Throughout the year, all businesses look to categorize their business expenses to help alleviate the tax burden at tax time. According to the Internal Revenue Service (IRS), certain business expenses are exempt from taxes, and some are not. Nondeductible expenses are those the IRS still taxes because they are not strictly considered business-related.

Here’s a summary of the key takeaways regarding nondeductible expenses:

Non-deductible expenses include fines, personal expenses, political contributions, commuting costs, gifts over $25, illegal activities, and entertainment expenses.

Non-deductible expenses are reported on specific tax forms.

Amended returns can be filed to claim overlooked non-deductible expenses.

Non-deductible expenses reduce a partner’s capital account but not taxable income.

Non-deductible expenses are not included on personal tax returns but are reported on Schedule K-1.

Thorough record-keeping is essential.

Read on for a closer look at non-deductible expenses, including the most common ones, such as government fines and penalties, personal expenses, lobbying, and more, and where they belong on tax returns. Paper trails are always important in these situations to ensure the business claims expenses correctly and to maximize its potential to deduct expenses.

What are non-deductible expenses?

IRS Publication 535 has further background information concerning tax deductible and non-deductible expenses, some of which are listed below.

Non-deductible business expenses

Personal expenses

This bears no other explanation except that it doesn’t fall under a business expense, therefore, it is a non-deductible expense. Personal and business expenses should be kept separate at all times so that deductible expenses do not become muddled. The following expenses are examples of a personal expense.

Examples of private expenses

Medical expenses

Personal car

Family expenses

Personal spending

Adoption expenses

Other expenses

Fines and penalties

Whether levied against a person or a business, fines and penalties, by their very definition, are non-deductible expenses. They cannot be used as a benefit on a tax return when they are clearly marked to be penalizing a company.

Even almost trivial-sounding expenses such as parking tickets fall into this category, whether it was during the use of a business or personal vehicle. Others, such as the expense of check writing fees, also fall into this category. Most companies will work extra hard to make sure they never get hit by fines and penalties from any overseeing agency for partially this reason.

Political contributions

No matter how passionately a business might feel about the upcoming elections (local, state, or federal), the contribution is a nondeductible expense as it isn’t necessary for the business to function. Unlike charitable contributions, which are in some instances at least partially deductible expenses, a donation to a political campaign is not a deductible expense.

Commuting expenses

These commuting costs encompass only everyday commutes to and from a business office, whether by car, bus, or subway. Whether the commuting costs were incurred during the use of business vehicles or a personal vehicle, this expense cannot be used as an itemized deduction.

Traveling to meet with a client or when you have business in another state can fall under a deductible expense category as travel expenses rather than commuting expenses. It’s important to keep in mind that such expenses need to have a direct relation to the business and the individual traveling must spend a certain amount of time working.

Gifts

That is to say, any business-related gifts over $25. Though it might feel like gifting a potential client or a business partner a token of appreciation is a common practice, that doesn’t make it a necessary business expense. Therefore, any gift above the mentioned threshold becomes a non-deductible business expense.

Illegal activity

This should go without saying, but activities considered to be illegal are categorized as a non-deductible expense. Gambling losses, for example, fall into this category, as well as illegal bribes. If you’re ever unsure, a tax professional will have more information; however, the general rule of thumb is if you don’t include it on your tax return, you can’t deduct it.

Entertainment expenses

To start, when traveling for work, meals and entertainment are tax-deductible expenses. But team building exercises, including entertainment, entertainment facilities such as country clubs, or a meal, are non-deductible expenses. The same can happen when dining out with a potential client, which is a deductible expense in many cases. The fine line is determining what is personal and what is strictly business.

The same regard is given to a business trip. For a business trip to be considered tax-deductible, those undergoing travel have to spend more than 50% of the workday on business rather than pleasure.

Read More: Tax Facts. An article on fun tax facts!

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic approach to receipt tracking for tax season. 30-day full money-back guarantee!

Get Started TodayWhere do I report nondeductible 1120 expenses?

First, IRS Form 1120 is the U.S. Corporation Income Tax Return. Similar in definition to the 1040 most citizens are familiar with, the 1120 Form is used to report income, gains, losses, tax deductions, credits, and calculate a corporation’s tax liability.

