Employers and employees should understand the business’s guidelines for T&E or travel expense reimbursement policies so that neither runs into any issues over business-related expenses down the road.

The IRS is pretty flexible with employers when it comes to employee reimbursement for business travel expenses while away on a company trip.

Does travel expense reimbursement qualify as a deductible travel expense?

What the IRS is not flexible about is whether or not the travel-related expenses incurred on the business trip qualify as a deductible travel expense.

Employers can deduct “ordinary and necessary expenses” of employees traveling away from their tax home.

According to the IRS, any reimbursement that does not qualify as a deductible travel expense is considered employee wages.

What are “accountable” and “non-accountable” plans?

There are two methods for reimbursing workers for expenses incurred when traveling for business. These are the “accountable plan” and the “non-accountable” plan.

An “accountable plan” is based on the Internal Revenue Service’s guidelines for reimbursing employees for the actual travel costs so that the reimbursable expenses incurred are not counted as income.

This means that the reimbursements are not subject to W-2 reporting or withholding taxes.

The expenses, however, must be business-related. To qualify for the “accountable plan,” expenses must be business-related, reported accurately, and excess reimbursements issued.

If the company’s reimbursement process doesn’t meet the guidelines under federal law for the “accountable plan,” then the expenses fall under the “non-accountable plan.”

If a reimbursed cost is non-accountable, then it is subject to being taxed as part of the employee’s compensation, therefore, it must be reported on the W-2 form and is subject to withholding.

Travel and Expense Reimbursement 101 by CUFinancialServicesWhat is travel expense reimbursement?

Travel expense reimbursement is when you pay employees back for business expenses incurred while traveling.

The expenses that are reimbursed are dependent upon the reimbursement policies determined by your business.

A travel reimbursement policy should be set up by your business that specifies the rules and procedures regarding reimbursement for travel-related expenses.

Many companies are using traditional expense management systems where staff can use a credit card and submit refunded trip expenses after the trip ends.

The use of credit cards prevent employees from having to make on-the-spot payments using their personal funds for the out of pocket expenses when traveling.

Hit the road with Shoeboxed 🚗

Stuff receipts into the Magic Envelope while on the road. Then send them in once a month to get scanned. Expense reports don’t get easier than this! 💪🏼 30-day full money-back guarantee!

Get Started TodayWhat common types of travel expenses qualify for deductible expense reimbursement?

As an optional reimbursement provider, you have a choice on whether or not to reimburse employees for travel expenses.

Regardless, a clear reimbursement policy should be established within the company.

Some of the most typical reimbursable expenses include the following:

Transportation costs between your home and the business destination

Transportation between airport/station and hotel

Transportation between the hotel and the work location

Sending company-related supplies from your regular work location to your travel work destination

Business use of a rental car or the actual expenses of operating your personal vehicle when traveling away from home on business such as mileage reimbursement

The cost of parking your rental car can vary significantly depending on factors such as location, duration, and demand. Urban areas and popular tourist destinations often have higher parking fees, while off-peak times or less crowded areas may offer more affordable options

Lodging and meal expenses

Dry cleaning and laundry

Business communication expenses

Business related tips

Parking fees and tolls

How do expense reports play a role in a business’s expense reimbursement policy?

To prevent fraud and to keep company records updated and accurate, companies should use expense reports as part of their expense reimbursement policy.

The expense report should be used by employees to report incidental expenses such as travel expenses, business meals, and small purchases of supplies or equipment for the office.

Employees fill out these expense reports, which require the information of a typical transaction.

Some of the information found on an expense report include the vendor’s name, date paid, expense description, amount paid, and totals for each expense category.

Then the expense report is submitted to the company and according to the reimbursement policy, the employee is reimbursed.

See also: Expense Report Template Google Sheets: 4 Free Templates

Receipt requirements

It’s important to always have proof or documentation of the expenses that you incurred. The best proof is to provide the original receipt from the store, merchant, or a receipt book.

Therefore, when turning in an expense report, always attach any supporting documentation such as your receipts to the expense report.

This safeguards the company against expense fraud and ensures that the company will have the documentation needed for tax deductions and any audits if requested.

