A successful business is always looking for ways to save money and run more efficiently.

One way for a business to look for a way to cut costs is to dial in on travel expenses incurred during business trips.

Mastercard has issued a report that T&E expenses are the second highest indirect cost incurred by small businesses, making it an expense that should be carefully monitored since it can have such a big impact on the company’s growth and bottom line.

What does T&E mean?

Small business owners refer to T&E either as “travel and expense” or “travel and entertainment expenses.”

No matter which term you use, T&E are the costs employees incur while they are traveling for business.

Employees expect to be reimbursed, and rightfully so, for all qualified business expenses that they pay for out of their own pocket during their business travels.

As a result, all companies should have a policy in place outlining what employees can spend money on and how much they can spend when traveling for business.

This policy is known as a travel and expense policy.

The employee’s business expenses must comply with the company’s travel policy in order to be fully reimbursed.

What is Travel & Expense Management? by Axys OdysseyExamples of T&E

Here are some examples of the most common business-related expenses incurred while traveling for business.

a. Business travel and mileage

Business travel is the cost of travel from the employee’s home to the business destination.

This includes the price of road, rail, water, and air travel required to arrive at your business destination in order to conduct business away from home for any extended amount of time, usually beyond office hours where at least one night of accommodations is required.

This includes out-of-pocket costs only and not the value of reward programs or frequent flier miles.

If an employee uses their own car to travel for business, they are reimbursed for their vehicle expenses.

This typically means a reimbursement for gas and wear and tear such as a mileage allowance.

Parking and toll charges are also reimbursed.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. Expense reports don’t get easier than this! 💪🏼 30-day full money-back guarantee!

Get Started Todayb. Local transportation at destination

Local transportation includes shuttle, rental cars, taxis, limousines, buses, subways, metros and ride-sharing services like Uber or LYFT.

These expenses includes getting from the airport to the hotel and on to the business destination.

c. Shipping and couriers

Shipping and courier expenses include the cost of shipping samples, trade show equipment, luggage, and other material and supplies needed for the business trip.

d. Accommodations

The money spent by an employee for hotels or other accommodations is also considered a business travel expense.

e. Meals

Companies reimburse employees for expenses incurred for meals, including money spent on taking clients out to eat as long as business is discussed.

f. Gratuities and tips

Gratuities and tips to service providers are considered business-related expenses.

g. Business communication

Business communication includes internet access, faxes, business phone calls, video conferencing, SIM rental and roaming. All of these costs fall under travel business expenses.

h. Other business expenses

Other business expenses when traveling may include laundry or gifts, such as flowers or perfume, given to clients.

What is included in a T&E expense report?

For employees to be reimbursed for their out-of-pocket expenses while traveling for business, companies require employees to submit T&E expense reports.

These expense reports typically contain the following information:

Date the expense incurred

Where the expense incurred

The client for whom the expense was incurred

The type of account the expense falls under

Cost of the expense incurred

Additional notes to explain how the expense is used for business purposes

Typically, there is a designated time frame for the submittal of expense reports.

What is the typical process for expense management?

There are typically five stages in a standard expense management process.

Stage 1. Pre-authorization

During the pre-authorization phase of the expense management process, the expense claim is checked against the T&E policy to ensure that the expense will most likely be approved before it is incurred.

Stage 2. Expense reporting process

For employees to receive expense reimbursements, they need to first create and submit an expense report, which is usually the second phase of the expense management system.

Employees need to know the process for creating the report, how to track expenses and what documentation is needed as proof of costs incurred for business purposes.

They also need to know the timeline for submitting their expense reports.

Stage 3. Approval process

When it comes to the travel expense management process, the approval phase involves the denial or acceptance of expense claims.

Stage 4. Reimbursement process

As far as employee reimbursements, employees should be made aware of when and how the reimbursement will be made available. Will the reimbursement be made directly to the employee, included in employee pay, or used to pay a credit card if one was used?

Stage 5. Accounting process

Accounting is the final phase of the expense reporting process.

The employee submits an expense claim and from there the finance team prepares the accounts and spending reports.

Since the T&E expenses are tax deductible, the finance department will also need to create financial statements.

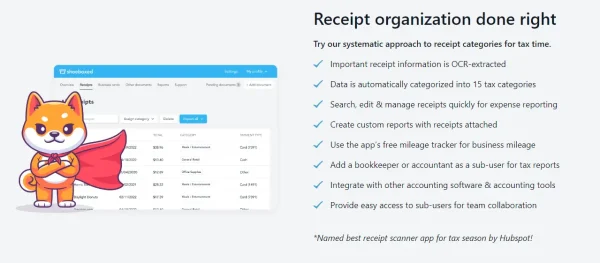

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. 30-day full money-back guarantee!

