In today’s competitive real estate market, agents must diligently track their expenses to ensure financial stability and growth.

One effective way to achieve this is through a real estate agent expense spreadsheet. A well-organized spreadsheet can help professionals keep track of all their expenditures, enabling them to make informed decisions about their business operations and spending habits.

By keeping an accurate record using a real estate agent expense spreadsheet form, tracking both fixed and variable expenses, realtors can better understand their financial patterns and identify areas for cost reduction or increased investment.

This data-driven approach helps agents optimize their operations, leading to greater success in the real estate industry.

Using an expense spreadsheet with pre-built expense categories and data validation structures improves efficiency and ensures the information’s reliability.

Implementing this tool in daily business operations helps real estate agents maintain a solid understanding of their financial health and empower them to make better decisions for long-term success.

This article provides a shortlist of the best free real estate expenses spreadsheet options online today. And then we’ll also cover need-to-know real estate accounting basics!

Top free real estate expense spreadsheets

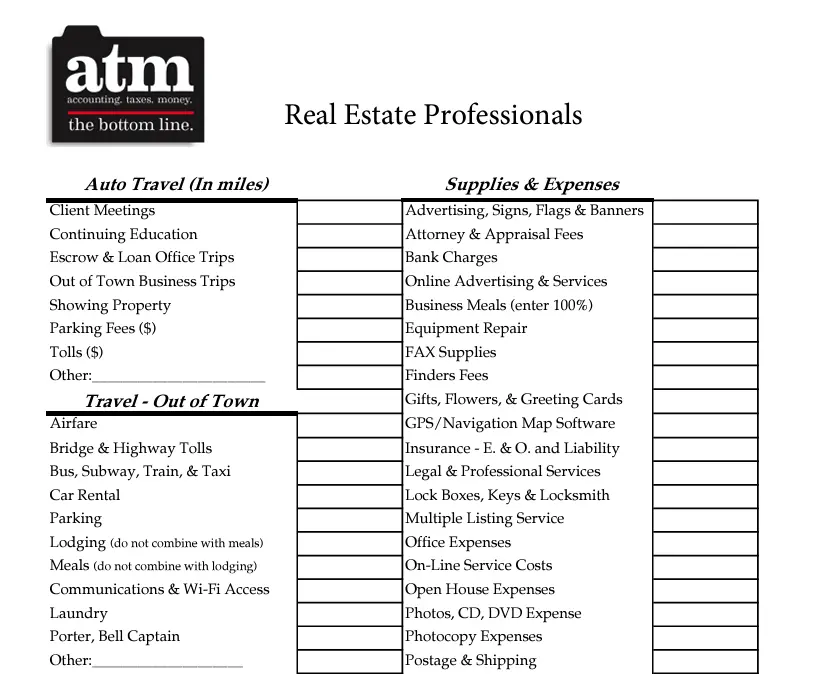

1. Kyle Handy’s realtor expense spreadsheet

Kyle Handy offers a helpful realtor expense spreadsheet template that helps real estate agents track their expenses.

Kyle Handy’s real estate expenses spreadsheet

This free Google Sheets spreadsheet includes different categories to keep track of and report both income and expenses, making it easy for real estate professionals to monitor their finances throughout the month or year and keep on top of tax deduction expenses.