Processing expense reports for travel reimbursements

Once expense reports are submitted to the company, the company is responsible for the accuracy of the expense reports.

The company has an obligation to check the expense report against its business travel and reimbursement policies.

This is meant as an assurance system for ensuring accurate compliance with corporate policies.

Deadlines for expense reimbursement

Businesses should establish monthly or quarterly deadlines for expense reports. This ensures that the business can claim the expense as a tax deduction.

It also ensures that records are kept more accurate and up-to-date, that an expense doesn’t fall through the cracks, and that the company maintains a more efficient cash flow.

Not only should there be a deadline for the employee to submit an expense report, but there also should be a deadline for when the employee will be reimbursed by the company.

See also: Travel Nurse Expenses: Put Money Back in Your Pocket

4 Free travel expense reimbursement form templates

Whether you’re a new business looking for an easy way to keep up with eligible travel reimbursements or an employee that often travels for work, these free travel expense reimbursement form templates are a great way to record travel expenses and separate them from non travel reimbursements.

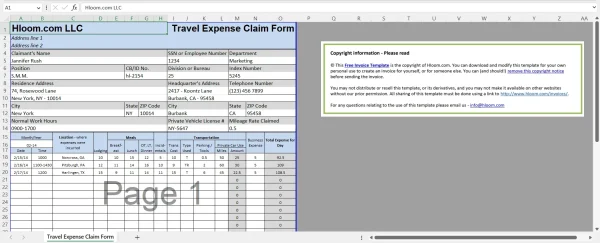

1. Hloom free travel expense reimbursement spreadsheet

Hloom free travel expense reimbursement spreadsheet for Excel.

Hloom offers a free travel expense reimbursement spreadsheet that you can use to report any travel expenses made while away on a business trip.

Employees’ travel expenses should be recorded in a concise, organized template so it’s easy to categorize eligible reimbursement claims, see if expenditures were within spending limits, and receive reimbursement all by looking at a single form.

Use this template to record:

The date, time, and location you traveled to

The meals you ate

The cost of lodging

Cost of transportation

Private vehicle license

And more!

This template is 100% free and customizable, so you can adjust the columns as needed to suit your company.

2. GeneralBlue simple free travel expense reimbursement form

This free travel expense reimbursement form by GeneralBlue is as easy as it gets. It’s an Excel template with 8 columns for recording the expenses incurred traveling for business.

With this straightforward form, you can record:

The date you traveled

A description of your trip

The cost of transportation

The cost of hotels

The cost of meals

Phone use

Miscellaneous expenses

The total amount of travel expenses

There is also a line for employee and approval signatures so you have an official record of travel expenses and reimbursements.

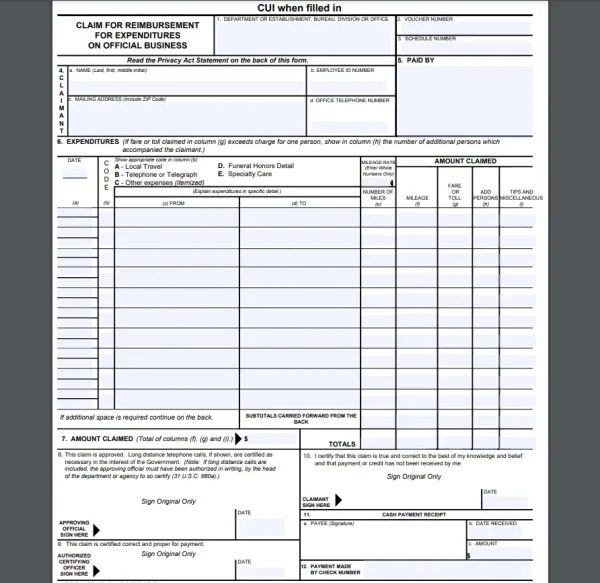

3. U.S. General Services Administration travel expense reimbursement template

Travel expense reimbursement template from the U.S. General Services Administration.

For state employees, the U.S. GSA offers a free travel expense reimbursement template that you can use to record spending while out on state business.