Get Started TodayHow to create a T&E policy

In an attempt to control expenses, most businesses have an expense policy that establishes how much employees can spend while traveling for business and what they can spend the money on.

A comprehensive and transparent T&E expense policy will ensure that expenses are being effectively managed and that costs are under control.

The policy establishes guidelines on the types of expenses that will be reimbursed, sets employee spending limits, explains how to prepare expense reports and the procedure for submitting expense reports, and how and when employees will be reimbursed.

A well developed T&E policy will make the whole expense management process much more efficient.

Here are some tips for creating an expense policy.

1. Make the policy easy to understand

The policy should clearly state the types of expenses that will be reimbursed, establish any spending limits, explain how to prepare and the procedure for submitting expense reports, and detail how and when employees will be reimbursed.

2. Establish criteria for the approval of expenses

Rules should be established for when and how employee expenses will be approved or rejected.

An example of a specific criteria would be setting a spending limit on future expenses for accommodations or meals.

3. Explain procedure for booking travel arrangements

Instructions should be provided on how to book travel arrangements.

Should the employee use a designated travel agent or is there a limit on what the employee can spend?

Does travel need to be approved before booking the itinerary?

Should employees use corporate credit cards or their own personal money when paying for travel expenses?

4. Explain the tracking and reporting process of expenses

Are employees tracking actual expenses or are they claiming per-diem amounts?

Do employees need to provide receipts to back up for their expenses?

Outline the expense management workflow

Detail or illustrate the route of the receipt on up to the time the expenses are reimbursed or paid.

5. Separate expenses by category

One thing that will save you a whole lot of time during tax season or an audit is to separate the expenses by categories.

That way it will be a lot easier to see what the expense categories are and to total up each category for its associated tax deduction.

Did you know? Shoeboxed automatically sorts all receipts into 15 common tax categories!

6. Review and update the policy regularly

Use your policy to analyze your expense data, look for spending patterns and ways to save money.

Also, look to see if you need to change your policy in any way due to new tax laws.

How to handle T&E reimbursements

Traditionally, employers required their employees to submit their business expenses using the paper reporting process, which meant filling out a form and attaching paper receipts for each expense.

Once the expense report was approved, it was forwarded to the accounting department where the employees expenses would either be reimbursed or the credit card paid.

If the employee paid out-of-pocket for the expenses, then the expenses would be reimbursed directly to the employee or included in the next employees pay.

If the employee paid for the expenses with a corporate credit card, then the company would provide the money to pay off the expenses on the credit card.

Today, most businesses use expense reporting software, as it has proven to be the most efficient expense reimbursement method.There are also services available such as Shoeboxed who automate the process for keeping track of receipt reimbursement requests, as well as receipt management for travel-related expenses.

Shoeboxed’s homepage

Automated expense management software for handling T&E

With expense management software for handling T&E, the expense forms can be filled out online with images of receipts.

Not only that, but the travel expense management software can check for compliance with the company’s T&E policy and automatically approve or deny the expense claim.

How to automate T&E report management

When you choose expense management software, you want to make sure it has the following features:

Able to set up custom T&E expenses and policies

Simplify the process of creating expense reports for the employees

Seamlessly upload any supporting documentation

Track reports throughout the whole reporting process

Include a mobile app for capturing images of receipts

Have a straightforward and intuitive interface so it’s user-friendly

Integrate with electronic payments or accounts payable

Operate in real-time reporting so that better business decisions can be made

Automating and streamlining T&E report management will make the process much simpler and more efficient for your employees and your business.

Benefits of automating T&E expenses and the reporting process

Automating the T&E expense reporting process doesn’t just benefit the employees, but it also benefits finance teams and the company itself.

Manually processing an expense report can take up a lot of time and cost a lot of money.

It takes a lot of time for employees to manually fill out forms, hold on to and attach paper receipts, and physically submit all paperwork to the finance team.

It takes finance teams a lot of time to manually review the report, check for compliance with company policy, and to track the approval process.

Automation makes it easier to scan receipts and submit expense reports with a mobile device while on the road—while also minimizing data errors from manual entries.

T&E expense report automation cuts down on the amount of work, both for the employee and the finance team, makes it easier to track expenses and process expense reports, ensures better compliance, and maximizes accuracy and productivity, which directly affects the bottom line.

Another key benefit of T&E expense report automation is that it makes fraud much more transparent.

