In this article, we’ll walk you through Dave Ramsey’s Five Foundations of Personal Finance as well as his 7 Baby Steps program to help you navigate your financial path, manage your money, and maintain your financial health over the long term.

So, if you’ve been wondering, “How will the five foundations of personal finance help you start your future off right?” and “How can they help you make wise choices with money?“—you’ve come to the right place!

What are the five foundations of personal finance?

A financial knowledge strategy is as individual as the person who creates it. There is no one-size-fits-all approach, but the five foundations of personal finance, as articulated by Dave Ramsey, are a popular set of principles that are helpful to follow.

The Five Foundations of Personal Finance by Dave Ramsey

Foundation 1. Start an emergency fund: Aim for $500

If you have significant debt, saving money may seem impossible. Start small. Begin by putting $5 into your savings each week.

Re-evaluate your current lifestyle and consider what you need to live comfortably and what you can do without. Don’t scrimp too much—your quality of life should come first. Instead, think about which expenses you can reduce while avoiding becoming unhappy.

For example:

Eat at home. A home-cooked meal is less expensive than eating out.

End any club membership or subscriptions that you don’t need.

Take public transportation or ride a bicycle rather than getting an Uber or driving your car. You’ll also benefit from some light exercise.

Sell your secondhand and unused belongings. One person’s trash is another one’s treasure!

What other personal finance rules might you be missing out on? Check out this fun video for more insights!

10 Personal Finance Rules School Doesn’t Teach YouFoundation 2. Pay off your debts.

The second foundation of personal finance is about paying off your debts. If you already have debts (college tuition, credit card bills, etc.), make it a priority to pay them off as soon as possible. Sending a debt validation letter to your creditors can be a critical step in this process. This ensures the accuracy of the debt claimed and helps you better understand what you owe. The faster you can pay off your debt, the less interest you’ll have to pay.

Ask yourself:

Do your expenses usually outweigh your income? If so, by how much?

Where can you start cutting back on your spending?

What opportunities are there to earn a little extra income?

How much money do you want to pay towards your loans each month?

Hold onto the receipts from your purchases to see how much you’ve spent each month. By analyzing your receipts, you’ll become more aware of your spending habits and can adjust them as needed.

There are many ways to store receipts. However, we suggest digitizing your paper receipts with a receipt scanning app, like Shoeboxed, a receipt-tracking and expense-managing service for freelancers, sole proprietors, and small business owners.

Check out Shoeboxed’s quick user-demo video right here:

Turn receipts into data and deductibles!Foundation 3. Buy your car with cash.

What’s the third foundation? Pay for your car with cash.

The latest statistics from Lending Tree show that every month, Americans borrow more than $60 billion for new vehicle loans. And paying them off takes 69.7 months for new cars and 67.4 months for used cars.

Dave Ramsey’s tips for purchasing a car with cash are as follows:

1. Set a reasonable budget.

Be honest about the type of car you need.

2. Save up for your car.

Use a zero-based budget or other budget types to keep yourself accountable toward your saving goals.

3. Don’t purchase brand new.

Of course, if you have money to burn, feel free to splurge. But for everyone else—buy a pre-owned car.

4. Know where to shop for pre-owned cars.

Look for private sellers, online car retailers, and independent used car dealerships in your area.

5. Inspect before you buy.

Get a car inspection before you purchase that pre-owned car. It will cost you some extra cash, but it could save you tears on the flip side.

6. Brush up on some negotiation tactics to get the right price.

We suggest reading Never Split the Difference by Chris Voss to help you go into your negotiation ready with the right tactics that will help you get a great deal.

Foundation 4. Pay for college with cash.

The fourth foundation of personal finance is paying for college with cash instead of taking out a student loan. According to NerdWallet’s 2021 study on household debt, the average United States household student debt was $58,957. And the total amount of student debt owed in the United States clocks in at $1.59 trillion.

While many high school students think that going into debt for college will be worth it in the end—those paying off college loans disagree.

Dave Ramsey advises against going into debt for college and provides two rules for determining if you should even go:

Rule 1. Pay cash for college.

Rule 2. If you have cash or a scholarship, go.

If you don’t have either 1 or 2, then don’t go to college.

Research the price of attending college. Compare the cost of a big state university with the cost of a smaller state university.

Foundation 5. Build wealth with investments and give back.

What is the fifth foundation?