This template has everything an employee would need to record official business expenses, including:

Department or establishment

Official business categories

Mileage, including fare or toll

Date traveled

Additional persons

Tips and miscellaneous expenses

Spaces for authorizing signatures

The U.S. GSA travel expense template has to be printed and written as a paper copy.

4. Vertex42 travel expense reimbursement sheet

The Vertex42 travel expense reimbursement sheet is available for free and can be downloaded as an Excel file or Google Sheet.

This expense report includes:

Date

Description of travel

Air and transportation costs

Lodging

Fuel and mileage costs

Conferences and seminars

Meals and tip costs

Entertainment

Other expenses

The total cost of expenses

There’s also a place for authorized signatures, department, manager name, employee ID, and more.

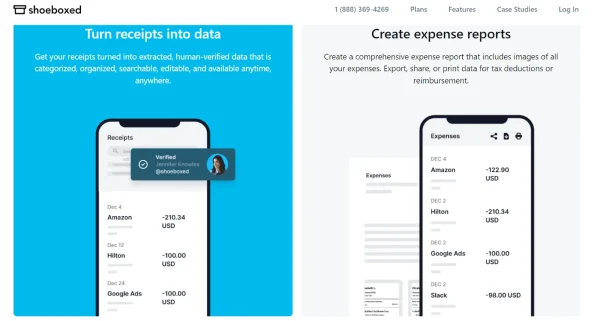

Bonus: Shoeboxed for receipt tracking and expense reports

Use Shoeboxed to capture your receipts and create detailed expense reports for reimbursement.

If you don’t want to deal with the hassle of keeping up with your receipts, manually inputting the expenses into a spreadsheet, or printing out an expense report for your boss, Shoeboxed can help!

Tracking receipts with Shoeboxed

Shoeboxed is a great travel management software that allows you to snap photos of your receipts, digitally extract the important information, and categorize the expenses so that they’re easy to find and manage in your Shoeboxed account.

If you have more receipts than you bargained for while away on an extended business trip, you can stuff all of your paper receipts into Shoeboxed’s prepaid Magic Envelope and mail them to their scanning facility to be scanned and uploaded for you.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 30-day full money-back guarantee!

Get Started TodayCreating expense reports for business travel expenses

Once your receipt details are uploaded to your Shoeboxed account, you can select the receipts you want to put in your expense report and either export, print, or email them to the appropriate authority.

Shoeboxed will then create a detailed and organized expense report with images of your receipts attached so you can get reimbursed!

And if you didn’t think it could get any better, Shoeboxed also offers a free mileage tracker so you can effortlessly calculate business mileage and add it to your expense report.

Frequently asked questions

Can I get reimbursed for travel expenses?

The IRS offers two plans for reimbursing workers for travel expenses that are deductible: 1. Employers don’t have to pay employment tax by not including the reimbursement for travel-related expenses from the worker’s wages with the accountable plan; or 2. Employers will have to count all payments to workers as wages under a non-accountable plan.

What are travel reimbursements?

Travel compensation consists of reimbursements for out-of-pocket expenses by employees when they travel for work. The employee typically fills out an expense report and turns it in to the employer. Your employee’s costs will be affected according to your company and reimbursement policies. Travel insurance policies provide you with guidelines for reimbursement of travel expenses.

How much travel expense can I claim?

During business travel the actual cost of transport is 100% deducted—whether it is a flight ticket, train ticket, or bus ticket. Similarly, renting a motor vehicle can make your travel expenses deductible.

In conclusion

The best way to establish an accurate reimbursement strategy for your employee and your company is to ensure that you have an expense reimbursement policy in place and that it is covered by all applicable employees during the onboarding process.

Providing an expense report template makes it much easier for the employees and for those processing the expense reports.

The expense reports will also help to maximize tax deductions, make the audit process much smoother, and ensure that the employee is being reimbursed the correct amount.

How to Create an Expense Reimbursement Policy for Your Company by JotformCaryl Ramsey has years of experience assisting in different aspects of bookkeeping, taxes, and customer service. She uses a variety of accounting software for setting up client information, reconciling accounts, coding expenses, running financial reports, and preparing tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!