Some examples of fraudulent activities are expense reports that have been manipulated, duplicate expense entries, and non-existent expenses included in the report.

Software that allows companies to set their own policies for allowable expenses can automatically scan for these inconsistencies and flag expenses that don’t conform or look out of place.

How much do companies spend on T&E?

According to the Global Business Travel Association, companies were expected to spend $1.4 trillion on business travel in 2024.

In addition, a Forrester Research poll indicated that 8 to 12% of the average organization’s total budget is spent on business-related travel.

That’s why it’s so essential that small business owners efficiently manage and control costs of travel expenses because it has a significant impact on the business’s growth and bottom line.

How to budget for T&E

When setting up a budget for T&E, you first need to consider your business’s goals and needs.

Then make sure your projected expenses align with that criteria.

1. Establish a budget that is realistic for your business

Determine how much money you can spend on business trips without sacrificing any of the money spent on necessities such as payroll or rent.

Look at past travel patterns and determine the average cost of a typical business trip.

Consider current travel needs, the company’s goals, the expenses that employees can claim and compare your current income with your current costs and the projected travel expenses.

This should give you a pretty good idea of a realistic amount that you could set aside for business travel expenses.

2. Always look for ways to cut costs

There are several ways to shape your budget so that you are saving money at every possible turn.

Booking in advance gives you cheaper flights and cheaper rates on accommodations.

If practical, have employees use public transportation whenever they can since it’s usually cheaper than taxis, etc.

Using a travel management platform for booking travel arrangements will give you access to more competitive flight and hotel rates.

Book flights and hotels with a flexible cancellation policy so that if an employee or the company needs to cancel a trip, the company won’t lose an unnecessary amount of money.

3. Include a margin for error

While your budget has included all the expected projected costs, be sure to make room for unexpected expenses such as emergencies or incidental costs.

Otherwise, it’s easy to go over your budget with the unexpected costs.

4. Establish a clear T&E policy

Once the budget is established, you need to make sure you create a travel expense policy where everyone is on the same page, one that is easy to understand and one that is easily accessible to all employees.

The policy should include the booking process, expense reporting, expense categories and expenses that are and are not reimbursable.

5. Constantly refine your budget

It’s important to remember that your initial budget is not set in stone.

Go back and revisit your budget often so that you can look for areas to cut costs or update the travel policy as needed.

Does the IRS allow for travel and entertainment expenses?

Not only does T&E help control how money is spent when traveling on business, but the reporting of T&E expenses are essential for tax purposes as well.

The IRS does allow for T&E by recognizing that most business expenses are tax deductible.

For example, in 2023, the standard mileage rate for taxpayers to use in calculating the deductible costs of operating a personal automobile for business is 65.5 cents per mile.

The IRS will accept that most business expenses will be considered tax deductions as long as they’re deemed “ordinary and necessary” within your industry.

However, companies must be able to show documentation as evidence and purpose for the expense.

At one time, most entertainment expenses were 50% tax deductible.

However, the 2017 Tax Cuts & Jobs Act eliminated a lot of the entertainment expenses from being considered tax deductions.

The exception to this act is if the expenses are considered recreational such as expenses related to business meetings, conferences, and holiday parties.

Business Travel Expenses 101: Everything You Need To Know #travelmanagement & #expensemanagement by ITILITEFrequently asked questions

What is included in T&E?

Some examples of the expenses included in travel and expense while on a business trip are business travel, local transportation, shipping, accommodations, meals, and business communication.

What is a T&E policy?

A travel and expense policy are guidelines established by a company that inform employees of the employee expense reporting and expense reimbursement process.

Does the IRS allow for T&E?

Yes, the IRS does allow for T&E. Most T&E expenses included in expense reporting are tax deductible as long as they are considered ‘ordinary and necessary’ for your business.

In conclusion

Travel and spending are a significant expense for most businesses.

Small businesses that track and monitor T&E expenses tend to stay more compliant with IRS regulations, avoid audits, more easily recognize policy violations and fraud, and do a better job of controlling business costs incurred.

With an effective spend management strategy, small businesses can more closely track how money is being spent on business travel and entertainment expenses.

This makes it easier to determine if spending policies need to be refined or if there are areas where costs can be cut.

Traditionally, manual expense management has been a time-consuming and costly process.

Fast forward to today’s technology, and the automation of the T&E expense reporting process via expense management software minimizes errors, maximizes productivity, ensures better compliance, mitigate fraud and saves on time and money.

Since T&E expenses have such a big impact on the bottom line and growth of a small business, it’s important for small business owners to be strategic about managing and controlling business-related travel expenses.

Caryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!