The fifth foundation refers to a philanthropic concept of building wealth and giving back to society through mentorship and developmental partnerships. It involves an individual sharing their knowledge, skills, and perspectives to foster the personal and professional growth of another person. The fifth foundation is based on the belief that giving to others not only helps the recipients but also enriches the giver’s life. By fostering mentorship and developmental partnerships, the fifth foundation aims to create a sustainable cycle of growth and learning for individuals and communities alike.

Ask yourself questions like:

What other financial goals do I have?

Where do I want to be financially in 10 years?

What kinds of things do I want to own?

What kinds of experiences do I want to have?

By answering these questions, you’ll be able to adopt a long-term perspective of your personal finances rather than just focusing on covering this year’s expenses.

Don’t worry too much if these questions are challenging or if you don’t know how to respond with certainty. The goal isn’t to schedule your entire life. Instead, it’s to improve your personal financial literacy and financial responsibility. And get you to start thinking about it so you can eventually build a financial roadmap.

Remember that your financial planning blueprint should be as adaptable as your life.

Check out the following bestselling books on investing and finance:

How will the five foundations of personal finance help you start your future off right?

The Five Foundations of personal finance, as proposed by financial expert Dave Ramsey, can provide a solid starting point for anyone looking to manage their money wisely and set themselves up for financial success in the future. For example, by saving a $500 emergency fund—this can help you cover unexpected expenses that might otherwise lead you into debt. And paying off debt frees up your income for other uses and reduces financial risk. Without debt, you can save more, invest more, and have more flexibility in your budget.

By adhering to these Five Foundations, you’re likely to avoid common financial pitfalls like debt and insufficient savings, while promoting habits that lead to wealth and financial security. This can provide you with increased options, reduced stress, and a better quality of life in the future.

Turn receipts into data with Shoeboxed ✨

Try a systematic approach to receipt categories for tax time. 30-day full money-back guarantee!

