your expenses into the appropriate category.

By customizing your expense categories, you can tailor your expense spreadsheets to your specific industry. For example, check out the following spreadsheets for truckers, Airbnb hosts, lawn care specialists, real estate agents, etc.

Step 2. Calculating expenses

You can use formulas and functions in the spreadsheet to calculate your total expenses for each category.

For example, you could use the SUM function to add up all expenses in a category or use the AVERAGE function to calculate the average expense amount for a particular category.

Step 3. Standard mileage rate

If you use your personal vehicle for business purposes, you can deduct your mileage expenses from your taxes. The standard mileage rate for 2023 is 58 cents per mile.

To calculate your mileage expenses, you can use an app with a mileage tracker, like Shoeboxed, or simply keep track of your mileage manually and enter the total amount into the spreadsheet.

Track business mileage with Shoeboxed.

Shoeboxed’s built-in mileage tracker automatically calculates the distance traveled, which you can then export in an expense report for tax purposes.

Step 4. Expense amount

When entering expenses into the spreadsheet, be sure to include the expense amount, the date of the expense, and a description of what the expense was for.

Including the expense amount will make tracking and calculating your total expenses for each category easier.

Step 5. Total amount

At the end of the year, you can use the spreadsheet to calculate your total expenses for each category and your total expenses for the year.

Calculating your total expenses will make it easier to file your taxes and determine how much you owe (or if you’re entitled to a refund).

By categorizing and calculating your expenses in an independent contractor expense spreadsheet, you can easily track your expenses and ensure that you’re claiming the deductions you’re entitled to.

5 Tips for managing independent contractor expenses

Managing expenses can be daunting, but it’s crucial for the success of any business.

Below are some tips to help you manage your independent contractor expenses effectively:

1. Keep track of all expenses

It’s essential to keep track of all big and small expenses, including advertising, meals, gifts, and business meals.

By keeping track of every expense you make, you can identify areas where you can cut back and save money.

2. Understand IRS rules and regulations

Keep the receipts you claim as tax deductions in case you’re ever audited.

As an independent contractor, it’s crucial to understand the IRS rules and regulations regarding expenses.

These include understanding which expenses are tax deductible and which are not.

It’s also important to keep all receipts and invoices for expenses, as these will be needed during tax filing season.

3. Hire a professional

If you need help managing your independent contractor expenses, consider hiring a professional.

A tax professional can provide valuable insight into bookkeeping as an independent contractor, managing your expenses, and ensuring that you comply with IRS rules and regulations.

4. Understand tax forms

As an independent contractor, you will need to file a tax form 1099. Understanding this form and how to fill it out correctly is essential.

If you’re unsure, consider hiring a professional to assist you.

Watch this video on how to maximize deductions as a 1099 contractor:

Maximizing 1099 deductions for contractors, XQ CPA5. Consider a sole proprietorship

A sole proprietorship can provide tax benefits and make it easier to manage your expenses.

In conclusion, managing independent contractor expenses can be challenging, but it’s important for the success of any business.

By keeping track of your expenses, understanding IRS rules and regulations, using a spreadsheet, hiring a professional, understanding tax forms, and considering a sole proprietorship, you can effectively manage your expenses and save money in the long run.

Frequently asked questions

How do you create an expense spreadsheet for independent contractors?

To create an expense spreadsheet for independent contractors, use Microsoft Excel or Google Sheets to create a table to track expenses. The spreadsheet should include the date, expense description, amount, and category columns. Update the spreadsheet regularly to ensure accurate financial records.

What are the essential expenses to track for independent contractors?

Independent contractors should track all business-related expenses, including office supplies, travel expenses, equipment expenses, and professional services. They should also track expenses related to marketing, advertising, and website development.

What are some free spreadsheet templates for self-employed individuals?

The templates from Spreadsheetpoint, Keeper Tax, Freshbooks, and Hello Bonsai are popular free spreadsheet templates for self-employed people.

How do you categorize expenses for taxes as an independent contractor?

Categorizing expenses is crucial for tax purposes as it helps claim tax deductions. Independent contractors should categorize expenses into different categories, such as office, travel, equipment, and professional services. It’s important to keep the receipts and invoices of all expenses to support tax deductions.

How do you calculate tax deductions for independent contractor expenses?

To calculate tax deductions for independent contractor expenses, subtract the total expenses from the total income. The resulting amount is the net income, on which the taxes are calculated. Independent contractors can claim tax deductions on business-related expenses, including office supplies, travel expenses, and professional services.

What’s the best way to maintain an independent contractor expense tracker?

Update the spreadsheet regularly, categorize expenses accurately, keep receipts and invoices of all expenses, and review the spreadsheet periodically to ensure accuracy. Independent contractors should also seek professional help to ensure compliance with tax laws and regulations.

How much is self-employment tax?

As a self-employed individual, you need to make tax payments yourself. The total amount is 15.3%, 12.4% for Social Security, and 2.9% for Medicare.

In closing

Independent contractors can gain valuable insights into their business operations by tracking their expenses with spreadsheets.

An independent contractor expenses spreadsheet is a valuable tool for any contractor looking to improve their financial management.

By creating and maintaining an accurate spreadsheet, contractors can save money, improve their profitability, and make informed decisions about their business.

Tammy Dang is a staff writer for Shoeboxed covering productivity, organization, and digitization how-to guides for the home and office. Her favorite organization tip is “1-in-1-out.” And her favorite app for managing writers and deadlines is Monday.com.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!