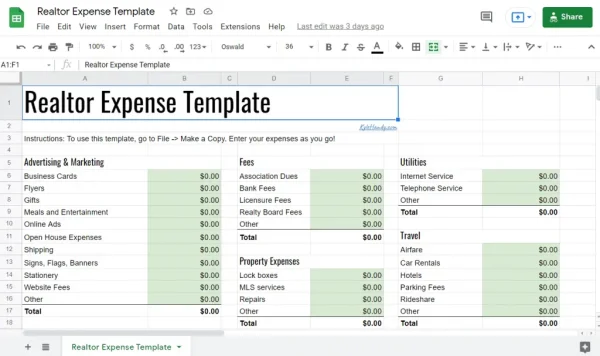

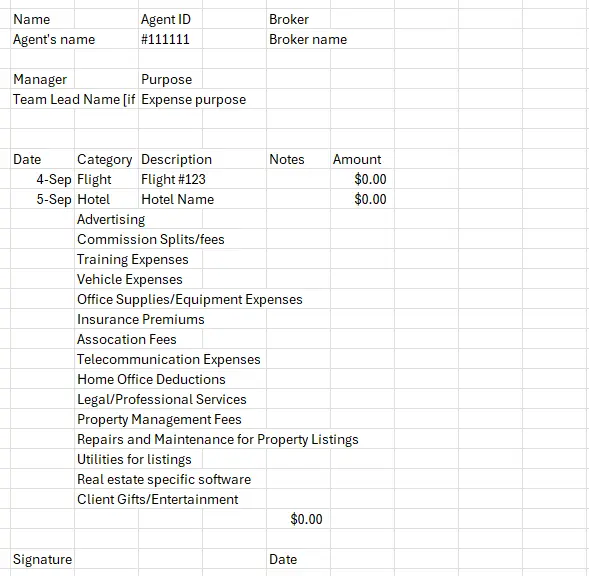

2. Daszkal Bolton LLP real estate agent tax deductions worksheet Excel 2023

Designed by Daszkal Bolton LLP, this real estate agent tax deductions worksheet in Excel format caters to realtors needing an accessible way to organize their tax deductions.

Daszkal Bolton LLP real estate agent tax deductions worksheet Excel 2023

The user-friendly interface includes a list of expense accounts, built-in data validation, and an easy-to-follow layout.

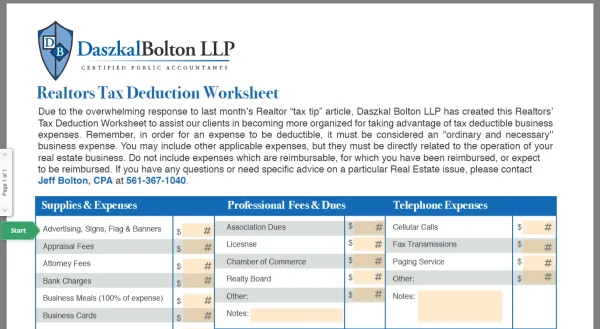

3. ATM expense worksheet for realtors

ATM offers a real estate expense worksheet that focuses on helping real estate professionals calculate totals from their business-related expenses.

This tool enables users to categorize expenses into common tax-deductible buckets, including auto-related travel expenses, travel out of town, supplies and expenses, and more.

The worksheet aims to simplify expense management and support end-of-year and tax return preparation with its structured layout.

4. KS Realty Agent Templates

KS Realty Agent provides an expenses spreadsheet tailored for real estate agents who need a detailed method for tracking their spending.

This template categorizes expenses, making it simple for agents to see where they allocate their funds.

Users can input expenses as they occur, automatically totaled to see monthly and yearly expenditures.

5. Other free spreadsheets for realtors

Beyond the resources mentioned above, there are numerous other spreadsheet options for real estate professionals, each with its own set of benefits. These include rental property cash flow analyzers, rental property management spreadsheets, and commercial real estate valuation and financial feasibility models. If you have employees, consider using an expense report template for Google Sheets or an Excel expense spreadsheet if you prefer Excel. By exploring tools like these, agents can enhance their financial management skills and improve their businesses.

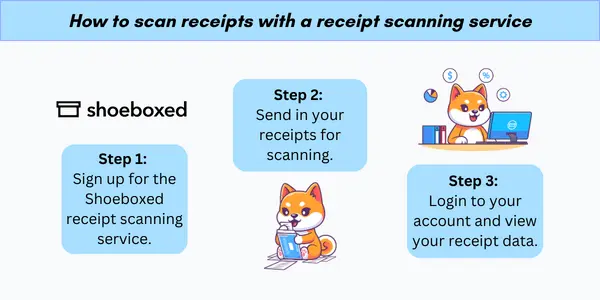

6. Shoeboxed’s receipt scanning service

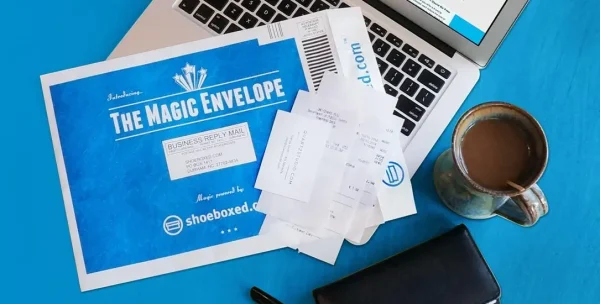

For real estate agents who are always on the go, a notable option would be to use Shoeboxed’s Magic Envelope service to outsource manual entry of receipts and expenses.

Starting from $18 per month, you receive a postage-prepaid Magic Envelope that you can keep on your car’s dashboard. Simply stuff receipts into the envelope as you pay for gas, meet clients for lunch out, and purchase supplies.

At the end of the month, send the Magic Envelope to Shoeboxed, and Shoeboxed will get all your data scanned and categorized into 15 common tax categories. Easy peasy.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 30-day full money-back guarantee!

Get Started TodayWhat else can Shoeboxed do?