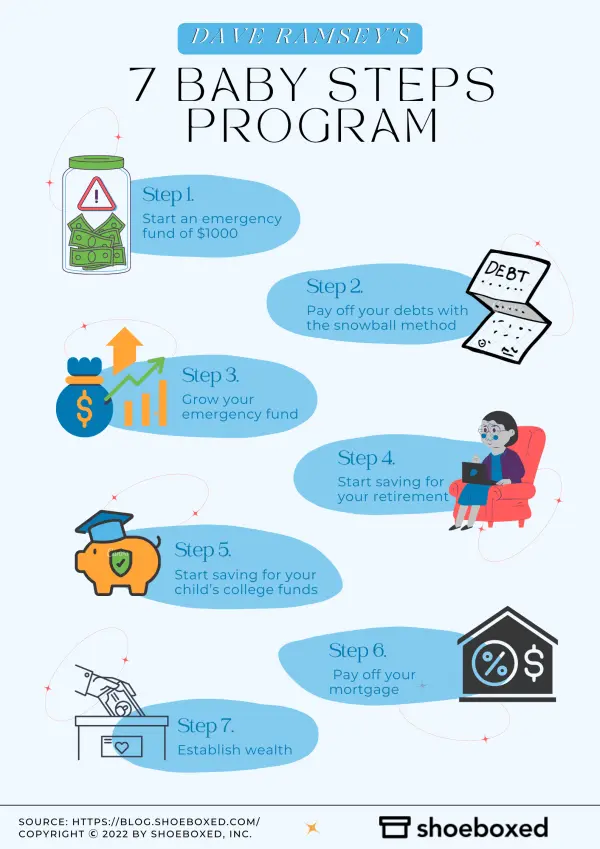

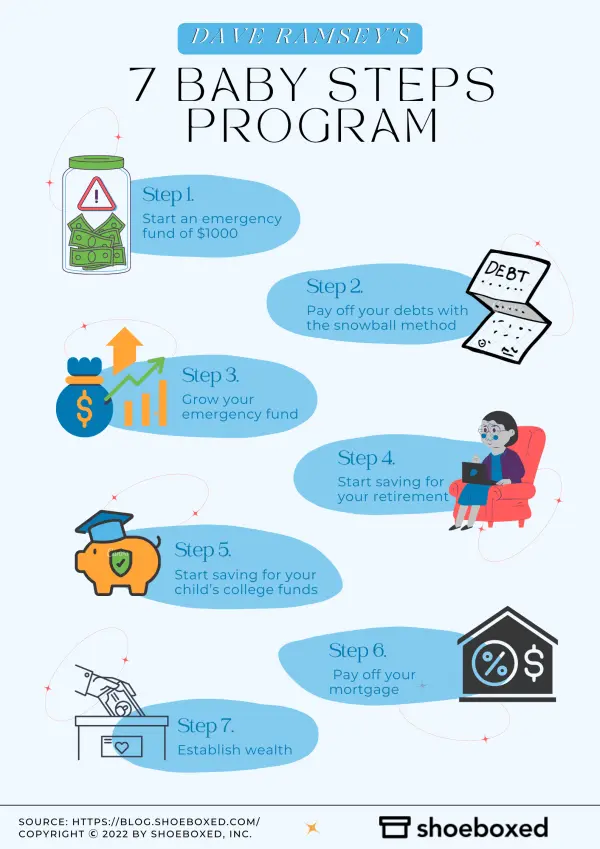

Get Started TodayWhat are the seven steps to financial success in Dave Ramsey’s “7 Baby Steps” program?

So now that you know what the foundations are, what connections can you make between the 7 baby steps and Dave Ramsey’s 5 foundations of personal finance?

Let’s look at the 7 steps to financial success in Dave Ramsey’s “7 Baby Steps” program:

7 Baby Steps Program by Dave Ramsey

Step 1. Start an emergency fund of $1000.

The first step in Dave Ramsey’s 7-step plan is to save $1,000 that you designate for emergencies. He advises that you place this emergency money in a separate account until you reach at least $1,000. Placing it in a separate account will help prevent you from using it to cover sudden expenses. See Foundation #1. Start an emergency fund.

Step 2. Pay off your debts with the snowball method.

Settle all of your debt using the debt snowball method. The snowball method starts by paying off smaller debt amounts and gradually increases as your ability to pay them off grows. List out all your debts from the smallest debt amount to the largest. Then start by paying off the smallest debts first and then move on to the larger amounts owed. See Foundation #2. Pay off debt.

Step 3. Grow your emergency fund.

Once you have good control of your debt, the next step is to save money in case of an emergency. According to Ramsey, there are three reasons to have an emergency fund:

If you lose your job, you will still have enough money to last several months. Your savings amount will give you a ballpark estimate of how long you have to find a new job.

If you need to upgrade your car, you will be able to pay for the necessary repairs or put money toward purchasing a new one.

If you need to go for a health check-up, you will be able to pay your medical bills.

If you’re able to control your expenses, then you will be prepared with your emergency fund.

Never lose a receipt again 📁

Join over 1 million businesses scanning receipts, creating expense reports, and reclaiming multiple hours every week—with Shoeboxed.✨

Get Started TodayStep 4. Start saving for your retirement.

Next up is to spend 15% of your household income toward saving for the day when you’ll retire. To find out the number to put aside for retirement, multiply your monthly income by 0.15 and commit to putting that toward your retirement. See Foundation #5 Build wealth with investments and give back.

Step 5. Start saving for your child’s college funds.

Use a 529 college savings plan or an education savings account to save for your child’s college expenses. Schedule a meeting with your banker or hire a financial consultant to help you plan for your child’s education. See Foundation #4: Pay for college with cash.

Step 6. Pay off your mortgage.

The sixth step is to pay off your house loan. Put all your extra monthly income into paying off your mortgage loans as early as you can manage. See Foundation #2. Pay off debt.

Step 7. Establish wealth.

The last step is to build wealth for yourself and give back to the community. By reaching this step, you are now at a place where you can focus on building wealth and giving back to your community. This is the step where you focus on letting money work for you, so you can enjoy financial freedom. See Foundation #5 Build wealth with investments and give back.

Follow The 7 Steps To Success!Frequently asked questions

What are the five foundations of personal finance?

Foundation 1. Start an emergency fund: Aim for $500

Foundation 2. Pay off your debts.

Foundation 3. Buy your car with cash.

Foundation 4. Pay for college with cash.

Foundation 5. Build wealth with investments and give back.

What are the seven steps to financial success in Dave Ramsey’s “7 Baby Steps” program?

Step 1. Start an emergency fund of $1000.

Step 2. Pay off your debts with the snowball method.

Step 3. Grow your emergency fund.

Step 4. Start saving for your retirement.

Step 5. Start saving for your child’s college funds.

Step 6. Pay off your mortgage.

Bonus infographic: 5 steps to setting achievable financial goals

Infographic: 5 steps to setting achievable financial goals.

In closing

The more you understand your current financial situation, the more straightforward the path forward will become. Start by applying the five foundations of personal finance—and soon you’ll have a solid financial plan that will work for your unique situation.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!