Non-deductible expenses, such as those incurred during the production of tax-exempt income, get reported on line 16c of Schedule K. This Schedule gets attached to the original 1120 Form. Some other nondeductible expenses to get included on line 16c are:

Amounts paid to influence federal, state, or local legislation

Amounts paid to communicate with certain federal executive branch officials to influence actions or positions

Expenses that were set aside for conventions, seminars, or other similar meetings

Where to put non-deductible expenses from K-1 on 1040?

Form K-1 is a Form 1040 Schedule used to show unreimbursed partnership expenses. These specific expenses are not included on Schedule A as an itemized deduction but go directly to the K-1 under the section listed as Additional Information. These items include expenses paid personally on behalf of a partnership, even in the case of a home business.

Schedule K-1 Form 1065 Tax Return by Jason D. KnottWhere do I put the prior year’s non-deductible expenses?

Did you overlook claiming non-deductible business expenses on a prior tax return and are now getting burdened with a higher tax bill? Perhaps you hope to claim them in the current year. Your option here is to file an amended tax return for individual returns called the 1040X, which has to get filed on paper.

For a business owner who operates as a sole proprietorship, the 1040 Form is the appropriate paperwork for claiming a tax deduction, with the 1040X Form constituting the amending of the document. Schedule C assists with claiming any revenue or expenses related to business activity if something was missed or needs to get reviewed.

For corporations, this would be the 1120X. Much the same as the 1040X Form, the 1120X provides business owners (who are not sole proprietors) a way to adjust tax mistakes to the originally filed 1120.

Do non-deductible expenses reduce tax basis partnerships?

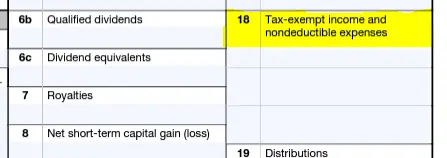

Nondeductible and non-capitalizable business expenses will reduce a partner’s capital account but will not reduce taxable income. Rather, these nondeductible expenses will get reported on the IRS Schedule K-1 Box 18 and should then decrease the adjusted basis of the interest the partner has in the partnership by that exact amount.

Does a non-deductible expense get included in a tax return?

Though it’s impossible to include any non-deductible expense on a personal tax return and deduct it from taxes, it gets placed on an IRS Schedule K-1, Box 18, Code C, when the business files its 1120 tax return for the year.

Where to include your nondeductible expenses on Form 1120

Never lose a receipt again 📁

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayFrequently asked questions

What expenses are never considered deductible expenses for tax purposes?

Although the laws vary from state to state, certain expenses are almost never deductible. These include the following expenses:

1. Entertainment

2. Meals; outside of business travel

3. Political contributions

4. Lobbying expenses

5. Gifts; over $25

6. Illegal activities such as illegal bribes

7. Commuting

In closing

Managing business expenses and using knowing which is deductible is a way to lower your tax liability, and rightfully so. Personal and business expenses are used quite the same way on tax returns despite using different forms and changed regulations. However, in both cases, some expenses fall into certain categories the IRS deems nondeductible and cannot be used as part of the itemized deductions the business hopes to disclose.

For businesses, these nondeductible expenses will be included in Schedule K-1 attached to the 1120 Form. Some examples of these business expenses include political lobbying, governmental fines and penalties, any personal expenses, political contributions, meals or entertainment outside of business travel, illegal activity, daily commuting, and gifting over $25.

Businesses hope to deduct expenses for various expenses related to the business to offset the amount of taxes owed to the government. Hence why a personal expense or commuting expenses do not fall into the category of deductible expenses. A personal expense does not have any impact on business activities and cannot get treated as such.

For situations that require further clarification, it’s best to reach out to a tax professional, as there will be grey areas. In many situations, however, these expenses will not lower the company’s tax liability, even if they are included on Schedule K-1. The key is to ensure a thorough paper trail, allowing deductible expenses to work for the company, even if some of the expenses incurred throughout the year are considered non-deductible.

Agata Kaczmarek has held a passion for writing since early childhood. A professional writer for many years, Agata specializes in writing articles and blogs focused on finance as someone who holds a Masters Degree in Accounting and Finance.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!