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

A quick overview of Shoeboxed's award-winning features:

a. Mobile app and web dashboard

Shoeboxed’s mobile app lets you snap photos of paper receipts and upload them to your account right from your phone.

Shoeboxed also has a user-friendly web dashboard to upload receipts, warranties, contracts, invoices, and other documents from your desktop.

b. Gmail receipt sync feature for capturing e-receipts

Importing e-receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, using Shoeboxed's special Gmail Receipt Sync feature.

Shoeboxed’s Gmail Receipt Sync grabs all receipt emails and sends them to your account for automatic processing! These receipts are then labeled as Sent to Shoeboxed in your Gmail inbox.

In short, Shoeboxed pulls the receipt data from your email, including the vendor, purchase date, currency, total, and payment type, and organizes it in your account.

Your purchases will even come with images of the receipts attached!

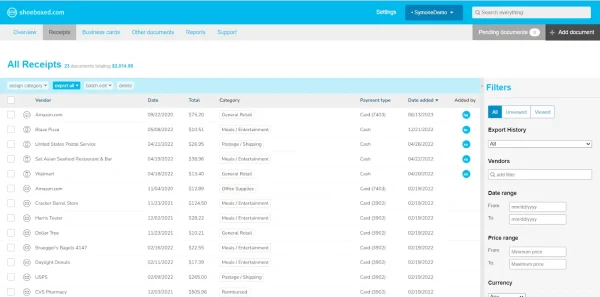

c. Expense reports

Expense reports let you view all of your expenses in one cohesive document. They also make it simple to share your purchases with your accountant.

You can also choose certain types of receipts to include in your expense report. Just select the receipts you want to export and click “export selected.”

d. Search and filter

Call up any receipt or warranty in seconds with advanced search features.

Filter receipts based on vendors, date, price, currency, categories, payment type, and more.

e. Accounting software integrations

Export expenses to your accounting software in just a click.

Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting.

f. Unlimited number of free sub-users

Add an unlimited number of free sub-users to your account, such as family members, employees, accountants, and tax professionals.

g. Mileage tracker for logging business miles

After you sign up for Shoeboxed, you can start tracking miles in seconds:

Open the Shoeboxed app.

Tap the “Mileage” icon.

Click the “Start Mileage Tracking” button.

And drive!

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive.

As you make stops at stores and customer locations, you can drop pins to make tracking more precise.

At the end of a drive, you’ll click the “End Mileage Tracking” button to create a summary of your trip. Each summary will include the date, editable mileage and trip name, and your tax deductible and rate info.

Click “Done” to generate a receipt for your drive and get a photo of your route on the map. Shoeboxed will automatically categorize your trip under the mileage category in your account.

h. The Magic Envelope

The Magic Envelope service is Shoeboxed's most popular feature, particularly for businesses, as it lets users outsource their receipt management.

When you sign up for a plan that includes the Magic Envelope, Shoeboxed will mail you a pre-paid envelope for you to send your receipts in.

Once your receipts reach the Shoeboxed facility, they’ll be digitized, human-verified, and tax-categorized in your account.

Have your own filing system?

Shoeboxed will even put your receipts under custom categories. Just separate your receipts with a paper clip and a note explaining how you want them organized!

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. 30-day full money-back guarantee!

Get Started TodayHow to create an effective spreadsheet

Want to create a bespoke realtor expense spreadsheet on your own? Here are the steps to take.

Step 1. Choose a platform

When creating a real estate agent expenses spreadsheet, the first step is to choose a platform to start working on your spreadsheet. Excel and Google Sheets are the two most popular options available for creating spreadsheets.

Excel is a software program that can be installed on your computer, while Google Sheets is an online-based platform accessible through your Google account.

Both platforms are suitable for creating a worksheet to track and organize expenses.

However, Google Sheets offers more online collaboration features, whereas Excel provides access to better customization options and a more robust set of tools for advanced users.

Step 2. Know what you want to include

An organized spreadsheet is crucial for efficient expense tracking and financial management. When creating your real estate agent expenses spreadsheet, consider the following key components:

Income and expense categories: Categorize expenses in the spreadsheet, such as marketing, utilities, and insurance.

Dates and frequency: Track tax expenses by date and note the frequency (monthly, quarterly, or annually) for a better overview.

Tax deductions: Identify tax-deductible expenses, such as mileage and home office expenses, for a more accurate financial overview.

Subtotals and totals: Use formulas to calculate subtotals for each expense category and grand totals for your overall expenses.

Step 3. Customize and keep it up to date

Customization is an essential aspect when building a real estate agent expenses spreadsheet. Adapt your spreadsheet to your specific needs and accounting workflow, tailoring it to better serve the unique requirements of your business.

