Bank reconciliation problems are as headache-inducing as they sound.

The reconciliation process involves quite a bit of investigative work, which many find tedious.

Still, companies must be aware of and know how to reconcile bank statements to maintain the financial health of their company.

We take a look at 5 common bank reconciliation problems and how to solve them in this quick-but-timely article.

What is bank reconciliation?

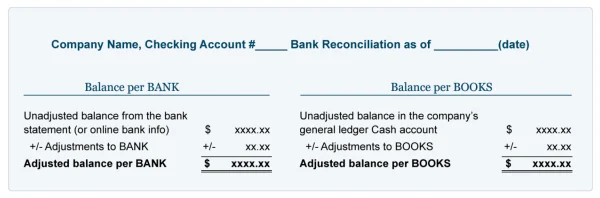

A bank reconciliation is a business process to ensure records are correct.

During this process, business records such as the general ledger or balance sheet get compared to the amounts disclosed on the bank statements.

When no differences are found between the two, the accounts are considered reconciled.

Bank reconciliation formula by Accounting Coach

Further investigation is required for situations where the information between the company and bank records does not match.

In such cases, the discrepancy needs to be justified or fixed.

What Is Bank Reconciliation? by Accounting Instruction

Why is bank reconciliation important?

The reconciliation process benefits businesses and business owners in a variety of ways, such as:

Catching errors: Bank reconciliations allow you to spot issues between your books and bank accounts before they get out of hand.

Filing taxes and tax breaks: Before you can file your taxes, the bank reconciliation process must be complete. You can also identify tax-deductible expenses when reviewing your accounting records.

Prevent fraud within your company: Catch expenses that have been wrongfully recorded by an employee.

Stay on top of business performance: The bank reconciliation process allows businesses to see where they stand financially.

Whether you’re a freelancer, employee, or small business owner, proper bank reconciliation is a necessary step in the bookkeeping process.

Never lose a receipt again 📁

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayWhat are the common types of bank reconciliation problems?

As a company goes through the bank reconciliation steps, there is a possibility of running into problems along the way.

Here are 5 of the most common problems that arise and how to solve them.

Problem 1. Transaction delays

Banks usually do not process monetary transactions on the same day, whether the transaction is a check, electronic payment, ACH transfer, or wire transfer.

Instead, the transaction waits to clear as the bank confirms funds and completes the process.

This transaction delay can cause a difference between a general ledger and the bank statement when a company performs a bank reconciliation.

For example, the transaction completes after the end of the recording period—such as the end of the month or year.

As a result, the business is likely to show more funds available—the transaction was logged under the date of payment—than the bank that waited until after the last day to post the transaction.

How to solve transaction delays in bank reconciliation

The best solution to a transaction delay is to book entries to reconcile the accounts for specific periods where they don’t match.

The company will show an adjustment on statements for both date ranges to account for the difference.

Problem 2. Unrepresented checks

When an unrepresented check problem creeps up during reconciliation, it means checks the company issued weren’t cashed in before the end of the reporting period.

This is considered one of the most predominant issues during bank reconciliations.

How to solve unrepresented checks in bank reconciliation

For a short while, these are easily fixed with a booked entry at the end of the reporting period to carry the check balance toward the next one.

After 90 days, the company should take additional steps, the first of which should be to call the payee.

Problem 3. Errors

Errors happen for all sorts of reasons. For example, a deposit or check is recorded with the wrong amount.

Sometimes, a transaction is not recorded altogether. Although these types of errors usually happen mostly in the company’s general ledger, they can also occur at the bank.

How to solve errors in bank reconciliation

Solving this problem is done by scrupulous attention to detail. When transactions get recorded in your accounting tool, they should be double-checked to ensure accuracy.

Once the error is made, the reconciliation must be completed one by one to find the error.

Problem 4. Unaccounted fees

Bank fees such as overdraft fees and non-sufficient funds fees cause bank reconciliation issues.

Though such fees have to be kept in check through smarter money management, they can slip through the cracks.

How to solve unaccounted fees in bank reconciliation

Companies that find this happening too often should reconsider the bank they use for their monetary transactions.

Find a bank with lower penalties or a more lenient fee schedule. However, to solve these, the transactions need to be accounted for in the general ledger.

Problem 5. Unauthorized withdrawals

Another way to say unauthorized withdrawals is fraud.

Unauthorized withdrawals from an internal party, such as an employee or partner, defrauds a company and make it hard to carry on.

Businesses must take proactive steps to guard against unauthorized withdrawals through a clear approval process.

How to solve unauthorized withdrawals in bank reconciliation

These situations should be planned for ahead of time.

As an example, the person completing the reconciliation should not be the same person writing down transactions in a general ledger.

The discrepancy between the general ledger and bank statement will remain until an adjustment gets recorded to account for the amount.

How often should you do a bank reconciliation?

If you wait too long to reconcile accounts, you’ll face more bank reconciliation challenges than you bargained for.

Your bank balance should always match your records, so you don’t want to wait too long to find out what’s making the difference when recording transactions.

Aim to reconcile your accounts at least once a month or whenever you generate a bank statement.

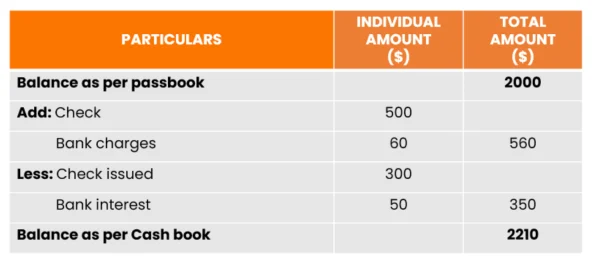

What are the bank reconciliation statement rules?

The list of rules below will help you stay on the right track as you reconcile your accounts:

Cash book debit balances are deposits of your business.

Your cashbook debit must match the credit in the passbook.

Your cashbook’s credit balance refers to a negative or unfavorable bank balance.

Your cashbook’s debit balance refers to a positive or favorable bank balance.

Presented checks should be adjusted in your business’s cashbook.

As you’re making your bank reconciliation statement, keep these rules in mind so you avoid additional errors.

What are some bank reconciliation example problems?

Bank reconciliation compares a bank transaction statement with the financial records of a company. When there are discrepancies, reconciliation allows you to find and correct the issues.

If you want to see bank reconciliation in action, check out the real-life bank reconciliation example problems below.

Example 1: The bank statement has a greater balance than the company books

John’s Construction Co. has a recorded ending balance of $750,000, but the bank statement’s ending balance is showing $790,000.

Upon further inspection, John’s Construction discovered that a $40,000 job had not been included in their books.

To reconcile the two balances, John’s Construction added the $40,000 deposit to their books.

Example 2: The cash book balance shows more than the bank statement

Sarah’s recorded ending balance is $12,550. When she receives her bank statement, it shows that her ending balance is $12,500.

As she’s reviewing the accounts, Sarah realizes that the bank charged her a $50 fee for a late loan payment.

Bank fees for checkbooks, late fees, and NSF checks can oftentimes be the culprit behind mismatched closing balances.

Hopefully, these bank reconciliation problems and solutions have given you a better idea of what it means to reconcile an account entry.

Where does an NSF check go on bank reconciliation?

One of the bank reconciliation challenges many businesses face is NSF checks.

When a customer makes a payment with an NSF (not sufficient funds) check, the amount is deducted from the business’s account as soon as the bank is aware of the bounced deposit.

If you have NSF checks while reconciling your accounts, you’ll need to subtract them from the balance on your books.

Make sure to mark any outstanding checks and uncleared checks in your records.

Watch this helpful video on check errors and NSF checks:

Bank Reconciliation Statement, Allen Mursau

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic approach to receipt tracking for tax season. 30-day full money-back guarantee!

Get Started TodayFrequently asked questions

What are the most common bank reconciliation problems?

There are five common reconciliation problems companies run into:

1. Transaction delays

2. Unrepresented checks

3. Errors

4. Unaccounted fees

5. Unauthorized withdrawals

In some instances, these problems are easier to fix than others, such as transaction delays or unrepresented checks.

In those instances, it’s a matter of entering in the adjusting transactions for the right times.

Why does a company need to conduct a bank reconciliation?

A company needs to complete a bank reconciliation in a timely fashion for various reasons:

1. Finding fraud in case someone is hiding unauthorized transactions

2. Track funds, fees, and penalties

3. Accurate record-keeping for receivables and accounts payable

4. Detect various problems like missed payments or doubled transactions

Overall, the process helps double-check all of the financial statements a company will use for future financial decisions and even for raising funds.

In closing

A bank reconciliation is a process for matching business transactions to bank statements.

Companies go through this process routinely to ensure the information is correct between both statements, to find any errors, and to prevent fraud.

Small business bank reconciliation problems happen to many companies despite the best processes for writing down transactions.

In some instances, though rare, even the bank can have the transaction information incorrect, and this should be brought to their attention.

To ensure an unbiased review, it’s best to hire an external individual to perform the bank reconciliation.

At the very least, the person going through the process should not be the same as the one that writes down transactions into the general ledger.

Interested in resources that will help you monitor the financial health of your company? Check out our mammoth list of bookkeeping resources!

Agata Kaczmarek has held a passion for writing since early childhood. A professional writer for many years, Agata specializes in writing articles and blogs focused on finance as someone who holds a Master’s Degree in Accounting and Finance.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!