Customize the columns, rows, and formulas to make the information easy to read and understand, and update the expense spreadsheet as needed to ensure it remains a relevant and accurate accounting tool.

What are important expense categories for real estate agents?

a. Office supplies and equipment

For real estate agents, keeping track of office supplies and equipment expenses is crucial for managing finances and claiming tax deductions. These expenses may include items such as computers, printers, stationery, and office furniture.

By recording this spending, agents can maintain an organized cash flow and budget for operating expenses. Using a Google Sheets or Excel expense spreadsheet can help realtors manage these costs effectively.

b. Travel and vehicle expenses

Travel and vehicle expenses are another crucial category. As a realtor, it is essential to track mileage and other vehicle-related costs, such as gas, maintenance, and insurance premiums.

This will allow agents to claim relevant deductions on their taxes. To stay organized, it’s a good idea to keep business receipts and records of rental expenses in a dedicated folder or digital storage system.

c. Advertising and marketing

Advertising and marketing play a significant role in the success of a real estate agent. Expenses in this category may include print ads, online marketing, social media promotion, and website maintenance.

Keeping track of all marketing expenses can help realtors analyze their return on investment and optimize their advertising strategy. It’s also important for claiming tax deductions related to business expenses.

d. Education and professional development

Ongoing education and professional development are essential for real estate agents who want to stay ahead in a competitive market. Among the potential investments in continuing education, NYREI courses stand out as they offer a comprehensive curriculum for realtors. Taking these classes allows agents to stay informed about the latest trends, regulations and best practices within the industry. Other expenses in this category may include seminars, workshops, and books.

By recording these costs, agents can monitor their investments in personal and professional growth, and claim relevant tax deductions.

e. Insurance and professional services

All real estate agents need to account for insurance and professional services expenses. These may include insurance premiums related to their business, such as liability or errors and omissions coverage, as well as fees for services like accounting, bookkeeping, and legal support.

Accurate tracking of these expenses is vital for maintaining a healthy business and claiming tax deductions.

By categorizing and managing the expenses mentioned above, real estate agents can better understand their spending habits, maximize tax deductions, and make informed decisions about their investments.

An expense spreadsheet can serve as a helpful tool in this process, allowing agents to maintain a clear, organized view of their finances.

What are some best practices for real estate agents to maximize profitability and analyze performance

1. Track income and expenses

For a real estate agent, it’s essential to have a clear understanding of their income and expenses. By keeping track of these financial aspects, agents can analyze the overall performance of their real estate business and devise strategies for future growth.

Accurate record-keeping of revenue, such as commission and fees and expenses like advertising, office space, and professional services, allows realtors to make better-informed decisions about their transactions, clients, and properties.

Real estate agents should also track their profits vs. losses to check if they’re making a profit. For example, if their real estate leads cost less than the money they’re making off of said leads, then their lead generation campaign was successful and profitable.

2. Utilize accounting software and tools

There are numerous realtor accounting software and tools available for real estate agents to simplify and streamline their bookkeeping process. Popular software like QuickBooks can generate comprehensive financial reports, allowing agents to closely monitor their revenue and expenses.

Other tools, such as receipt management software, like Shoeboxed, makes it easier for agents to input data on-the-go.

3. Plan and make the most of tax deductions

Proper tax planning and deductions are essential for real estate agents to minimize their tax bill and increase their overall earnings.

Realtors, often categorized as self-employed or independent contractors, must thoroughly understand self-employment tax liabilities and possible deductions for their business expenses.

To achieve optimal tax planning, realtors may consider consulting a CPA or a tax professional experienced in dealing with small businesses.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. 30-day full money-back guarantee!

Get Started TodayIn closing

An effective real estate agent expense spreadsheet can be a valuable tool for keeping track of financial data and making important business decisions for their real estate business.

Utilizing this financial resource can help real estate agents better understand their income and expenses, contributing to greater efficiency and financial success.

One useful aspect of a real estate agent expense spreadsheet is the ability to categorize various sources of revenue and expenditure. By tracking expenses such as marketing costs, office supplies, and transportation expenses, agents can quickly identify areas where they might be overspending or areas where they might strategically invest more resources.

Additionally, a well-organized spreadsheet allows real estate agents to monitor their income and track progress toward their financial goals.

For those who want a more efficient way of keeping track of business expenses, consider using Shoeboxed’s receipt scanning service and receipt scanner app and save yourself from countless hours of tedious expense entry!

Tomoko Matsuoka is managing editor for Shoeboxed, MailMate, and other online resource libraries. She covers small business tips, organization hacks, and productivity tools and software.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!